- Sweeping education gains, record economic development, and now, elimination of its income tax place Mississippi in a unique position. It’s winning.

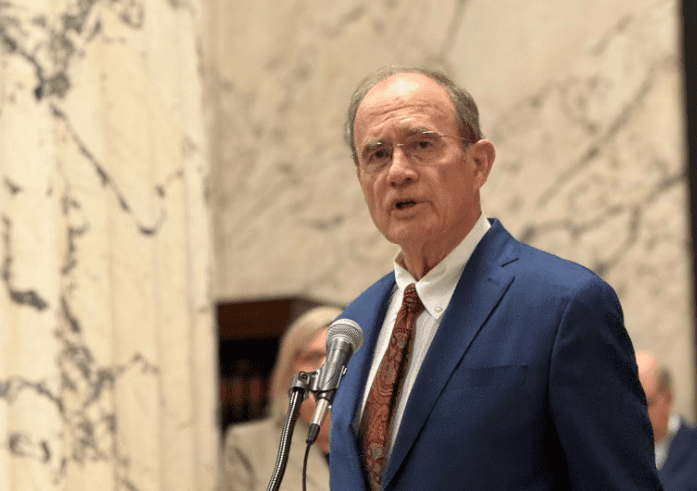

Mississippi Governor Tate Reeves recently signed a historic package of tax reform that includes the elimination of the state’s income tax.

Standing in the courtyard of the governor’s mansion, surrounded by lawmakers and a handful of longtime advocates, Reeves declared a simple driving vision: “Our people should be rewarded for hard work, not punished.”

Under the Build Up Mississippi Act, the Magnolia State will become the tenth state to operate without a tax on work. Only one other state, Alaska, has ever eliminated an income tax once in effect.

The particulars aren’t all that sexy. The state’s flat income tax will phase down to 3 percent by 2030, marking an annual cut of some $647 million by conclusion of the phase-in. From there, revenue growth triggers will be used to pare the rate down to zero.

The law also reduces the sales tax applied to groceries, another $127 million cut. It adds $200 million in new revenue for transportation and takes an important step toward fixing the state’s public retirement system.

It represents a bold but responsible step for a state often unfairly maligned —– made possible by two decades of vision and determination.

The Journey

Elected in 2003, former Mississippi Governor Haley Barbour came into office with national-level conservative credentials that stretched back to Reagan. Barbour faced a $700 million annual deficit.

Despite Hurricane Katrina in 2005 and the mortgage crisis of 2007–2008, Barbour righted the ship.

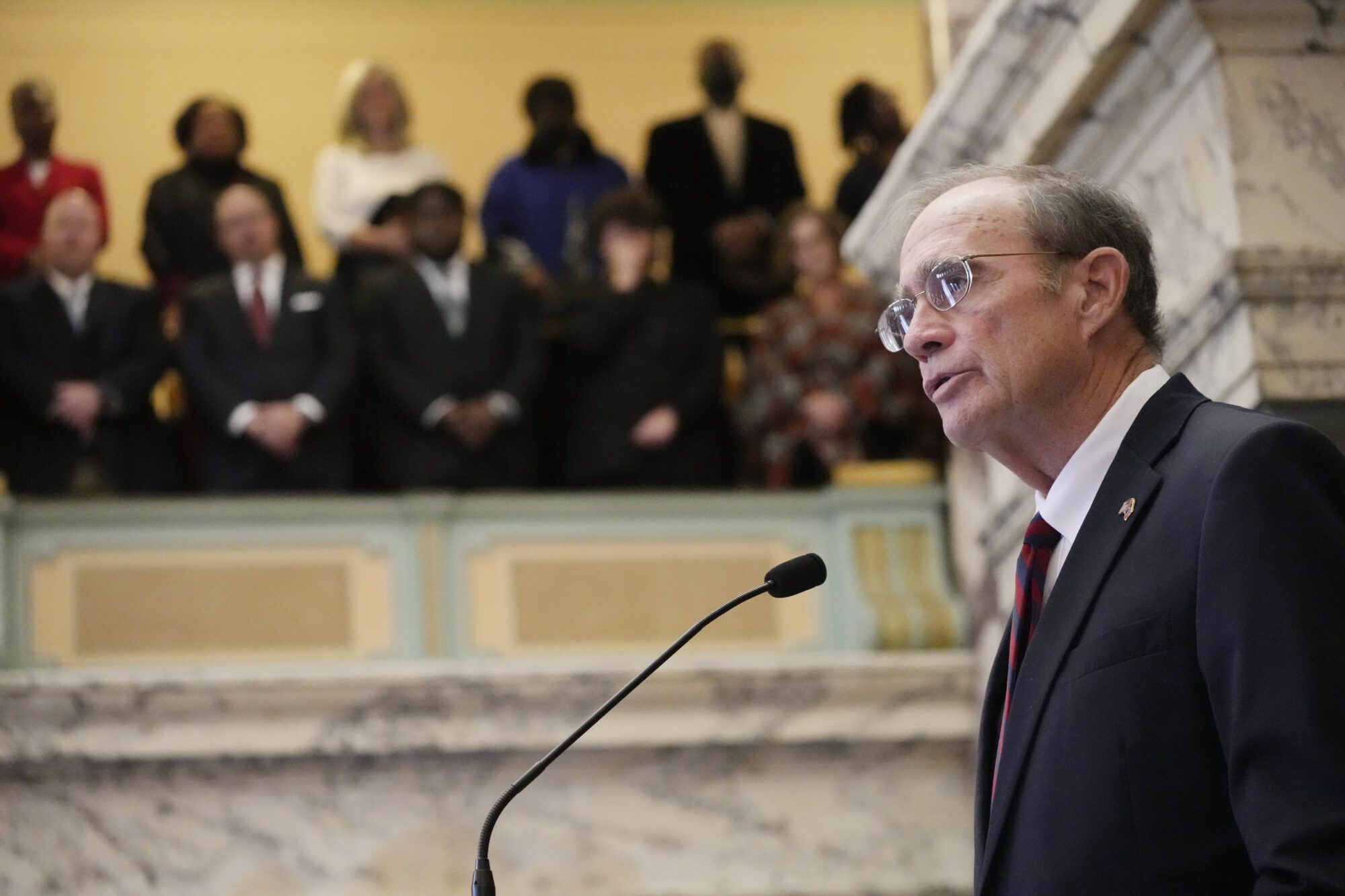

His successor, Governor Phil Bryant, built on Barbour’s foundation, with an education agenda informed in no small part by Florida’s Jeb Bush. In 2013, Bryant passed a package of reforms — including the state’s Literacy Based Promotion Act — aimed at pulling Mississippi’s national scores from the bottom of the heap.

Two years later, Bryant, then–Lieutenant Governor Reeves, and then-Speaker Philip Gunn began plotting a total overhaul of Mississippi’s tax structure. In the decade that followed, leaders whittled down the state’s tax code with a series of individual and business tax cuts.

The reforms included eliminating Mississippi’s franchise tax, crafting the largest exemption among states that tax income, moving to a flat tax, and becoming the first state to allow full and immediate expensing for businesses.

The journey culminated this session with Reeves, House Speaker Jason White, and Lieutenant Governor Delbert Hosemann agreeing to take the final step toward full elimination this year. Senator Josh Harkins and Representative Trey Lamar accomplished much of the legwork and deserve much of the credit for crossing the finish line.

A Work in Progress with Real Progress

Barbour faced backlash for being too austere during his tenure. Bryant squared off with an education establishment so disturbed by his reforms that it attempted, through ballot measure, to wrest control of education policy away from the legislature. It failed.

And Governor Reeves and legislative leaders have been under a constant barrage of criticism from advocacy journalists. With each passing tax cut, Chicken Littles squawked about the sky falling. Their chirping fell on deaf ears.

In two decades, Mississippi has moved from $700 million deficits to $700 million surpluses. Lawmakers built over $2.5 billion in reserves while paying off nearly $1 billion in debt in just the last five years.

Since the passage of Bryant’s education reforms in 2013, Mississippi leads the nation in both math and reading gains on the National Assessment of Education Progress tests. Once last, Mississippi’s fourth graders now rank ninth in reading and 16th in math.

And even as large tax cuts have taken effect, tax revenue collected by the state grew by 39 percent over the last decade. This put the legislature in position to make nearly $800 million annually in new education spending commitments — including the largest teacher pay raise in history and a beefed-up, student-centered funding formula.

Reeves, for his part, has been laser focused on economic development, harnessing the state’s cheap natural resources and energy to lure Big Tech to Mississippi.

In the last year alone, Amazon Web Services and Compass Data Centers have announced $26 billion in new data center projects in Mississippi communities. In the fourth quarter of 2024, Mississippi’s economic growth ranked second in the nation, behind only Arkansas’s.

When you start behind, there’s a lot of room for improvement. That certainly remains true here. Getting off the bottom requires taking risks that require intestinal fortitude. But conservative ideas are working, and Mississippi has momentum. It’s undeniable.

A version of this column first appeared in National Review.