Douglas Carswell

Any increase in government spending should not exceed the rate of population growth plus inflation.

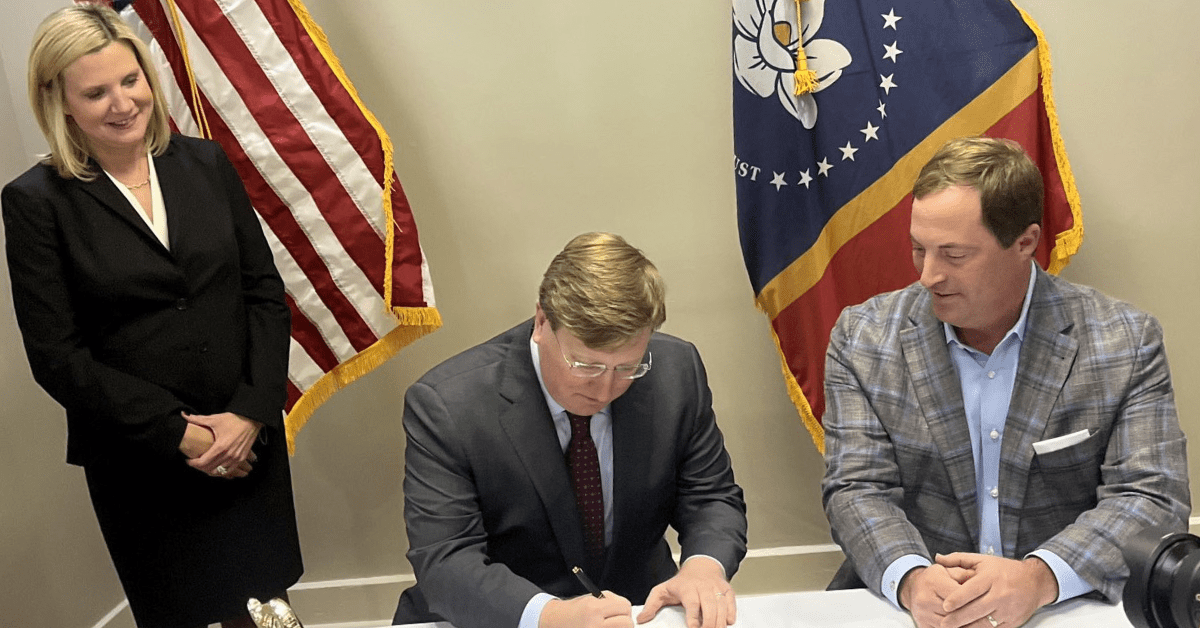

Mississippi recently made some significant tax cuts. Thanks to the 2022 Mississippi Tax Freedom Act, over a million Mississippi workers will be better off as the state income tax rate is reduced from around 7 percent to a flat 4 percent.

In the coming legislative session, Mississippi lawmakers have to set a budget for 2024. Some will call for further tax cuts. Others will insist that we cannot afford tax cuts.

What should conservative lawmakers do? To help authentic conservatives in our state, the Mississippi Center for Public Policy has published a responsible budget for our state.

The key to setting a responsible budget, as every householder knows, is to get control of what we spend. We believe that Mississippi’s government spending (general fund appropriations) for 2024 should not exceed $6.75 billion.

To increase spending over and above that amount would mean raising spending per person in our state faster than inflation. That would be un-conservative.

When setting a budget, conservatives that are serious about limiting the size of government ought to follow a simple fiscal rule; any increase in government spending should not exceed the rate of population growth plus inflation.

Before drafting our budget, we took a look at Mississippi government spending over the past decade or so. Unfortunately, over the past decade state government spending (the general fund appropriations) has tended to grow rather rapidly. Between 2014 and 2019, state government spending grew faster than population change plus inflation, meaning that the relative size of the state government in Mississippi increased.

The good news, however, is that since 2020 the expansion of the state government in Mississippi has slowed. Spending growth over the past three years has not exceeded changes in population plus inflation.

Genuinely conservative lawmakers should aim to keep things that way in 2024, and not exceed $6.75 billion spending.

If lawmakers set a responsible budget that keeps control of spending, we estimate that there will be a budget surplus of around 800 million in 2024 – a portion of which could be used to reduce the tax burden yet further.

During the last legislative session, a number of lawmakers argued that we could not afford to cut taxes. If we were not careful, they claimed, we could end up like Kansas. Kansas did indeed once cut taxes, before having to raise them again when the money ran out. But the money only ran out in Kansas because they failed to get control of spending first.

Here in Mississippi, provided we limit the general fund appropriation to $6.75 billion, there will be not just a surplus, but a sustainable surplus that can be used to cut taxes.

We believe that Mississippi’s budget surplus is both cyclical and structural. That is to say the surplus will not simply disappear as and when the economy slows. Provided Mississippi lawmakers keep spending under control there will be money left over to reduce taxes.

Over the past few decades, the southern United States has flourished. Tennesse, Texas, Georgia and Florida have enjoyed rapid growth. Dallas and Nashville have become go-to places for ambitious young people right across America.

Why are these southern states doing so well? Because they tend to be run by people who appreciate the importance of low taxes and light regulation.

While those that run New York, Chicago and California have raised taxes and red tape, driving

businesses away, the south has gone in a very different direction.

Mississippi could be part of this southern success story too – provided we continue to cut taxes. A responsible budget for 2024 that carefully controls spending would be another big step in the

right direction.

The Responsible Budget for Mississippi can be read here.