It seems the closer tax cuts get to reality, the more hysterical media outlets become.

The mainstream press and education lobby have jointly hit the panic button in a seemingly coordinated fashion as a major income tax elimination effort gathers steam in the Mississippi legislature. It seems the closer tax cuts get to reality, the more hysterical media outlets become.

Speaker Philip Gunn took exception late Monday to some press articles that seemed, according to math provided by his office, to create the sense of a false choice between income tax elimination and the current teacher pay raise. Both the House and the Senate have passed teacher pay raises that will have about $200 million of budget impact, and the deadline for action for both teacher pay bills currently alive is Tuesday, March 1.

“There have been some misleading press articles about the effect of the House tax plan on teacher pay. The record needs to be corrected. We have a billion dollar surplus in recurring revenue,” Gunn said. “The Fiscal Note showed that in its first full tax year of implementation the House plan will be a $665 million tax cut. That still leaves far more than the $200 million we need to do the teacher pay increase the House passed. We can do both tax reform and a teacher pay raise.”

“There have been some misleading press articles about the effect of the House tax plan on teacher pay. The record needs to be corrected. We have a billion dollar surplus in recurring revenue,” Gunn said. “The Fiscal Note showed that in its first full tax year of implementation the House plan will be a $665 million tax cut. That still leaves far more than the $200 million we need to do the teacher pay increase the House passed. We can do both tax reform and a teacher pay raise.”

An article along these exact lines was manufactured in the last 24 hours by Mississippi Today’s Adam Ganucheau. The article was long on innuendo, but real short on facts and math. Other liberal outlets fell dutifully in line.

Here’s the math in the fiscal note form provided by the House:

In FY2024 (the first year of a phased in income tax cut), recurring revenues would still exceed recurring expenditures based on their projections by $870 million. The net reduction in recurring revenues factoring in lowered revenues from income tax collections and increased revenues from sales tax revenues equals $665.9 million leaving the $204 million in net surplus . . . or roughly the amount of the cost of the teacher pay increase.

Since personal income taxes are calculated on a calendar year basis and government receipts are calculated on a fiscal year basis, the first year of implementation looks a little different, but the FY23 surplus according to budget estimates generated for the House would be $839 million of recurring revenue over recurring expense.

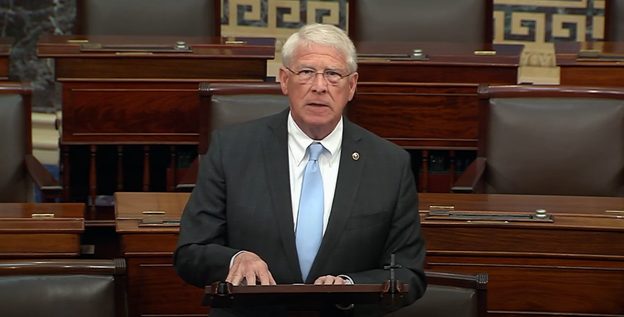

The tax cut plan devised and advocated for in the state Senate does not go as far as the House plan does in terms of eliminating the income tax altogether. However, it does not seek revenue offsets in the form of higher sales taxes. Lieutenant Governor Delbert Hosemann in a statement for his part also seemed to try to tamp down the media driven panic over a choice between teacher pay and tax relief.

The tax cut plan devised and advocated for in the state Senate does not go as far as the House plan does in terms of eliminating the income tax altogether. However, it does not seek revenue offsets in the form of higher sales taxes. Lieutenant Governor Delbert Hosemann in a statement for his part also seemed to try to tamp down the media driven panic over a choice between teacher pay and tax relief.

“The Senate plan cuts the income tax and raises teacher pay without raising any taxes. Both objectives are achievable in the same plan,” Hosemann said.

Complicating policymaking matters is the fact that Mississippi has had a spate of pretty spectacular underestimation of revenue projections in recent years. FY2023 looks like recurring revenues will exceed recurring revenue estimates by over a billion dollars (and that’s not inclusive of federal one-time money). For a $6 billion projection to underestimate by a billion dollars is roughly a 15% miss. Hence, the deck is essentially stacked against legislative conservatives that want to eliminate/lower taxes because future revenues upon which budgets depend are chronically underestimated.

The House has provided its version of the tax cut budget impact projections to Y’all Politics. Similar analysis is pending for the Senate version, and both will be provided side by side when available.

URC Analysis of HB 531 Final by yallpolitics on Scribd