(Photo from Shutterstock)

- Another bill could set the age for purchasing the opioid-like substance at 21.

With only days left in the 2025 legislative session, Mississippi lawmakers have agreed on at least one solution to deal with kratom – tax products containing the opioid-like substance at a higher rate.

Bills that were introduced earlier in the session that would have banned the sale of kratom products, which have been described as dangerous and at times lethal, died more than a month ago.

On Monday, the House and Senate adopted a conference report for HB 1896, which sets the tax rate for those products. The measure now heads to the Governor’s desk.

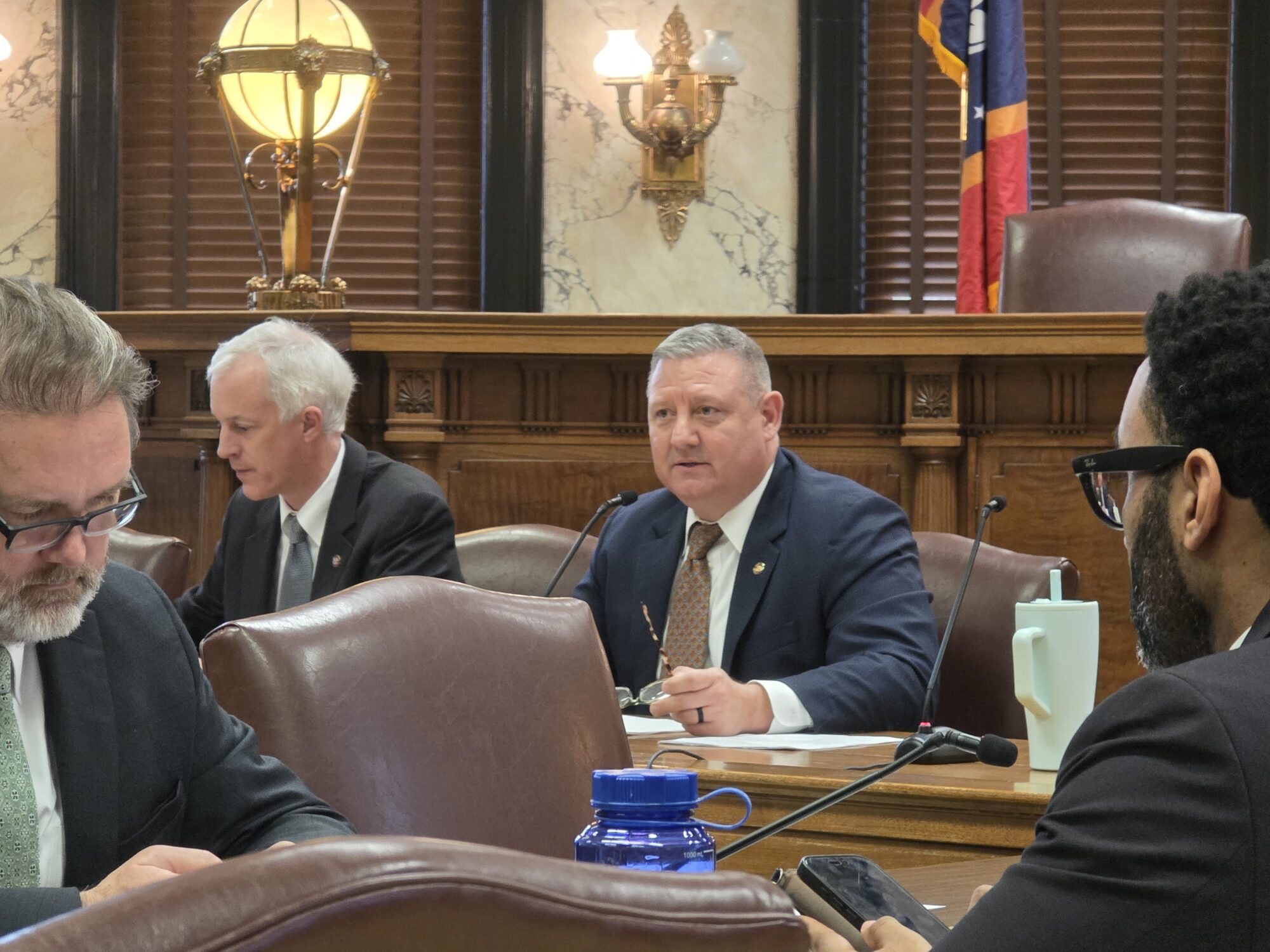

State Rep. Trey Lamar (R) said the bill’s current iteration as it was approved on Monday reflects the work of the Senate and House to define kratom and set the rate at which it will be taxed.

“The final negotiations came in at a 25 percent rate, which is a little bit more than how we tax tobacco,” Lamar described.

Tobacco’s excise tax is 15 percent, 10 percent less than the soon-to-be levied tax on kratom products.

The bill also includes language concerning how and when taxes on certain types of tobacco products, such as cigars, can be paid.

State Senator Joey Fillingane (R) clarified while discussing the measure on the floor of the Senate Monday that the bill allows retailers to pay that tax at the point of sale.

When asked, Rep. Lamar clarified that the measure does not set an age limit to purchase kratom products.

“There is a separate bill as I understand it relating to those matters you’re talking about,” Lamar added.

That bill is HB 1077, which aims to set an age restriction of 21 on the sale of products that contain kratom. The legislation is still alive late in the session, but no action was taken on it Monday by either body.

Two bills died in February that would have essentially made kratom products illegal by classifying them as a Schedule III controlled substance.