Mississippi State Finance Committee Chairman Josh Harkins, R-Flowood, in the Senate chamber at the Mississippi State Capitol in Jackson, Miss., Thursday, Jan. 25, 2024. (AP Photo/Rogelio V. Solis)

- Magnolia Tribune obtained a preview of the Senate’s tax reform proposal from Senate Finance Chairman Josh Harkins. Here are the high points & how it compares to HB 1.

The wait is over. Early this session the Mississippi House passed a bill — HB 1 — aimed at eliminating the state income tax and reducing the tax on groceries. Governor Tate Reeves called the bill a “serious effort.” Reeves has long been a proponent of elimination. Questions have since swirled over the Senate’s response.

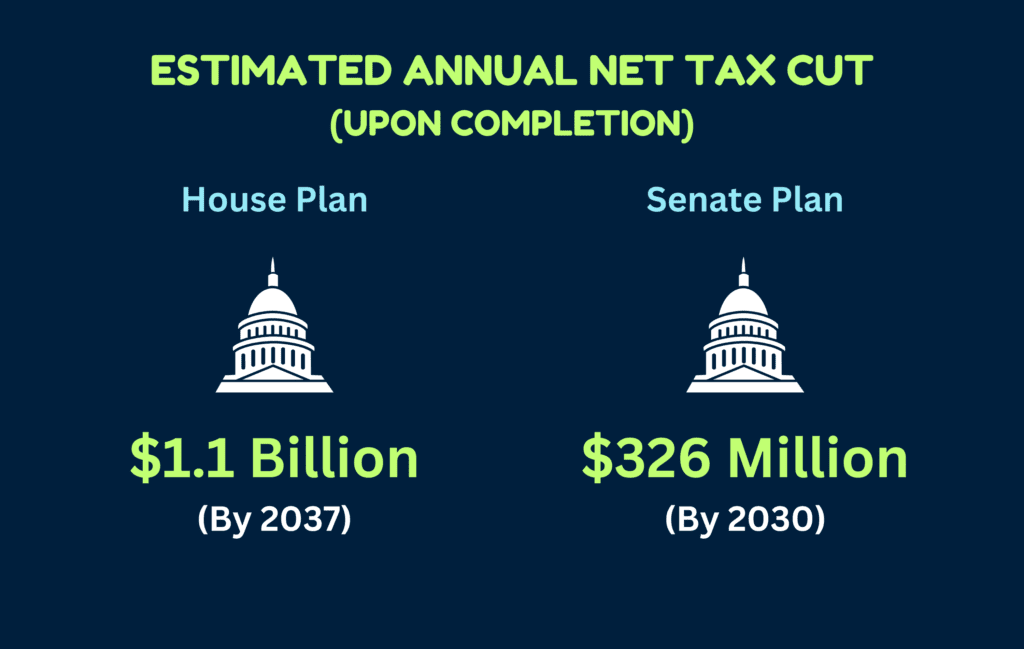

The Mississippi Senate is prepared to take a more cautious and less complicated path to tax relief this year, according to Senate Finance Chairman Josh Harkins. The Senate plan is smaller than the House plan, with a total annual net tax cut less than 1/3rd of the ambitious HB 1 passed in January by the House.

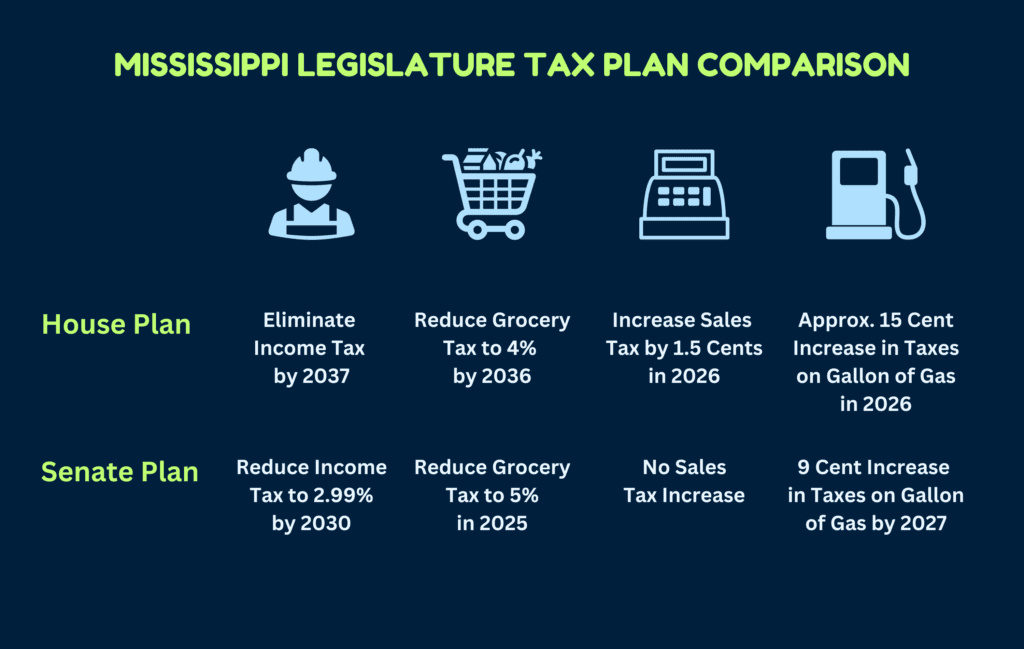

Harkins told Magnolia Tribune that the Senate’s proposal will pick up where the 2022 tax reform left off, further reducing the state’s flat income tax erate from 4 percent to 3 percent by 2030 (actually 2.99% to be precise).

The bill will stop short of complete elimination, though Harkins contends the Legislature can always reduce the rate further in the future.

Like the House plan, the Senate plan will drop the sales tax applied to groceries. Harkins says there will be an immediate reduction down to 5 percent. The House plan reduced the grocery tax down to 4.5 percent in year one, but then added a 1.5 local sales tax option — putting the effective rate at 6 percent. The House plan continues to whittle down the sales tax on groceries to 4 percent by 2036.

The Senate plan does not include the creation of the 1.5 cent local sales tax option contained in the HB 1. That option in the House plan would create an estimated $700 million in new tax revenue for cities and counties, allowing the Legislature to “claw back” the existing sales tax diversion to cities. It is one of the ways the House proposed to offset the larger cut of complete elimination.

The Senate plan also proposes a new dedicated revenue stream for MDOT in the form of a phased in gas tax increase. Mississippians currently pay a state tax of 18.4 cents on every gallon of gas they purchase, and pay another 18.4 cents in federal excise taxes. Under the Senate proposal, an additional 3 cents per year for 3 years (9 cents total). The excise tax would also be indexed for inflation. Harkins estimates this increase will generate roughly $212 million a year for MDOT.

HB 1 also contained new revenue for roads and bridges by adding a 5 cent sales tax on top of the excise tax. (This means that on a $3 gallon of gas, a consumer would pay the 36.8 cents in federal and state excise taxes, plus 15 cents in sales tax). The estimated revenue produced for MDOT under the House plan is between $300-$400 million.

House Ways & Means Chairman Trey Lamar previously told Magnolia Tribune the additional revenue for MDOT would free the Legislature to shift lottery resources from roads to the state retirement system. HB 1 proposes an additional $100 million annually for PERS.

Harkins told Magnolia Tribune that his bill would not address PERS, but the Senate is committed to both additional funding and a new tier of benefits for new public employees. The chamber passed a 5th tier for new public employees for PERS on Wednesday.

For his part, Lamar says HB 1 will generate a net tax cut of $1.1 billion by 2037.

Harkins says the Senate net cut is smaller — still over $300 million — but will be a net tax cut in year 1, without raising the sales tax on items Mississippians buy. He also expressed optimism the two chambers could work out a compromise that responsibly reduces the tax burden on working Mississippians.

Harkins did offer a word of caution, though, pointing out that there are considerable increased expenses on the horizon with Medicaid and PERS. He says the surpluses the state has experienced are shrinking as the state takes on new obligations and COVID money finishes working its way through the state.