The unfunded enhancements along with other challenges have resulted in something of a “perfect storm” for PERS – and taxpayers are being asked to shoulder the burden with no end in sight.

Mississippi’s retirement plan is not unique in that it faces challenges, such as market downturns, a global pandemic, and changes in accounting standards. These events are impacting pension plans nationwide.

Where Mississippi PERS differs, however, is structural enhancements to the system enacted by lawmakers in the late 1990s and early 2000s. In short, the Legislature voted to increase retirement benefits – without paying for these costs. They simply extended the pension plan’s payback period, a practice the legislative watchdog committee (PEER) warned against. A 1998 PEER report pulled no punches, suggesting legislative action was “almost analogous to buying benefits on credit. As anyone knows, too much credit can be a dangerous thing.”

Even the Mississippi Constitution (Sect. 272A) speaks to this issue, prohibiting legislation from being enacted to increase benefits “in any manner unless funds are available.”

The unfunded enhancements along with other challenges have resulted in something of a “perfect storm” for the system – and taxpayers are being asked to shoulder the burden with no end in sight.

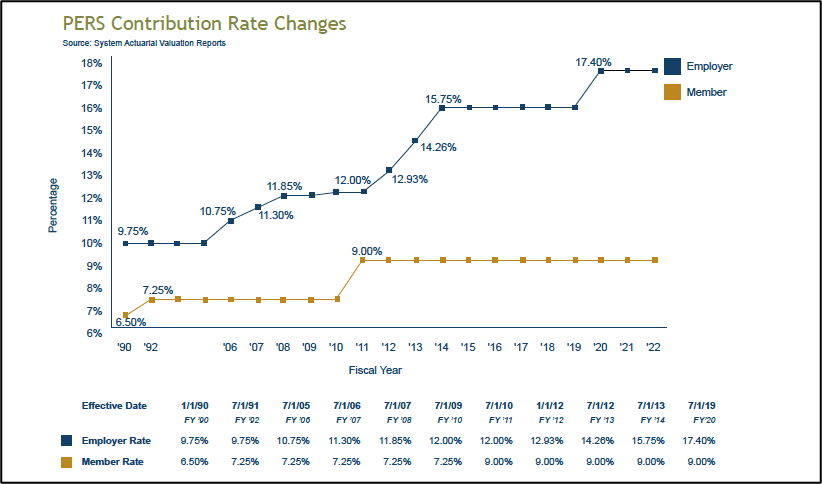

Contribution rates have flipped:

When the system was established, the employee (beneficiary) contribution rate was set at 4.0 percent, while the employer (taxpayer) rate was 2.5 percent, for a collective contribution percentage rate of 6.5.

Since that time, the ratio of taxpayer-supported contributions to beneficiary-supported contributions has significantly changed, with an increased reliance on Mississippi taxpayer dollars. At PERS’ beginning, taxpayers were expected to provide 38.5 percent of pension costs; today, that figure has risen to about 66 percent. But costs are rising for both taxpayers and members. Since its inception, PERS members have seen their rates rise by 125 percent, from 4.0 percent to 9.0 percent. Taxpayers, on the other hand, have seen their rates increase from 2.5 percent to 17.4 percent, an astounding increase of 596 percent.

Members have not seen their contribution rates increase since 2011, when the Legislature changed their required rates from 7.25 to 9.0 percent. However, during this same period, the PERS Board voted to increase taxpayer funding by 45 percent.

The PERS chart below visually demonstrates this increased reliance on taxpayer contributions.

Bottom Line:

As lawmakers evaluate the state retirement plan, it is important to understand historical context, the origins of PERS, and its current benefit structure. The lawmakers who developed the system anticipated that members – those who benefit from the plan – would cover most plan liabilities, not taxpayers. However, in recent years, that paradigm has shifted, with taxpayers being asked to contribute more and more funds to the fraught system.