According to the Joint Legislative PEER analysis, all three metrics used to evaluate the current public employees retirement plan were at a red signal-light status.

The Joint Legislative Committee on Performance Evaluation and Expenditure Review, or PEER, has released a new report regarding the financial soundness of the Public Employees’ Retirement System (PERS).

Read the full report here.

The report, titled 2022 Update on Financial Soundness of the Public Employees’ Retirement System, take a look into the state’s public retirement system and assesses its current financial status.

PERS is the state’s defined benefit retirement plan for employees of state agencies, counties, cities, colleges and universities, public school districts, and other participating offices. It functions under a 10-member Board of Trustees who are responsible for ensuring adequate funding of the plan. The board sets contribution rates for employers.

Each component, such as investment return and wage inflation assumptions, retirement tables and retiree mortality tables, must function in tandem in order for the plan to maintain a good financial standing.

Findings indicted metrics were not in good standing

PEER found that as of June 30, 2022, all three of the plan’s evaluation metrics were at red signal-light status, meaning a failure to reach the metric target. These metrics include funded ratio, and cash flow as a percentage of assets, as well as actuarial determined contribution/fixed contribution rate ratio.

During FY 2022 PERS took a negative investment hit down 8.54%. During the June meeting the Board recommended and adopted changes to the overall asset allocation model that includes private credit and infrastructure. PERS investment consultant, Callan LLC, made the recommendation.

The PERS Board’s response to adopting the changes were explained as follows:

The driving reason for the addition of the new asset classes is that they are expected to provide further diversification to a portfolio heavily weighted in public equities. The benefits that both private credit and infrastructure can provide to the PERS portfolio are (but are not limited to) cash flow generation, expected return premiums, higher downside protection, and volatility dampening.

Prior action to offset investment decrease

The PERS Board voted in December to raise the employer contribution from 17.40% to 22.40%, a five percent increase. The Legislature initially blocked the decision from taking place, during the 2023 session. Ultimately, lawmakers and the board came to an understanding and suspended the increase until July 1, 2024.

Political subdivisions, namely cities/towns and school districts, expressed strong concerns over the increase.

If the Board moves forward with the increase to 22.40%, projections indicate that three metrics would receive a green-light. By 2047 the funded ratio would be 86.1%, cash flow as a percentage of assets at -5.4%, and ADC/FCR ratio – the potential payment to the plan as determined by the actuary using a contribution allocation procedure – at 100%.

The plan’s fixed contribution rate (FCR) is the employer contribution rate set by the PERS Board.

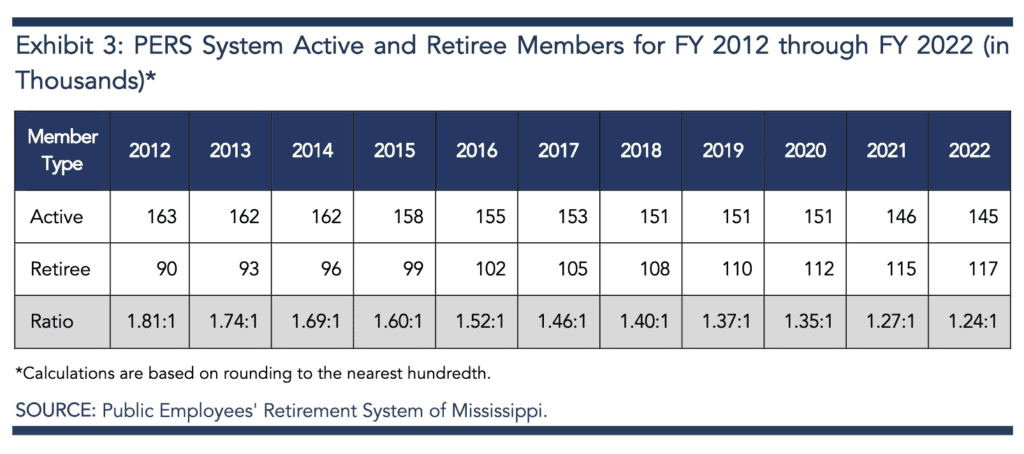

Currently, the ratio of active employees to retirees who are drawing on PERS has decreased from 1.81:1 in FY2012 to 1.24:1 in FY 2022. This is a 31.49% decrease.

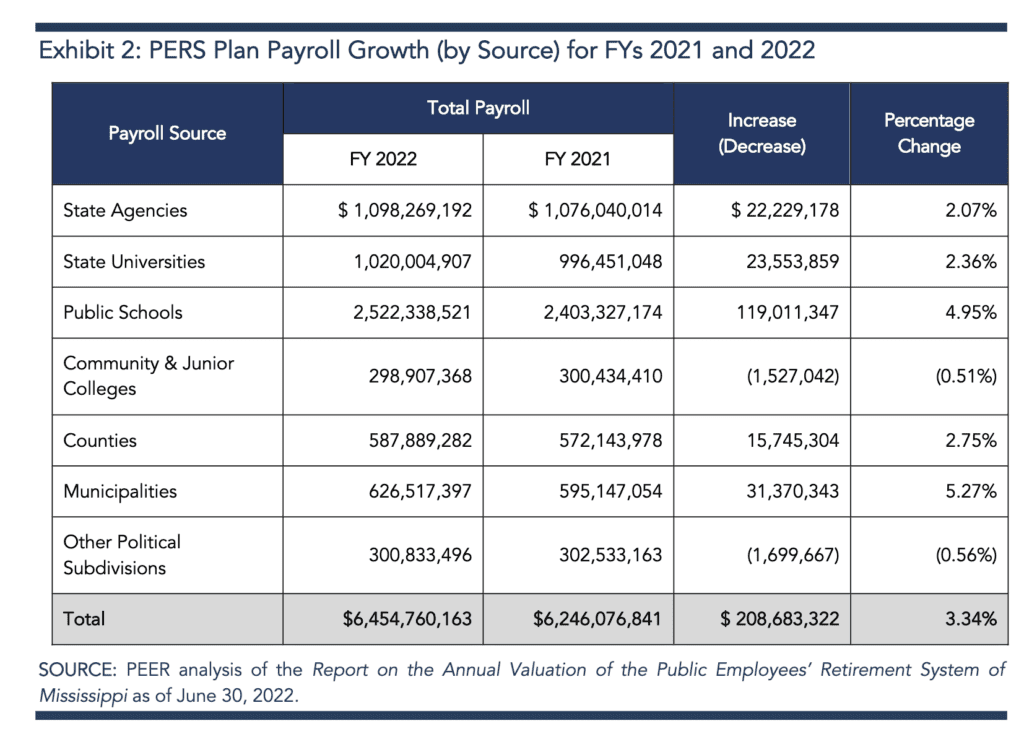

Payroll increases stayed below projections

In the last five to ten years, the average annual payroll increases for a PERS employee remained below the actuarial model’s projected rate. The projected rate was 2.65%, while the actual annual payroll increase was 1.36% in the last five years, and 0.98% in the last 10 years.

Because of the decrease, the payroll of fewer active members inevitably funds future pension

obligations. This factor is even more important, based on the report, because contributions from active members and their employers comprise approximately 45% of PERS revenues (as of FY 2022).

While PERS has experienced positive payroll growth in three of the last five fiscal years, each of these periods’ results, with the exception of FY 2022, was below the rate of wage growth assumed by the PERS Board.

The report indicated that the PERS Board should continue to analyze variation between actual and assumed wage growth.

According to the report, the PERS Board investment assumption target is 7.00%. Due to the plans funding policy, PERS has only experienced excess returns sufficient to reduce the plans utilized investment return assumption rate from 7.75% to 7.55%. It currently sits at 7.55% and is expected to be reduced over time.

It was PEER’s opinion that the current methodology used by PERS could be a cause of concern. PEER stated:

While adoption of any future changes under the current methodology may lessen the impact on the plan, any delays in the implementation of the discounted rate may cause any future needed adjustments, such as to the plan’s employer contribution rate, to be larger than was first necessary. Due to the method adopted by the Board for recognition of the actuary’s recommendations, it is imperative that the PERS Board and its consulting actuary continue to monitor the investment return assumption in future years to ensure that the investment return assumption accurately reflects market conditions and the PERS investment allocation model.

PERS response to the PEER report

In a letter response to the PEER committee written by PERS Executive Director Ray Higgins, he said that despite the market volatility, PERS has outperformed its benchmarks.

“While the report accurately mentions that we have experienced market volatility in recent years and compares PERS to other similar state retirement systems, it would also be informative to note that PERS continues to outperform its benchmark when analyzed over one-year, three-year, five-year, and ten-year periods,” wrote Higgins. “Given that states often vary in their legal requirements, benefit structures, liabilities and asset allocations, a comparison to a custom benchmark that is designed based on the specific requirements and asset allocation of PERS of MS is important as well. As a suggestion for this year or future reports, adding this data to the charts on investment performance or elsewhere in the report would be beneficial to the reader.”

Higgins added that overall, he believes it is a good review and consistent with the data from PERS.