Low cost of living, healthy job market, and relationship banking give the Magnolia State an economic competitive advantage.

Mississippi ranks as the second best state for first-time homebuyers, according to new research from Moneywise.

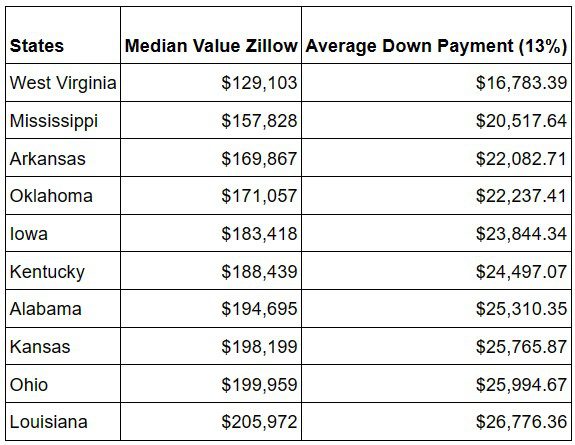

Moneywise, an online personal finance and investing publication, ranked all 50 states based on the median price for houses in each respective state as provided by Zillow, an online real estate marketplace, as well as the average down payment percentage of 13% according to the National Association of Realtors.

The report says buying a home in Mississippi has an average down payment requirement of $20,517.64. The overall average down payment for homes across the U.S. is $43,870.93.

“The state’s average Zillow home value of $157,828 is also a draw,” the Moneywise report notes, adding, “not to mention Mississippi being home to a rich cultural heritage, and its cities and owns offering a diverse range of architecture, cuisine, and entertainment.”

The chart below shows the states with the smallest down payment requirement, according to the new Moneywise report.

The research shows that the highest down payment states are those with a higher cost of living: Hawaii, California, Washington, Colorado and Massachusetts.

Gordon Fellows, President and CEO of the Mississippi Bankers Association, said the Moneywise report is a good reminder of the low cost of living that is enjoyed in Mississippi. He said it is an economic competitive advantage for the state.

“When you combine this low cost of living and the record low statewide unemployment rate with the relationship banking business model that is so prevalent in Mississippi, there’s a lot of potential,” Fellows told Magnolia Tribune this week. “Hopefully the national macro-economic environment doesn’t present too many hurdles over the next few quarters.”

RELATED: Mississippi’s unemployment rate reaches new record low of 3.5%

Those hurdles have included rising interest rates as the Federal Reserve continues to focus on the record high inflation and increased cost of goods that have plagued the nation over the past couple of years.

“Like most of the country, interest rate increases from the Federal Reserve have had a cooling effect on home purchases [in Mississippi],” Fellows said.

But, as he has seen across the state during this inflationary period, the slowing home sale activity in the Magnolia State seems to be less severe than in other parts of the country.

“Hopefully we’re close to the end of quarterly interest rate increases [by the Fed], which should be helpful,” Fellows noted.

Fellows said there is also a local component at play. Banks in Mississippi are largely community based, meaning lending decisions tend to be more locally driven.

“Mississippi bankers are experts on their local markets and integral parts of their communities,” Fellows added. “They help provide market-specific guidance to potential first-time homebuyers around the state.”