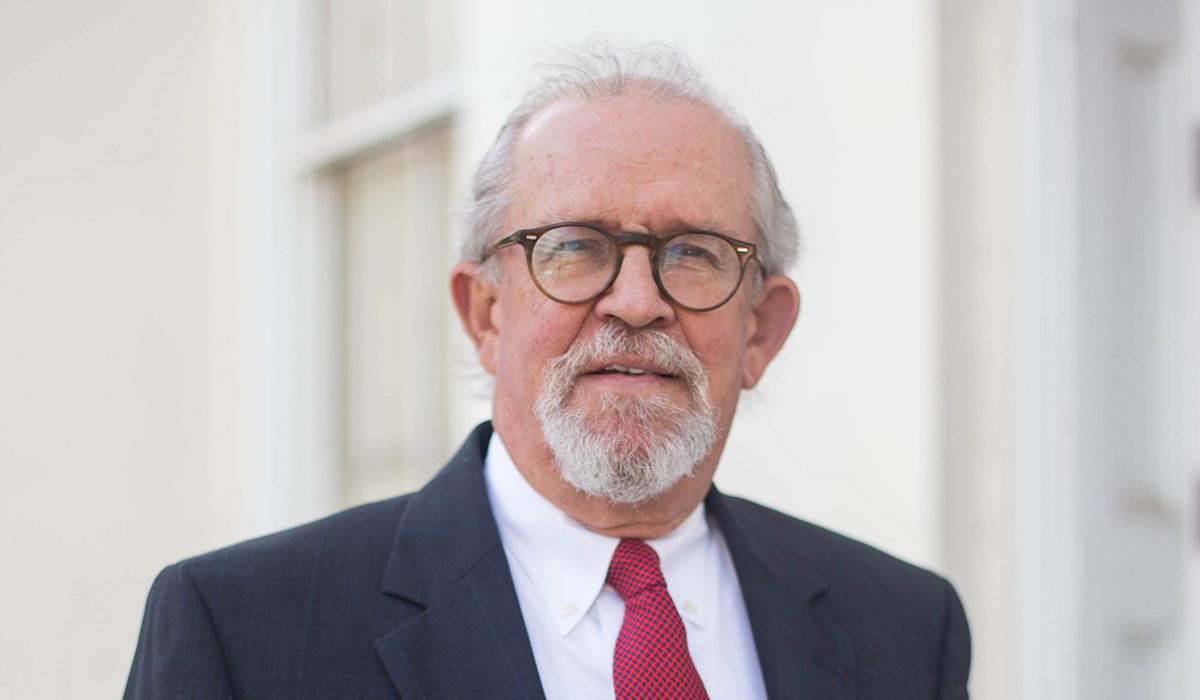

Submitted by Russ Latino

The Mississippi Tax Freedom Act provides immediate relief to working-class families.

On April 5, Mississippi joined a small cadre of states that have recently passed significant tax reform. The Mississippi Tax Freedom Act provides immediate relief to working-class families, and when fully phased in over the next four years, it will be the largest tax cut in state history.

Under the plan, Mississippi will create an income-tax exemption higher than any state in the country next year by fully eliminating tax liability on the lower of two income-tax brackets. Single filers will not pay income taxes on the first $18,300 of their income, while married couples filing jointly will not pay income taxes on the first $36,600.

For context, the federal poverty level is $13,590 for a single-person household and $32,470 for a five-person household. This exemption-first approach will result in most low-income workers having no state-income-tax liability in the first year of the plan and is a deviation from other states that have primarily focused their efforts on rate reductions.

The break could not come at a better time, with inflation adding an estimated $300 a month to the average family’s expenses.

Mississippi previously operated with three income-tax brackets. Between 2016 and 2021, it phased out the 3 percent bracket that applied to the first $5,000 in income. As a result of the Tax Freedom Act, it will eliminate the current 4 percent bracket, which applies to the second $5,000 income. The 5 percent bracket will be the only thing that is left, making Mississippi one of ten states that operate with a flat tax. In years two through four of the plan, the state income-tax rate will drop a full percentage point, from 5 percent to 4 percent, making Mississippi’s flat rate one of the lowest in the nation. In total, the package represents a $525 million tax cut.

The agreement comes after two years of intense public debate between the state’s Republican leadership, with Governor Tate Reeves and House Speaker Philip Gunn calling for complete repeal of the income tax.

In each of the last two legislative sessions, the Mississippi House passed plans for full elimination in hopes of joining Tennessee, Texas, and Florida among states that operate without an income tax. The case for gradual elimination was bolstered by back-to-back billion-dollar state-revenue surpluses in fiscal years 2021 and 2022, along with over $4 billion accumulating in reserves.

Those plans ran into roadblocks in the Mississippi Senate. Senators raised concerns about the sustainability of the state’s current revenue picture and the need to make investments in certain government services that were perceived as neglected. Those concerns were founded, in part, on questions about the revenue-boosting effect of the $35 billion in federal aid that poured into Mississippi during the Covid pandemic.

Negotiations were also stymied by a steady diet of increasingly complex proposals for tax offsets and growth triggers, and low-value gimmicks, such as a temporary gas-tax moratorium. A few weeks ago, talks appeared to be at an impasse. To their credit, state leaders kept talking. They stripped away the fat to get to simple, solid policy.

And what Mississippi ended up with was a good compromise — one that responsibly allowed the legislature to invest in key priorities, like a $250 million teacher pay raise, while still returning to workers more of what they earn than in any previous tax-relief plan.

I’ve called Mississippi home for most of my life, and my home has been misunderstood. One particular point of confusion is over our political and economic temperament. While Mississippi is quite conservative socially, when it comes to economic thought, we are historically protectionist and more dependent on state and federal government largess for our survival than almost every other state.

At the core of the tax debate was a philosophical question about whether that dependency would ever result in meaningful prosperity. Past performance and present condition — the worst labor-force-participation rate, lowest income levels, highest poverty, and second-shortest life expectancy in the nation — suggested it would not. If not, the quandary then became one about what conditions might create an atmosphere for growth and opportunity. The conclusion was to believe in people as the primary drivers of wellbeing — to better empower them to invest in their families, their businesses and their communities.

The move of our legislature, while it may on its face look typical of a red state, represents a paradigm shift for Mississippi. It also may prove to be a model for other states, not only with the simplicity, efficiency, and fairness of its reform, but on the value of honest, hard discourse that leads to the development of better ideas.

###

Submitted by Russ Latino. He is the President of Empower Mississippi, a non-profit think-tank that advances education, work, and justice reforms in pursuit of helping all Mississippians rise.