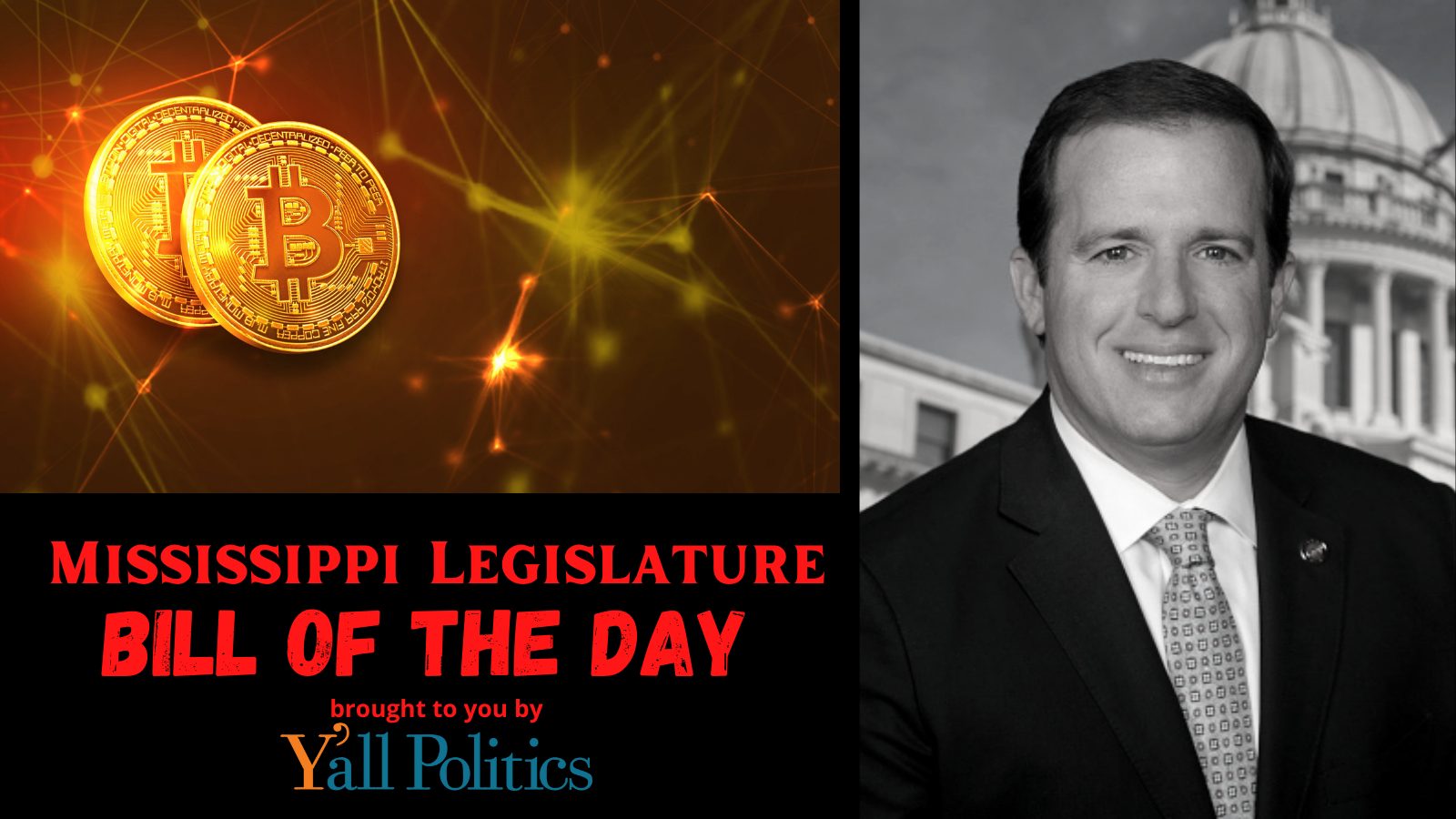

Y’all Politics brings you a Bill of the Day from the Mississippi Legislature that just may pique your interest.

Cryptocurrency has become a major financial story over the past few years. Celebrities and high-profile sports figures have helped to bring it into the mainstream by signing contracts that include payment in the digital currency.

For those who may not know what cryptocurrency is and how it works, the Miriam-Webster definition of cryptocurrency states that it is any form of currency that only exists digitally, that usually has no central issuing or regulating authority but instead uses a decentralized system to record transactions and manage the issuance of new units, and that relies on cryptography to prevent counterfeiting and fraudulent transactions.

State Senator Josh Harkins (R), chairman of the Mississippi Senate Finance Committee, has filed a set of bills aimed at addressing this developing digital currency, bringing it into state code and setting parameters for its recognition in Mississippi.

Harkins has filed the following bills related to cryptocurrency and its function in the state:

- SB 2631 – This bill would exempt virtual currencies from the Mississippi Money Transmitters Act. It has been referred to the Senate Business and Financial Institutions Committee.

- SB 2632 – This bill would create a Digital Assest Act, classifying digital assets and specify that digital assets are property within the Uniform Commercial Code (UCC). It would authorize security interests in digital assets and establish an opt-in framework for banks to provide custodial services for digital asset property. It has been double referred to the Senate Business and Financial Institutions Committee and the Senate Judiciary, Division A Committee.

- SB 2633 – This bill would create an exemption for open blockchain tokens from securities laws, meaning a developer or seller of an open blockchain token shall not be deemed the issuer of a security and shall not be subject to the provisions of the Mississippi Securities Act of 2010 if conditions are met as set out in the bill. It has been referred to the Senate Business and Financial Institutions Committee.

For now, it remains unclear as to whether these bills will make it out of the assigned committees.

Not having them assigned to the Finance Committee, which Harkins chairs, could be problematic for these bills, allowing for the powerful lobby by banks and other financial institutions to more readily play a role in how these bills move forward.

To learn more about these bills, click on the assigned bill numbers in the article above.