The Mississippi House’s plan to phase out the state income tax appears to be dead, dead, dead for the 2021 session.

Speaker Philip Gunn filed HB 1439, titled the “Mississippi Tax Freedom Act of 2021,” in late February. The bill would have phased out the state income tax and reduced the grocery tax while raising the state sales tax along with other use or sales taxes. It passed the House by a vote of 85-34.

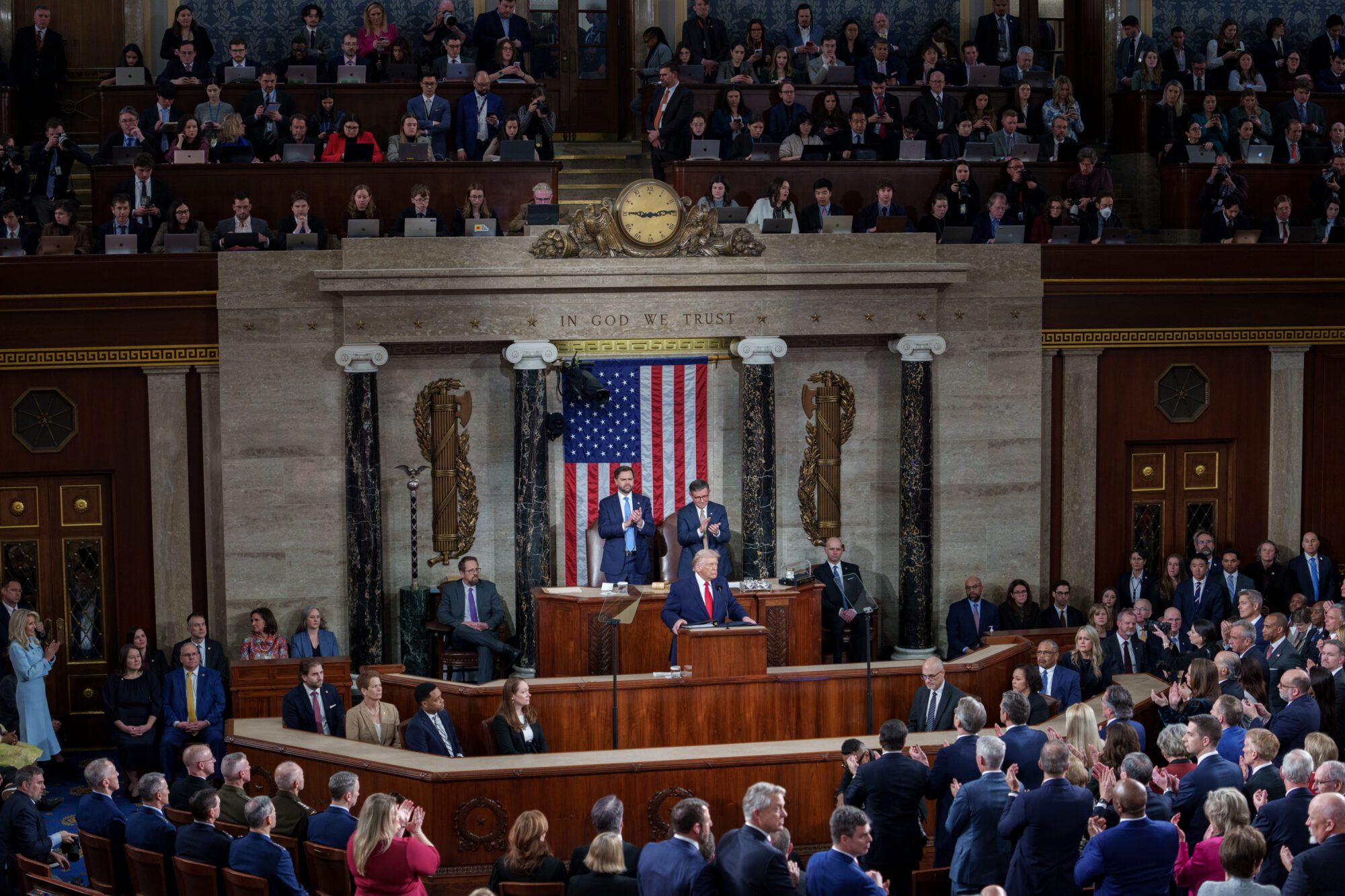

The measure was immediately panned in the Senate as senators were unhappy with having such a large change in tax structure dropped on them late in the session. Lt. Governor Delbert Hosemann went on record as saying no senator had come to him asking to have the House bill brought to the floor. As such, Speaker Gunn’s bill met its demise in the Senate Finance Committee, failing to make it out before the deadline.

House leaders tried to resurrect the bill by adding it as an amendment to a bond bill for the state institutions of higher learning, SB 2971. Following an impassioned floor speech by Rep. Trey Lamar, chairman the House Ways and Means Committee, where he noted changes made to the original language that included the removal of the tax increase that was previously placed on farmers, loggers and manufactures in the initial bill, addressing concerns that were raised by various groups, the House voted 89-22 to tack the income tax phase out language onto the bond bill, increasing the vote total in the House by four.

This move concerned a number of lawmakers, as some quietly asked if the language was germane to the bill and if it would survive should a point of order be raised.

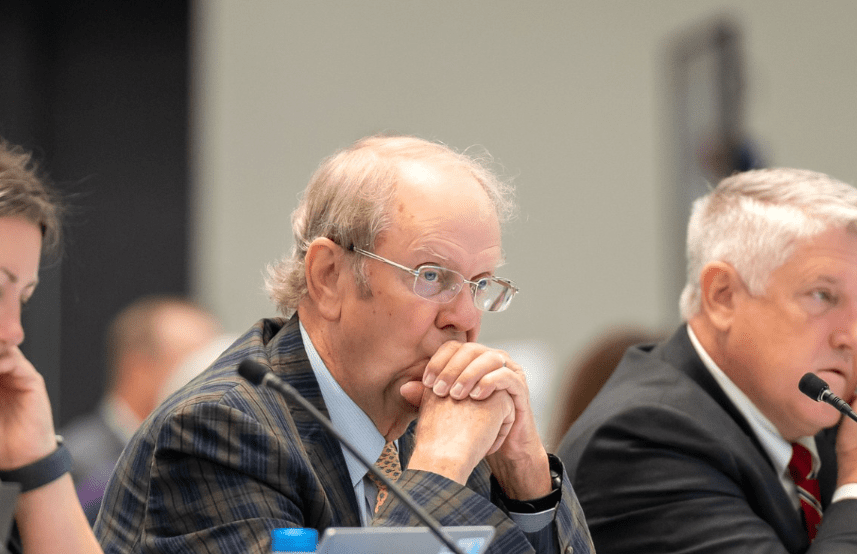

In the meantime, Senate Finance Chair Sen. Josh Harkins offered a resolution that would create a State Taxation Study Committee to allow lawmakers to come together during the summer and come up with a unified proposal between the two chambers. That resolution, SCR 536, passed the Senate by a vote of 48-3. It has yet to be taken up in the House.

The bond bill – SB 2971 – went to conference between the two chambers over the weekend as the session winds down. What resulted was that the House amendment related to the income tax phase out was removed from the final conference report.

Conferees on the Senate side were Senators Harkins, Chris Johnson, and Dean Kirby. For the House, conferees were Representatives Lamar, Jody Steverson, and Steve Massengill.

Senator Harkins told Y’all Politics on Monday that the plan is to have meetings this summer to allow lawmakers who have never delved into the state’s tax policy in any significant manner to get a better understanding of revenue and spending.

“Until you really look into it, it’s kind of a 30,000 foot topic,” Harkins said. “What ramifications are there?”

The unknowns are concerning, the Senator said, such as corporations changing their structures as a result of the tax reforms, which risks the stability of state revenues.

“We have passed a resolution on the Senate side setting up a study committee. Whether the House passes it or not I don’t know,” Harkins said. “We intend on having economists, tax experts, all different gamut of groups to come and have a conversation on our fiscal policy here in Mississippi to see what is the best path forward to be prosperous, competitive, stable and successful.”

Rep. Lamar released a statement on the conference report on SB 2791 removing Mississippi Tax Freedom Act provisions, saying;

“We believe there is nothing greater that we could do to benefit our citizens than relieving them of the burden of paying income taxes. We showed that with two very strong House votes this session. We will continue to lead on this issue and will not rest until the goal of income tax elimination is achieved.”