The recent “sales tax holiday” in Mississippi was a phenomenal success. I am proud as a member of the Mississippi House of Representatives that this legislation became law this year. I feel sure we will have many chances to “tweak” the act in coming years, but this was a great start.

I want to correct some points, however. I heard Sen. Walter Michel on a talk radio show insinuating that, but for the House of Representatives, the sales tax holiday in this state would have passed years ago, and that if had not been for him, it would never have come to fruition. While giving Sen. Michel full credit for his concern for our citizens and for his persistence in filing his bill for nine (9) consecutive years, the record needs to be set straight about the legislative history of the “sales tax holiday” bill.

According to official legislative records, Sen. Michel first introduced a tax holiday bill in 2000. It died in the SENATE FINANCE COMMITTEE (my emphasis). The same SENATE Finance Committee killed Sen. Michel’s tax holiday bills in 2001, 2002, 2003, 2004, 2005, 2007, 2008 and, even in the immediate past session of 2009.

In 2006, his bill passed the Senate and died in the House Ways and Means Committee. However, that was the session when all of the general obligation bond bills died in the Senate, but upon a suspension of rules by both House and Senate, five of them later passed both chambers. There was no way the House would pass his tax-holiday bill when the Senate was killing all of the House bond bills to the detriment of our citizens; therefore his tax bill died in the House committee.

Your readers need to know that although tax-holiday bills died in the SENATE Finance Committee from the years 2000 through 2006, HOUSE BILL 1612 , authorizing a “sales tax holiday” passed the full House in 2007. The bill was sent to the Senate where it died in the SENATE Finance Committee. THE SAME THING HAPPENED IN 2008 – the House passed a “sales tax holiday” bill and it DIED AGAIN IN THE SENATE FINANCE COMMITTEE.

That brought us to 2009 when House Ways and Means Chairman Rep. Percy Watson introduced HB 348 – the very act that Mississippi consumers took advantage of on July 31-Aug. 1.

So, while one must congratulate Sen. Michel for his intentions and his persistence in having filed “sales tax holiday” legislation for 10 consecutive years, only ONE of the bills he introduced got past the Senate Finance Committee. NINE OF THEM DIED IN HIS OWN SENATE FINANCE COMMITTEE.

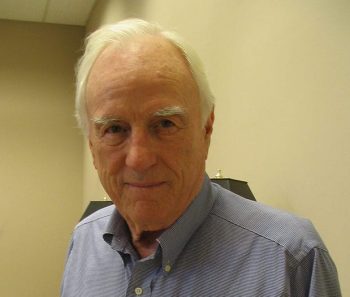

Respectfully Submitted,

State Rep. Sherra H. Lane, House District 86 (Clarke, Perry and Wayne Counties)