(AP Photo/Amy Sancetta)

Looking back on who said what when.

Even with record high gas prices right now, Mississippi’s gas prices would be 40 cents per gallon higher right now but for efforts to kill repeated gas tax increase proposals in the last five years.

In 2017-18, there was a major push for Mississippi to raise its 18.4 cent gas tax. At the time, former Transportation Commissioner Dick Hall, a Republican, led the charge with the argument that Mississippi needed increase in highway revenues to maintain and expand state highways and bridge infrastructure. He beat the gas tax increase drum for a decade. Media outlets fawned at the opportunity, lionized those leading the charge to raise taxes and regularly opined and slanted coverage in favor of the effort.

All sorts of dire predictions were made about the need specifically for a gas tax increase. What was left of the Editorial Page at the Clarion Ledger at the time hysterically screeched that legislature would “have blood on its hands” if a gas tax wasn’t passed and a bridge collapsed. It was, they considered, the only way. And proponents for raising taxes damn near tried everything. They did a study commission. They floated a local option gas tax. They floated a referendum on gas taxes. They proposed a gas tax short term increase that “rolled off”.

Of course, we know how the story went. Governor Phil Bryant and then Lt. Governor Tate Reeves opposed a gas tax increase. Speaker Philip Gunn had a version of a tax swap that had ultimately an 8 cent per gallon gas tax increase predicated on the elimination of the 4% income tax bracket. That’s not unlike his current proposal for a sales tax increase to offset eliminating Mississippi’s income tax altogether. But generally, Tate Reeves as both Lt. Governor and Governor and former Governor Phil Bryant found a way to thwart repeated attempts from multiple angles to increase a legislative mandated naked gas tax increase . . . because it was bad for business.

It’s critical to contextualize with the passage of time the massive push to raise the gas tax by road builders, those in the transportation commission, and some normally anti-tax business people. They were convinced that a straight gas tax increase was the way to go. But in August of 2018, Mississippi passed the Alyce Clark Lottery Bill which now has $80 million annually going to transportation funding and state recurring revenues in FY 2022 are about $7 billion.

Now admittedly, I wasn’t a giant fan of the lottery. I think generally the lottery is a tax on people who are bad at math, and I thought that Mississippi had cast its gambling lot with the casino industry which provides thousands of jobs all over the state. HOWEVER, the lottery did, at the very least, make those who wanted to fund highways do it optionally albeit largely unknowingly. Again, the lottery is probably not award winning public policy, but one can opt to play the lottery or not just like they can opt to gamble at a casino or not. Paying taxes on gas you need to drive to work is not optional.

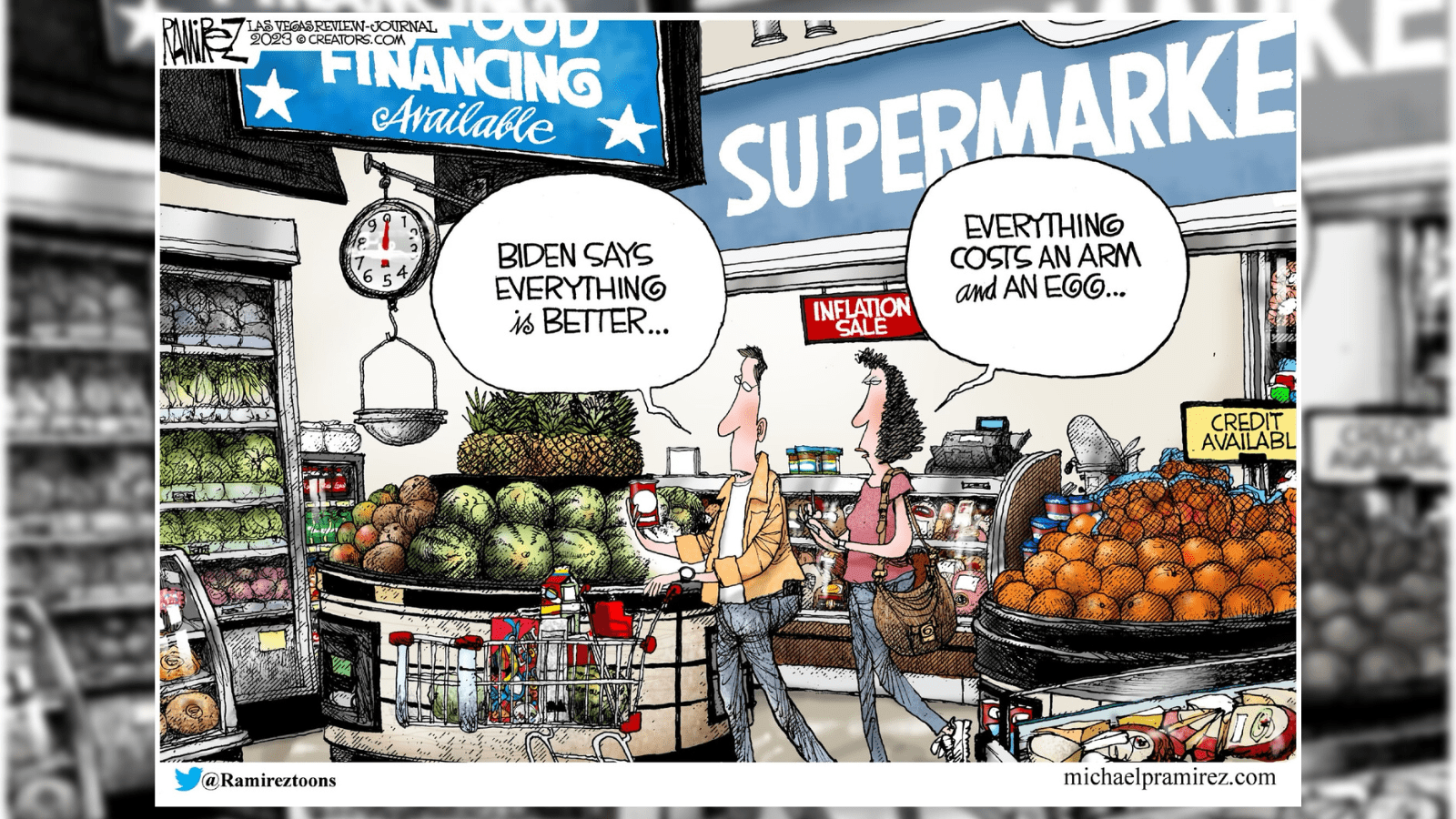

If policymakers had “listened to the experts” on the left and in the media, we would likely be paying $.40 per gallon more for gas today when gas prices are already over $4/gallon . . . and going up. The plan was to add 8-10 cents to the tax and then index it to the price of gas, which has now more than doubled. As we know, the price of fuel impacts the costs of everything from travel to what you get in the store. That’s probably the most pernicious sort of income hit to low and middle income families that pay more of a percentage of their income for gas and essentials.

Again, it’s time to remember who said what when and why a straight tax raising exercise is almost a bad idea 99.99% of the time . . . especially when viewed through the lens of how the future actually unfolded. It certainly was in this case.