Let’s assume for a moment the notion that Speaker Philip Gunn and House leaders put the teacher pay raise in their proposal to phase out the state income tax was a naked attempt to move the bill forward, knowing full well Governor Tate Reeves, Lt. Governor Delbert Hosemann and the Senate’s strong desire to pass a teacher pay raise this session.

That is certainly the assumption education lobbyists have made, calling it a “bargaining chip” and saying lawmakers are holding the teacher pay raise “hostage.” But all the public has heard for years was how bad conditions are for Mississippi teachers and how little they are paid for the work they do.

Sweeping changes to MS's revenue structure require thorough study & due diligence; vote NO on the rushed & unvetted HB 1439. Capitol switchboard: 601.359.3770

Don't believe the warning? Ask Kansas & Oklahoma: https://t.co/dRbS5nLly6#msleg #msedu pic.twitter.com/HmAdkibnNG

— The Parents' Campaign (@ParentsCampaign) February 23, 2021

This is politics, after all. Unless you are new to how the sausage is made, it’s what everyone expects, and that is exactly what this is. Surprisingly, education lobbyists who should know this have hit the panic button on behalf of teachers for some reason.

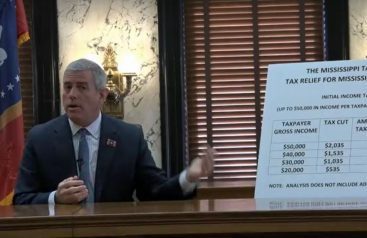

Regardless of your politics, Speaker Gunn’s tax bill is a home run for teachers. Teachers would receive:

- An immediate $1,000/year pay raise.

- A $1,700 reduction in income tax (based on a $45,000 average salary).

- The reduction of the grocery tax, which would net another $400 per teacher annually and likely more than offset the upward sales tax adjustments for purchases on other items.

The quick math is close to a $3,000 per year take home difference for each and every teacher in the state of Mississippi. That is nearly a 7% net economic benefit, which is much higher than the 2% benefit that teacher/education lobby groups have generally been supportive of in the past.

But let’s also assume that the political horse trading this play by Speaker Gunn would foster between members is exactly why the teacher pay raise was included in the income tax bill (HB 1439), making it more palatable and giving the phase out an additional leg to stand on knowing the scrutiny the bill was sure to receive from the left and the right given the other components and its quick rollout.

What is now clear is that the teacher and education lobbies are willing to sell out the economic interests of teachers at the drop of a hat.

If enacted, HB1439 could further reduce available state funds by a third, impacting schools and communities for decades and threatening access to quality education and essential services for our most vulnerable Mississippians. #msleg https://t.co/2Hyg3KHzz0

— MSPublicEducationPAC (@mspepac) February 24, 2021

As Y’all Politics has noted, we’ve been here before. Think back to 2019 when the Mississippi Association of Educators rattled sabers for a teacher’s strike after they “only got a $1,500 raise.” They considered that an “insult.” However, their tune was different a year later and they were tickled with only a $1,000 pay raise. Nancy Loome with The Parents Campaign was quoted as saying, “We are very pleased. So many of the new legislators campaigned on support for public schools.”

When you strip the political veneer off, these groups, such as The Parents Campaign, the Mississippi Association of Teachers and the Mississippi Professional Educators, are only interested in two things – maintaining the status quo that allows them to retain their fiefdoms and the narrative that the Mississippi Adequate Education Program (MAEP) is underfunded – both strategic talking points that provide them outsized influence at the Capitol.

No better example of the hypocrisy comes from the Mississippi Professional Educators. Their statement hyped fear that the sky was falling, writing, in part:

“…HB 1439 threatens state resources for state services. Lower state revenues result in budget cuts. Less state funding means local taxing authorities have to either cut services or raise taxes. States with no income tax have extremely high property taxes. Sales tax increases such as those provided for in HB 1439 hit low-income, elderly and retired citizens harder. Such financial challenges lessen, rather than strengthen, the likelihood of additional funding for our public schools, future teacher pay raises, and other state services…”

I thought they represented teachers, not low income, elderly or retired citizens.

In any event, MPE is either being intentionally misleading or intentionally dense as the lessened likelihood of additional funding for public schools was debunked by the Speaker and House leaders, and has been noted and dispelled even from Senators critical of the House bill.

Whether you agree with every provision in the House income tax phase bill or not, arguing that it is not beneficial to teachers is just fundamentally untrue – that is unless you’re an education lobbyist who would sell out teachers to maintain absolute control over education spending.

Then, it’s just all in a day’s work.