RELEASE:

COCHRAN MONITORS FEMA FLOOD INSURANCE REFORM PROGRESS

Homeland Security Secretary Says Solvency, Affordability Are Priorities for National Flood Insurance Program

WASHINGTON, D.C. – U.S. Senator Thad Cochran (R-Miss) today pledged to continue monitoring work by government officials on reforms intended to ensure federal flood insurance rates are accurate and affordable.

Cochran this week discussed with Homeland Security Secretary Jeh Johnson the efforts underway at Federal Emergency Management Agency (FEMA) to complete a flood insurance affordability framework, as required by the Homeowners Flood Insurance Affordability Act of 2014 (HFIAA). FEMA is attempting to complete its affordability assessments by fall.

“Mississippi homeowners, property owners, businesses and local leaders remain concerned about flood insurance rates and the outcome of the FEMA affordability study. We all want them to be as fact-based and accurate as possible as one way of ensuring the flood insurance is fair and affordable,” said Cochran, who serves on the Senate Homeland Security Appropriations Subcommittee which has jurisdiction over FEMA.

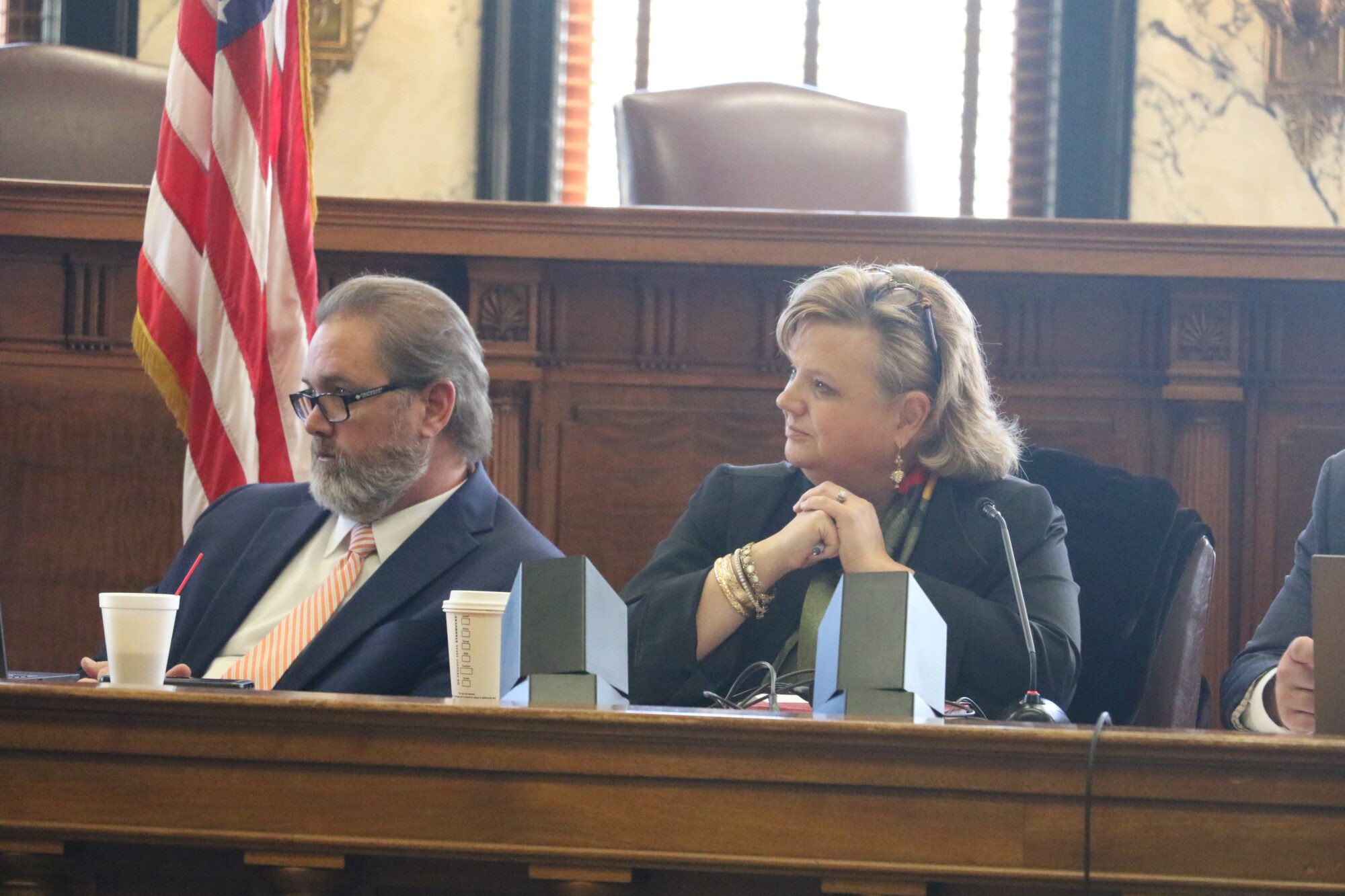

At a hearing Wednesday, Johnson stressed to Cochran his commitment to carry out the reforms outlined by Congress in the HFIAA.

“I’m interested in two things, and I know that [FEMA] Administrator Fugate agrees — affordability and solvency. I want to make sure we have a solvent national flood insurance program, and we want to be sure we have one that is affordable to those who need the insurance longer-term,” Johnson told Cochran. “Senator, I want you to know on behalf of your constituents in Mississippi and others in high-risk areas, this is a top priority of mine to make sure we have a solvent and affordable flood insurance program.”

The FY2016 budget request for FEMA recommends $181.2 million for the National Flood Insurance Fund, which will be used to implement the requirements in HFIAA and the Biggert-Waters Flood Insurance Reform Act of 2012.

“In this year’s budget submission, we have a request for new flood mapping to make sure that we get this right to update the districts, updates the areas that are high-risk. And again, I think that that should be done with the purpose of a solvent national flood insurance program and to make sure that it is an affordable one for people in high-risk areas. There’s no point in having flood insurance if nobody can afford it,” the Secretary said.

Cochran was a leading force in the development and enactment of HFIAA, a bipartisan law written to ensure that homeowners and communities across the country are not saddled with unaffordable flood insurance rate increases as the necessary reforms to the National Flood Insurance Program are implemented. The law also forced FEMA to certify its mapping methodology, and set milestones for the agency to carry out a flood insurance rate affordability study, among other things.

5/1/15