- Important state and national stories, market and business news, sports and entertainment, delivered in quick-hit fashion to start your day informed.

In Mississippi

1. Capitol Police hosting public panel discussion Monday

The Capitol Police in Jackson will hold a public Meet and Greet panel discussion on Monday, November 3. The open discussion will consist of a panel of law enforcement, court, and state officials, including Chief Bo Luckey, State Rep. Shanda Yates, CCID Court Judge James Holland, and representatives from the Jackson Police Department and Hinds County Sheriff’s Office.

This is an opportunity for residents to hear news and updates on policies and procedures that affect their communities. The Capitol Police said the intent of the forum is to encourage transparency, communication, and cooperation between law enforcement and the public.

The discussion is open to the public. It will take place from 6 p.m. to 8 p.m. at Jackson Academy with doors opening at 5:30 p.m.

If you would like to submit a discussion question, click this link.

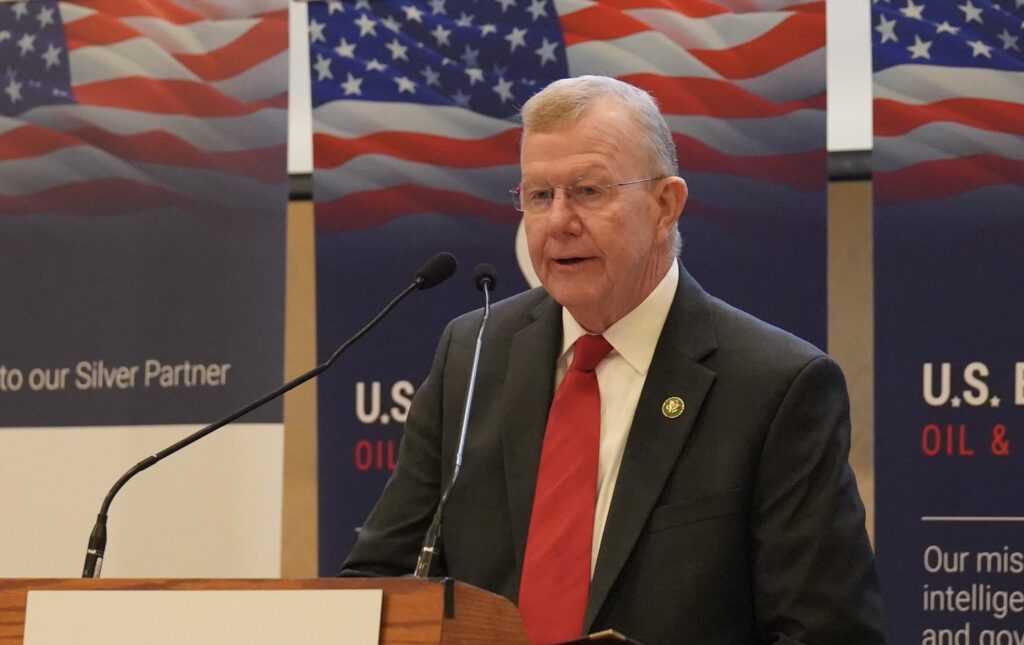

2. Ezell introduces legislation to restore NFIP

Mississippi 4th District Congressman Mike Ezell has introduced the NFIP Retroactive Renewal and Reauthorization Act, legislation to immediately restore the National Flood Insurance Program (NFIP). His goal is to ensure that those who plan to renew their NFIP policy are not punished due to the government shutdown.

NFIP has lapsed due to the shutdown, meaning no new flood insurance policies can be issued. Ezell has said that thousands of homeowners could face partial-risk assessments and higher rates unless Congress passes a retroactive extension.

The NFIP lapse has caused delays in home closings and leaves homeowners uninsured in still in hurricane season, Ezell noted.

Ezell said that under FEMA’s Risk Rating 2.0, many policyholders are not yet paying full-risk rates. Without a retroactive renewal, the congressman said those partial-risk protections could be lost, forcing families to start over at drastically higher prices.

National News & Foreign Policy

1. Trump says Senate GOP should get rid of 60 vote threshold

As The Hill reports, “President Trump on Thursday called on Senate Republicans to initiate the ‘nuclear option’ and get rid of the filibuster, which would allow them to end the government shutdown and pass legislation with a simple majority.”

“It is now time for the Republicans to play their ‘TRUMP CARD,’ and go for what is called the Nuclear Option — Get rid of the Filibuster, and get rid of it, NOW!” Trump posted on Truth Social, per The Hill.

The Hill continued, “The Senate filibuster rule requires most legislation to receive 60 votes to make it through the chamber, giving more power to the minority party and essentially preventing the majority party from passing whatever legislation it wants. Rule changes over the years have meant that judges and other nominees only require a simple majority.”

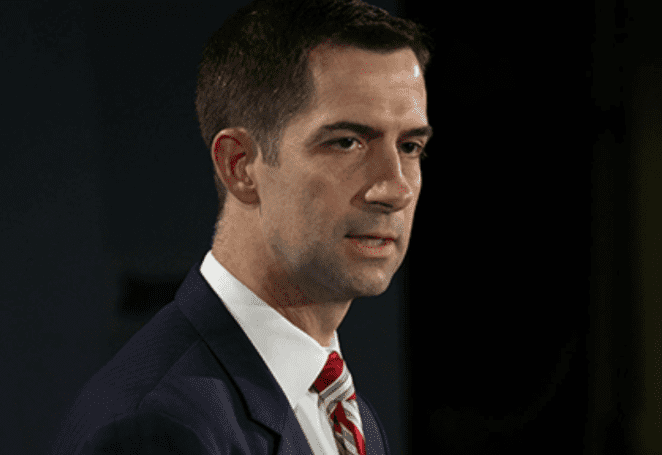

2. Senate GOP split on ending bi-annual clock changing

According to the Washington Post, U.S. Sen. Tom Cotton (R-Arkansas) blocked U.S. Senator Rick Scott’s (R-Florida) effort to end the bi-annual clock change, with Cotton “arguing that Americans would need to live ‘with an uneasy compromise’ and accept the regular clock changes.”

“When Donald Trump vowed last year to end America’s semiannual clock changes, pledging the Republican Party would finally resolve the issue, combatants in the years-long fight over daylight saving time thought their future was bright,” WP reported. “But the difficult politics of the matter have proved too much for Trump and his allies to overcome, culminating in a showdown on the Senate floor Tuesday that pitted Republican against Republican and left the movement’s future prospects cloudy.”

WP added, “The responsibility of changing the nation’s time code rests with Congress, meaning that Trump cannot simply issue an executive order. Nineteen states have also approved measures that would allow them to adopt year-round daylight saving time if Congress passed a bill making it permanent nationwide, according to the National Conference of State Legislatures.”

Sports

1. Ole Miss, Miss. State look for key SEC wins this Saturday

Two of Mississippi’s Big 3 are back in action this Saturday with four regular season games remaining on the schedules. Here are the matchups and how to watch:

- No. 7 Ole Miss (7-1) hosts South Carolina for a 6 p.m. kickoff in Oxford. It is being aired on ESPN.

- Mississippi State (4-4) travels to Arkansas for 3 p.m. kickoff on the SEC Network.

- Southern Miss (6-2) has a Bye Week.

2. Shuckers hosting LSU, Samford for fall ball exhibition this Sunday

The Biloxi Shuckers have announced that the defending national champion LSU Tigers and the Samford Bulldogs will meet at Keesler Federal Park for a fall ball exhibition matchup as part of the Hancock Whitney Classic on Sunday, November 2.

First pitch is scheduled for 11:00 a.m. The first 750 fans will receive a commemorative rally towel for the match-up and the first 1,000 fans will receive a 2026 Shuckers magnet schedule.

LSU will also be playing an intrasquad game on Saturday, November 1 at 12:00 p.m.

Tickets for the game can be purchased here or at the Shuckers Box Office located at Keesler Federal Park.

Markets & Business

1. Futures up on Amazon, Apple reports

CNBC reports that stock futures “rose Friday as investors digested strong quarterly results from tech giants Amazon and Apple.”

“Amazon shares rallied more than 12% after the e-commerce giant said its cloud computing unit’s revenue increased 20% in the third quarter, exceeding Wall Street’s estimates. Apple rose about 2% on the back of its strong fiscal fourth-quarter earnings and forecast for the iPhone maker’s December quarter,” CNBC reported.

CNBC went on to report, “U.S. stocks are coming off of a lackluster session as each of the benchmark indexes closed Thursday in the red. The Dow Jones Industrial Average fell nearly 110 points, or about 0.2%. The S&P 500 and Nasdaq Composite lost 0.99% and 1.58%, respectively, dragged lower by losses in big-name tech stocks Meta, Microsoft and Nvidia amid concerns about increasing AI spending. Meta recorded its biggest one-day loss in three years.”

2. Federal Reserve reducing banking supervision staff by 30%

The Wall Street Journal reports that Federal Reserve officials “are planning to reduce the staff of its banking supervision arm by 30% by the end of next year.”

“The reductions would leave the Fed’s supervision and regulation division with about 350 people, down from a previously authorized head count of 500, according to the memo. The cuts were announced by the Fed’s new top regulatory official, Vice Chair Michelle Bowman, during a morning meeting,” WSJ reported. “The move follows an earlier one by Fed Chair Jerome Powell, who in May said the central bank would seek to reduce staff across the institution by about 10%.”

WSJ added, “The banking supervision division manages the Fed’s oversight and regulation of thousands of bank holding companies and state-chartered banks. Under the Trump administration, banking regulators including the Fed have vowed to dial back the regulatory burden on banks. The shift follows a period of heightened scrutiny stemming from a regional banking crisis in 2023.”