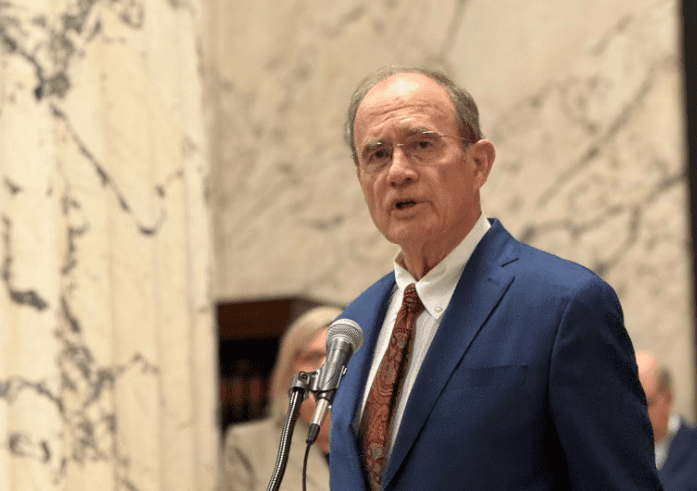

Speaker of the House Jason White addresses the media on Wednesday after Lt. Gov. Delbert Hosemann announced the Senate's new tax plan. He also discussed the expected death of a school choice bill in the House. Photo by Jeremy Pittari | Magnolia Tribune

- The House and Senate both stepped toward each other and the goal of ending the tax on work Monday. Leaders should continue to step boldly.

In the 2000 Hollywood blockbuster ‘Gladiator,’ Emperor Marcus Aurelius tells Russell Crowe’s Maximus character, “there was once a dream that was Rome. You could only whisper it. Anything more than a whisper and it would vanish.”

Big dreams are hard, prone to being picked apart by a cynic class eager to recount the reasons they can’t be done.

Eliminating the tax on work in Mississippi may not be Rome, but it’s not a small vision, either. While there are nine states who thrive with no tax on income, all of them started that way. No state has ever eliminated its income tax once in effect.

And this particular dream has faced more than a whisper’s worth of scrutiny and discord. Still, on Monday, both the Mississippi House and Senate came a step closer to making it a reality.

For the first time since talks began in earnest in 2021 about axing the income tax, the Senate unveiled a plan it says will result in complete elimination. Meanwhile, the House reworked its proposal to accommodate some of the Senate’s concerns about the original offering being too aggressive. Amid a sea of social media barbs and chatter in recent days, both chambers stepped toward each other.

That’s big.

There are 1.2 million workers in Mississippi. They teach in our schools, patrol our streets, build ships at our ports and do lots of jobs in between. Letting them keep what they earn is not radical. It’s moral. There is perhaps nothing more sacrosanct than the right of a man to enjoy the fruits of his own labor and nothing more deleterious to progress than punishing the productive.

When people are allowed to keep what they earn and invest in their own families, their own businesses, and their own communities, the economy grows and we’re all better off. This used to be common knowledge — that lasting growth and prosperity spring out of private enterprise, not bloated government.

Thinking like this gave birth to the wealthiest civilization in human history — no, not Rome, but us.

Coming Closer, Changes in Proposals

The House’s plan to eliminate the tax on work improved considerably today. The initial rate cut is not as steep as it was. In its original proposal, the House wanted to drop the rate from 4 to 3 percent in 2027. Now, the chamber proposes going down to 3.5 percent in the first year of new cuts.

This smaller initial cut — roughly $250 million — provides more cushion for future year’s cuts in a budget with a surplus approaching $700 million.

The House’s proposed partial offsets (sales and fuel tax) are not as big as they were. They are also phased in — versus the original plan that front-loaded increases — to ensure a net tax cut from Year 1.

In addition to the income tax elimination, the House plan reduces the sales tax on groceries, expands the homestead exemption for seniors, and directs $100 million annually to start shoring up PERS.

The Mississippi Senate’s plan, which originally dropped the rate to 3 percent by 2030, but no further, now includes “triggers” to allow the rate to be reduced over a longer period until it reaches zero. The Senate plan also includes a reduction of the sales tax on groceries, a smaller increase in fuel excise tax, and the resurrection of the Senate plan for a 5th tier of beneficiaries for PERS.

The crux now between the two chambers is that the House’s income tax cuts are automatic and made faster by sales tax offsets, while the Senate’s cuts are conditional and much slower.

If I were Emperor, I’d drop the fuel tax increase down to the Senate’s 9 cents (or meet in the middle), add a spending cap to the House’s proposal to ensure adequate cushion for its automatic and speedier cuts, and call it a day.

But I’d also caution about being too dogmatic. In the coming days, leaders in both chambers have the potential to do something historic.

Now is the time for bold leadership. Let’s end the tax on work and unleash Mississippi’s potential.