(Photo from Shutterstock)

- Local leaders say the extra funds in the House bill will go a long way in shoring up major infrastructure projects and public safety.

Mayors across Mississippi have expressed support for a provision in the proposed House Republican tax reform legislation allowing a local sales tax option, which would replace current diversions from the state sales tax to cities. This option is expected to generate $700 million in new revenue for cities and counties.

The legislation would also phase out the state income tax over a ten-year period.

READ MORE: Mississippi House passes ‘Build Up Mississippi Act’

However, the mayors are anxiously awaiting details of the Senate’s tax proposal before celebrating and signing infrastructure contracts, they said.

“We don’t know what’s coming out of the Senate and until we see what comes out of there, we’ll only have a wish list,” said Charley Dumas, Mayor of Prentiss.

Dumas and mayors from Cleveland and Ocean Springs said the extra funds in the House bill will go a long way in shoring up major infrastructure projects and public safety, which are financial headaches, big and small.

In Ocean Springs, Mayor Kenny Holloway, said House Bill 1 would bring in an extra $1.2 million in revenue. For his city of 20,000, that kind of funding could positively impact the police and fire department, the public works department and infrastructure projects, such as sidewalks.

“We could leverage [the extra funding] for grants to get additional money,” he said, adding that the city has three grocery stores and a super Walmart.

Dumas predicts that Prentiss leaders will see a bump of between $416,000 and $480,000. That is an increase of about 15 percent to their annual budget, of which about 60 to 70 percent comes from the sales tax on groceries in the town of about 1,000 residents.

“We could use the money. We need spot repairs on our roads. Asphalt for the road has gone up about 30 percent in recent years,” he said. “We’re responsible for the roads here. In 1998 or 99, we passed a $800,000 bond for road repairs. It’s been a struggle.”

Dumas, a former President of the Mississippi Municipal League, noted that within Prentiss’s city limits are a grocery store, six convenience stores, two Dollar Generals, and a Family Dollar. He said the sales tax on groceries is perhaps one of the “hardest taxes” on “working-class people.”

In Cleveland, population 12,000, Mayor Billy Nowell said his town could see a 13 to 15 percent boost to its coffers. Several hundreds of thousands of dollars would be split between Cleveland’s effort to combat flooding and street projects, he said.

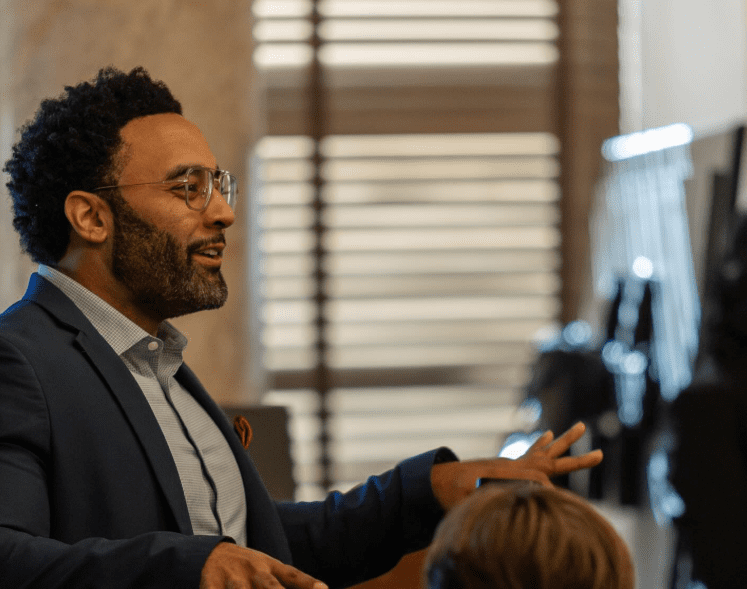

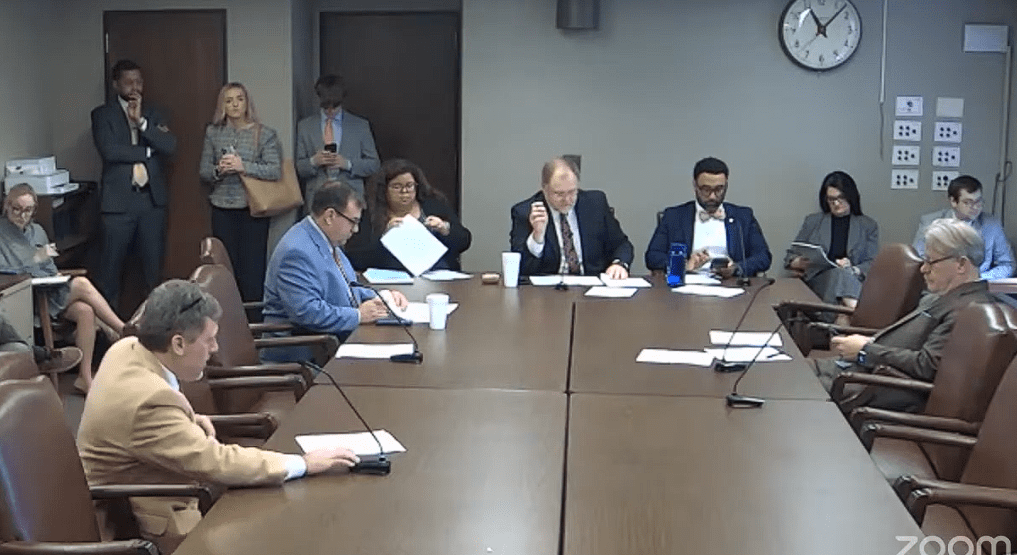

The mayors said they could add perspective to HB1. Holloway testified before a legislative committee in late 2024.

For his part, the bill’s author, State Rep. Trey Lamar, said one of the goals of HB1 was to help working-class Mississippians.

The bill “rewards the dignity of our people’s work by eliminating the income tax; it makes it easier to feed our families by slashing the grocery tax,” said Lamar.

“At this point, we like everything about HB1,” said Mayor Nowell, adding that municipal leaders across the state are waiting for the Senate bill to compare impacts on their municipalities, which may not include such a provision.

Upon passage of the legislation in the House, Speaker Jason White said by phasing out the state income tax and significantly reducing sales tax on groceries, “we alleviate the financial strain on Mississippians and create an environment ripe for robust economic growth.”

“Under HB 1, every municipality will receive more funding under the local option, 1.5 percent sales tax, than the current diversion,” White said. “With Build Up Mississippi’s proposed consumption-based model, Mississippi will maintain a lower sales tax and remain more competitive than our surrounding states.”

Governor Tate Reeves has called on the Senate to take up the House plan and send a tax cut bill to his desk this session.