- House plan to eliminate income tax draws bipartisan support, but also tough questions from House Democrats concerned about fiscal impact.

The Mississippi House overwhelmingly passed the massive $1.1 billion tax reform bill authored by House Ways and Means Chairman Trey Lamar (R) Thursday afternoon by a bipartisan vote of 88 to 24.

While House Minority Leader Robert Johnson (D) and other Democrats claimed the bill could lead the state into fiscal instability, Rep. Lamar defended the Republican-led legislation, calling the ‘Build Up Mississippi Act’ “the most transformational piece of legislation the state of Mississippi has ever seen.”

Governor Tate Reeves (R) has voiced support for eliminating the income tax for years and has called HB 1 a “serious effort.”

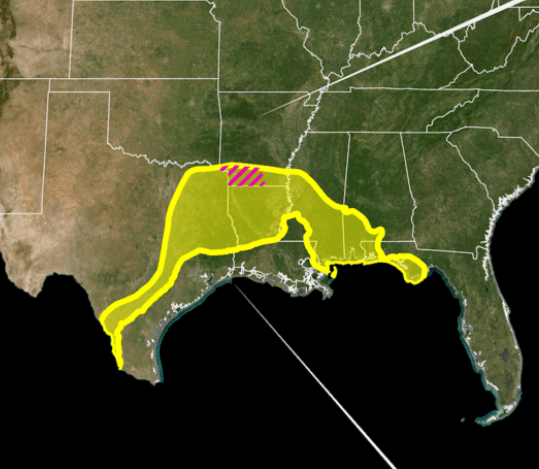

Reeves, who said the House delivered for Mississippi taxpayers, touted the legislation as giving Mississippi a competitive advantage among surrounding states. He noted that the bill would cut the income tax bracket from 4 percent to 3 percent in 2027, a year after the current income tax cut from 2022 is fully phased-in, while fully eliminating the state income tax in 10 years.

Speaker Jason White (R) expressed his gratitude for the overwhelming support his members have received from cities, county officials, statewide elected officials, and the Mississippi business community in what he described as “a comprehensive tax reform package designed to uplift Mississippians, support our infrastructure and PERS system, and empower local governments.”

“By phasing out the state income tax and significantly reducing sales tax on groceries, we alleviate the financial strain on Mississippians and create an environment ripe for robust economic growth,” Speaker White said.

“Under HB 1, every municipality will receive more funding under the local option, 1.5% sales tax, than the current diversion. With Build Up Mississippi’s proposed consumption-based model, Mississippi will maintain a lower sales tax and remain more competitive than our surrounding states.”

At 8.5 percent, Mississippi’s sales tax would remain lower than the average combined state and local sales tax rates in Louisiana (9.56%), Arkansas (9.45%), Tennessee (9.55%), and Alabama (9.29%).

The bill calls for reducing the state’s sales tax on groceries to 2.5 percent from 7 percent by 2036.

In addition, the legislation would place a 5 percent sales tax on gas, raising an estimated $400 million annually, according to Lamar, and providing dedicated funding for the Mississippi Department of Transportation’s maintenance and capacity projects fund.

The House bill also redirects $100 million of lottery revenue to stabilize PERS, the state employee retirement system.

Rep. Lamar fielded dozens of questions from House members during the floor debate on Thursday. Republicans sought clarification on the bill’s impact on local taxes as it relates to the sales tax on groceries, while Democrats asked about education and bond ratings, seeking assurance that Mississippi would not mirror other states that fell into financial problems when cutting income taxes.

Democratic Opposition

Minority Leader Johnson said the math does not add up to him. He said that in the past, the tax bills were revenue neutral, but after reading the 107-page bill, he questioned whether money coming in was equal to money going out of the state’s coffers.

“We always made tax bills revenue neutral,” said Johnson, who has more than three decades of legislative experience. “There’s no offsets in this bill.”

The bill which cuts an estimated $2.2 billion in income and grocery tax contains an estimated $1.1 billion in offsets through the fuel and sales tax changes, both of which take effect in full in 2026.

Rep. Lamar said the legislation would increase the state’s revenue, but Johnson was leery to that end.

The Democrat expressed concern that the bill would harm the state’s business community, adding Mississippi is No. 49 in GDP, behind Arkansas.

“I agree, and the best answer is for us to eliminate the income tax,” replied Rep. Lamar.

Rep. Johnson said that when other states, such as West Virginia and Kansas, eliminated or reduced their income tax, deep cuts were made to healthcare and education. Kansas, he noted, had hard fiscal times because it reduced taxes rather than spending.

Democrats hounded Lamar about cuts to education from higher institutions to K-12 public school. A key concern was the decreased funding for infrastructure improvements at aging colleges, mainly Historically Black Colleges and Universities, in the state.

Rep, Omeria Scott (D) asked if the bill reduces funding for the Education Enhancement Fund. Waving the FY 2025-2026 Budget, she showed where the fund will drop by $1.5 million during the next fiscal year.

After several additional questions about the elimination of the income tax leading to education cuts, Rep. Lamar replied, “I can guarantee you education is not being cut in this bill. But I cannot make any promises about in the future.” His remark led to some Democratic laughter on the floor.

The legislation should not adversely affect the state’s bond rating, which Fitch rates as ‘AA’ as of October 2024, according to Lamar. For the last several years he said the state has been paying cash, and its bond rating should remain strong.

“I wouldn’t think this bill would affect the bond rating, but I cannot predict the economic future,” Lamar added.

Rep. Scott introduced an amendment that would end the sales tax on groceries immediately.

“It would be good to cut grocery taxes for the people immediately, and not phase it out in 10 years,” she said. “If you are serious about helping working Mississippians, do it now.”

After a few questions from Republican members, the amendment was tabled by a vote of 72 to 36. In response, Scott let her displeasure be known, using President-elect Donald Trump to criticize her colleagues across the aisle.

“Mississippians voted for Donald J. Trump by 66 percent. Your guy wants to cut taxes, your guy wants to help working families,” she said.

The legislation will now head across the Capitol for consideration in the state Senate.

Senate Finance Chairman Josh Harkins (R) has said the Senate will introduce its own tax cut bill within a week. Previews from the Lt. Governor’s office included a plan to reduce Mississippi’s flat income tax from 4 percent to 3 percent by 2030 and immediately reduce the sales tax on groceries to 5 percent.