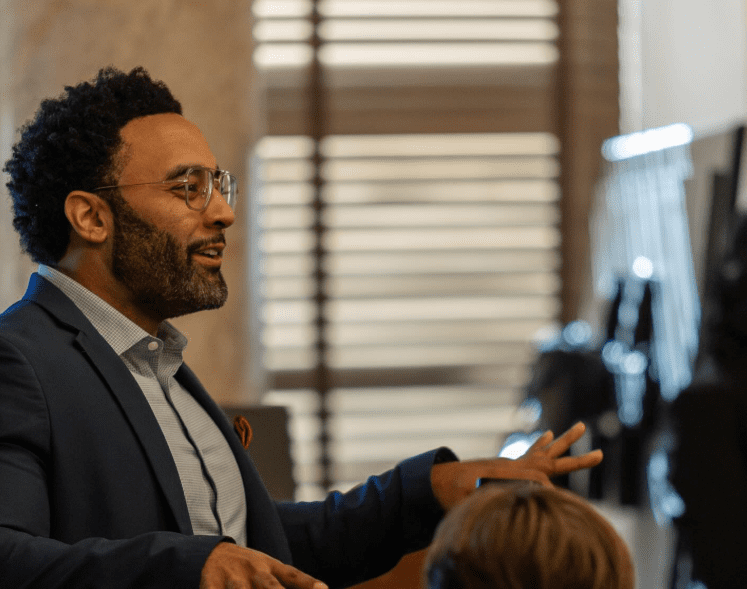

Mississippi House Ways and Means Committee Chairman Trey Lamar, R-Senatobia (AP Photo/Rogelio V. Solis, File - Copyright 2022 The Associated Press. All rights reserved.)

- Tuesday’s action by the House Ways and Means Committee sends HB 1 to the full chamber for consideration later this week.

The Mississippi House Ways and Means Committee voted HB 1, a comprehensive tax bill, out of committee on a voice vote Tuesday afternoon, sending the bill to the full floor as early as Wednesday or Thursday of this week.

Before the vote, State Rep. Robert Johnson (D), the House Minority Leader, asked if the bill was revenue neutral. Committee Chair State Rep. Trey Lamar (R) said it would cut taxes and increase the state’s revenue.

“The GOP caucus sees this as a bipartisan bill,” said Lamar. Lamar told Magnolia Tribune on Friday that the law, once fully phased in would yield a $1.1 billion annual tax cut.

The bill sets up a schedule to eliminate Mississippi’s income tax by 2037, and reduce the sales tax applied to groceries from 7 percent down to 2.5 percent by 2036.

Offsets Proposed to Bolster MDOT, Local Governments & PERS

HB 1 partially offsets its tax cuts with a new 5 cent sales tax on gasoline and a new 1.5 cent local sales tax option that will be collected by cities and counties.

Mississippi currently charges an excise tax of 18.4 cents per gallon of fuel charged, but exempts fuel purchases from sales tax. The new sales tax on gas, which would take effect in July of 2026, is expected to generate $400 million in annual recurring revenue for MDOT, according to Lamar.

Lamar says the new dedicated revenue stream for MDOT would allow the Legislature to shift $100 million annually in lottery proceeds to shore up the public employees retirement system.

The local sales tax option, which would replace current diversions to cities from the state sales tax, would also commence July 2026. It is expected to generate $700 million in new revenue for cities and counties.

Local sales taxes collected by counties will be directed to the Office of State Aid Roads. Rep. Lamar estimates the change will net an additional $80 million annually for county road projects.

At 8.5 percent, Mississippi’s sales tax would remain lower than the average combined state and local sales tax rates in neighboring states, including Louisiana (9.56%), Arkansas (9.45%), Tennessee (9.55%), and Alabama (9.29%).

Phase-In of Tax Cuts

The tax cuts in HB 1 would begin with a reduction of the sales tax on groceries in 2026 down to 4.5 percent (plus the 1.5 cent local sales tax), with a 0.2 percent drop in subsequent years until it reaches the 2.5 percent target.

A bill passed by the Legislature in 2022 created a flat 4 percent tax to be fully phased in by 2026. The rate for the 2025 tax year is 4.4 percent, dropping to 4 percent next year.

The first new cut of the income tax under HB 1 would occur in 2027, with a full percentage point drop from 4 to 3 percent, valued at approximately $500 million. Then, for a period of ten years, the rate would drop 0.3 percent until the income tax is eliminated.

In total, the bill proposes eliminating roughly $2.2 billion in annual taxes by 2037, minus the offset of approximately $1.1 billion in new taxes.

Senate Finance Chairman Josh Harkins (R) said last week that the state Senate is expected to release its own tax cut plan in two weeks. Previews from the Lt. Governor’s office included a plan to reduce Mississippi’s flat income tax from 4 percent to 3 percent by 2030 and immediately reduce the sales tax on groceries to 5 percent.