- Douglas Carswell says if Mississippi is going to achieve meaningful tax reform, those considering it need to be less Bernie Sanders, and more Ronald Reagan.

Tax reform is on the agenda. This is excellent news for our state!

To prosper, Mississippi must create a tax environment that is friendly to both businesses and families.

We have moved in the right direction in the past three years. According to the Tax Foundation, Mississippi now ranks as the 20th most business-friendly state in terms of tax.

This improvement in our state’s tax competitiveness is a consequence of the Reeves-Gunn tax reforms. Under Governor Tate Reeves and Speaker Philip Gunn, Mississippi passed legislation to cut the state income tax to a flat 4 percent and allowed businesses to fully expense capital spending. But the tax burden in Mississippi is still too high.

Our state is surrounded by states, such as Tennessee, Alabama and Texas, that have a lower tax burden than we do. Even Louisiana manages to tax less than us.

Fortunately, we have some state leaders that recognize this. Speaker Jason White is hosting a Tax Policy Summit in September to look at what might be done. Lieutenant Governor Delbert Hosemann has announced a study group in the Senate to look at fiscal policy, with the ultimate goal, he says, to “lower the tax burden and ensure taxpayer dollars stay in taxpayer pockets”.

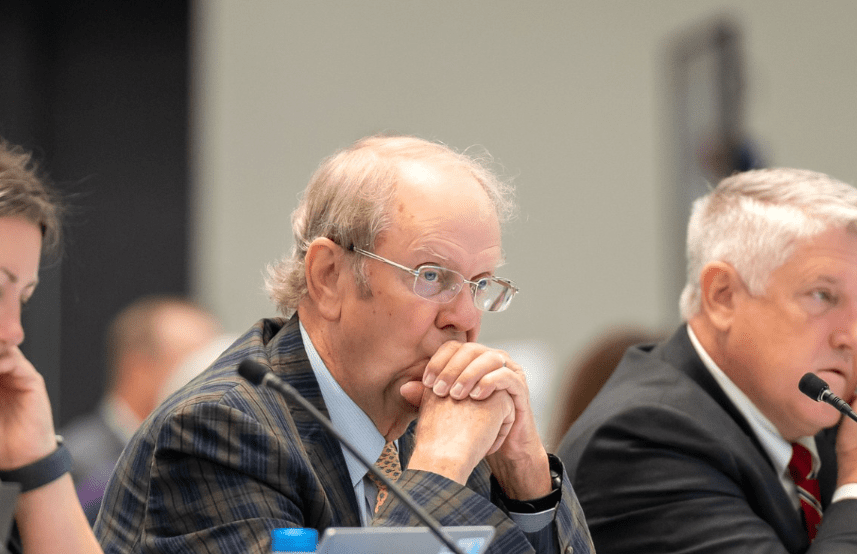

Mississippi’s House of Representatives also has a select committee on tax reform, which had its first hearing this week.

To be blunt, the House select committee hearing the other day was a big disappointment, especially seeing as we are a supposedly conservative state. Much of what I heard sounded like special pleading from vested interests to increase taxes, not cut them. I wondered at times if Bernie Sanders was in the room.

The hearing on tax reform began with a witness making the point that Mississippi needed to spend more money to build more road infrastructure. The conversation then became about the best way to do so; raise sales tax, tax gas more or charge motorists per mileage.

Not raising tax revenues was described as a “failure to invest”. Spending more tax dollars would pay for itself, it was asserted. Any serious review of tax policy in our state should not start with special pleading. It should start with the basic facts about the shape of Mississippi’s public finances.

The number one fact about Mississippi public finances is that we have a substantial budget surplus. That is to say politicians in our state have more of our tax dollars than they currently know what to do with.

How could we change the tax system to allow people to keep more of their own money before politicians figure out ways of squandering the surplus? That is where the select committee ought to have started.

What kind of tax reforms are feasible depends on the extent to which our budget surplus is cyclical or structural. In other words, is the budget surplus a temporary phenomenon, caused by growth at this stage in the economic cycle? Or is the surplus a surplus not withstanding fluctuations in economic performance?

This matters because if the surplus is temporary, tax reform will need to be phased in carefully to avoid having to put taxes back up again, as did Kansas. Failure to consider if our budget surplus is a blip or a longer term phenomenon allows those opposed to significant tax cuts to lazily claim Mississippi cannot afford more tax cuts. (Note how when the Senate Leadership was trying to water down the Reeves-Gunn tax cuts in 2022 they were able to get away with the claim that we would be ‘like Kansas’.)

Having established what Mississippi can – and cannot – afford in terms of tax cuts, the select committee should then consider what type of tax cuts.

One possibility would be to cut the grocery tax. This would be a relatively small but symbolic cut, which is why it tends to be favored by the Senate Leadership which is lukewarm about any significant reduction in the size of government in our state.

Another possibility would be to phase out the income tax altogether. This would be a big and bold step, and would need triggers and thresholds to ensure it was not done ‘like Kansas’.

“But who will pay for our roads, Carswell!”, I hear you say. “The witness who said we need to invest in infrastructure had a point, no?” I agree.

There are some things, like roads, that our state government does need to do. As and when we need to raise tax revenue for specific projects, like road building, then our lawmakers should propose ad hoc tax increases to pay for it.

Arkansas asked voters to approve a specific increase in sales tax, for a ten year fixed period, to pay for key state infrastructure. In other words, tax revenue was raised for a purpose. Taxes were not raised on the pretext of special pleading and then kept at the elevated level forever. What is very odd is to allow the special pleading of vested interests to be used as an argument for raising the tax burden, in a conservative voting state, and in front of a supposedly conservative-run House committee.

If Mississippi is going to achieve meaningful tax reform, those considering it need to be less Bernie Sanders, and more Ronald Reagan. The lobbyists might not like it, but the voters will.