- It’s hard to reconcile Lt. Governor Delbert Hosemann describing PERS reform as “the major issue of the session,” with the Senate’s decision to kill HB 1590, the only bill that could have implemented reforms this session.

In 64 A.D. a fire started in the Circus Maximus in Rome. It quickly consumed 10 of 14 districts in the ancient Italian capital. Whether true or not, Rome’s emperor, Nero, supposedly fiddled while the city burned. Two thousand years later, the concept of “fiddling while Rome burns” stands as a euphemism for doing nothing in the face of calamity.

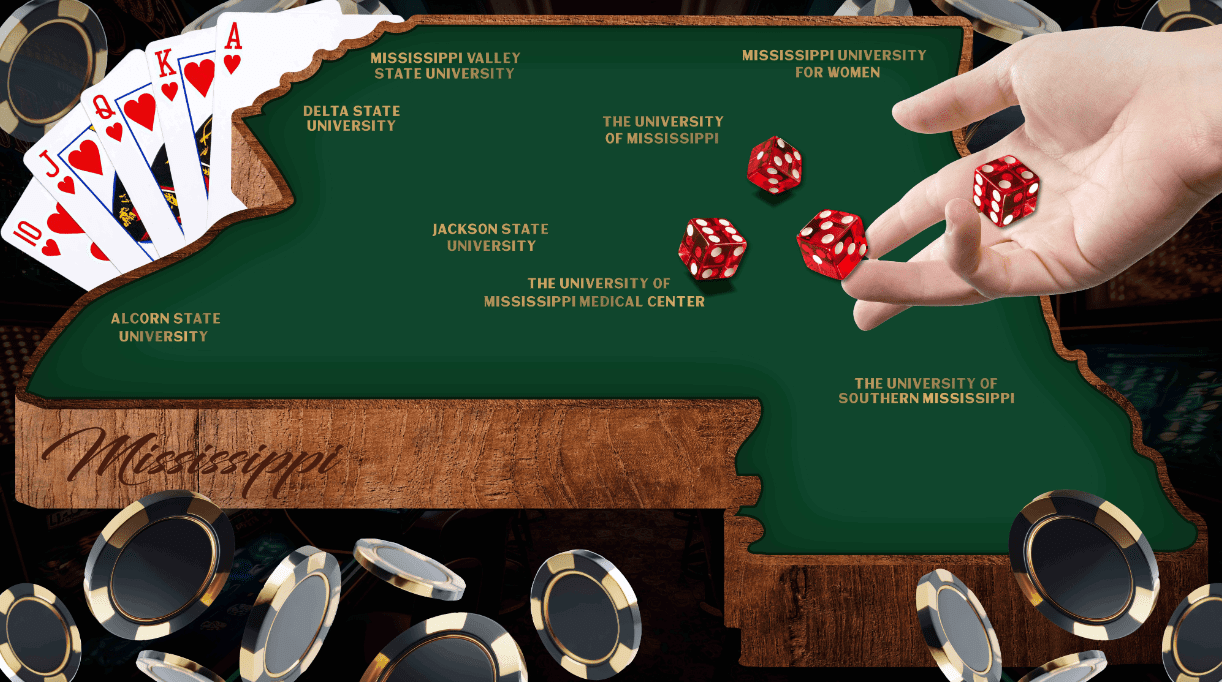

Mississippi may not be on literal fire, but left unchecked our retirement system for public employees (PERS) could burn state and local fiscal solvency to the ground. The fund designed to pay retirement benefits to public employees currently reports a $25 billion unfunded liability. In other words, PERS projects that in the next 30 years, it will have $25 billion too few dollars to pay retirees what they are owed. The current system is funded at a paltry 56 percent — one of only a handful of state retirement plans categorized as “unsafe” or “distressed” in the U.S.

Worse still, leaders afraid of upsetting public employees with even a whisper of change, have fiddled for nearly two decades as the flames got higher. With each passing year, the fire becomes harder and more costly to contain.

The PERS deficit is not a result of taxpayers doing too little to support the public workforce. At present, taxpayers fund not only public workers’ salaries and benefits like healthcare, but also annually contribute 17.4 percent of every public workers’ salary into PERS. Public employees kick in another 9 percent of their salaries for a combined employer-employee retirement contribution rate of nearly 27 percent. By contrast, private sector workers typically receive a 3-5 percent contribution from their employers.

The PERS Board, which is responsible for setting the rate of taxpayer contributions to the system, includes almost no private sector taxpayer representation. But private sector taxpayers bear the bulk of responsibility for any decisions the Board makes. Each time the PERS Board raises contribution rates to cover the sins of poor design and poor management, state and local governments are forced to take more money out of the coffee cans of mechanics and waitresses — people who no doubt would like to fund their own retirements.

This year, the Board has proposed dipping deeper into those coffee cans by raising the taxpayer-funded “employer contribution” by 5-10 percentage points. Such a move could bring the combined contribution rate as high as 36.4 percent, with no guarantee it will fix the problem.

It appeared at the start of this session, the Legislature might act to shore up PERS. As recently as mid-February, Lt. Governor Delbert Hosemann described acting to ensure the solvency of PERS as “the major issue” of this legislative session. Speaker of the House Jason White similarly identified the topic as a priority. His chamber, the Mississippi House, proposed and passed a modest proposal that did not, in any way, alter benefits.

Instead, HB 1590 sought merely to halt the proposed increases to taxpayer contribution rates. Mayors and county elected officials came out of the woodwork in support of the bill because the proposed contribution increases would cripple cities, counties, and school districts. The increase in contribution rates would trigger a combination of property tax increases and cuts in services. HB 1590 did not stand for a permanent moratorium on funding increases for PERS, but instead, sought to give taxpayers more of a voice on the PERS Board before additional changes were made.

The Capitol buzz is that an agreement was reached between Gov. Reeves, Lt. Gov. Hosemann and Speaker White on the terms of the legislation, and there was an expectation that the Senate would move HB 1590 quickly after House passage and send to Reeves for his signature. Senators I’ve spoken with have disagreed with that characterization. And ultimately, that’s not what happened.

The bill lingered over a weekend and a weekend was all the status quo brigade needed to whip public employees into a fear-induced frenzy. Senators came back the week after the House vote on HB 1590 reporting a deluge of calls urging opposition. And so the effort lingered further, and with each passing day, the likelihood of passage diminished.

Yesterday, HB 1590 died in the Mississippi Senate. The bill could have been amended or stripped to “keep the conversation alive,” a frequently heard quip around the Capitol when legislators lack the courage to say they are actually for something.

Even understanding the pressure exerted, it is hard to reconcile the Senate taking no action with it being “the major issue” of the session.

Speaker White tossed a few Molotov cocktails of his own the Senate’s direction following the death of HB 1590 yesterday. His members made a tough vote for nothing. Short of Gov. Reeves stepping in to call a special session, it looks like property tax increases could be on the horizon in a town near you.

Reeves has shown a penchant for standing against populism to make hard calls and a special session to force the issue could be another one of those moments.

To do that, Senate leaders will have to be prepared to put down their fiddles and act. Rome is still burning.