Mississippi Capitol (Photo: Sarah Ulmer/Magnolia Tribune)

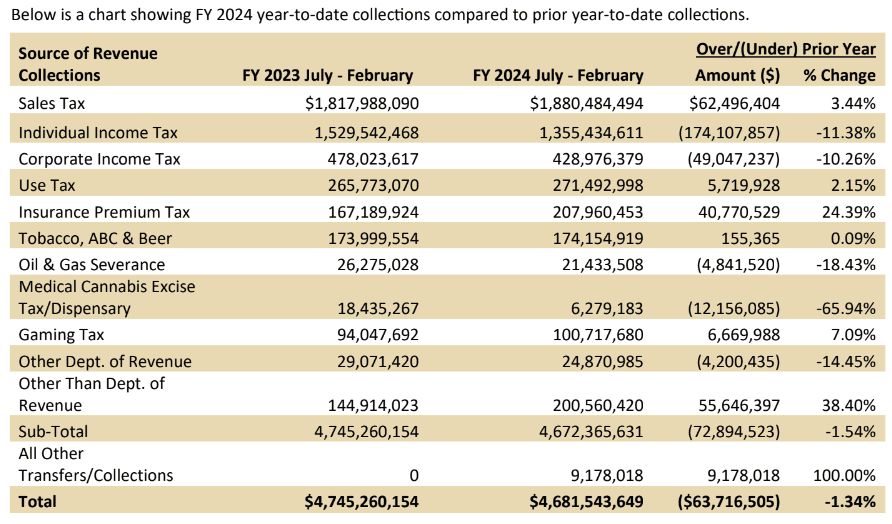

- As a result of the 2022 income tax cut package, individual income collections have been significantly reduced during the fiscal year.

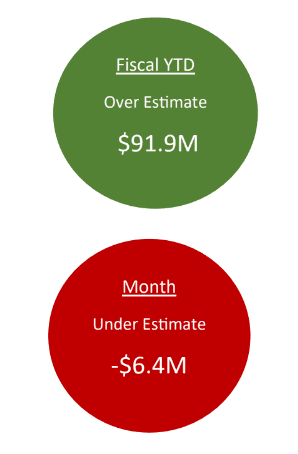

For the second consecutive month, Mississippi revenue collections came in below legislative estimates. However, overall state revenue collections remain nearly $92 million above budget estimates – down $6 million since January – with four months left in the current fiscal year.

RELATED: State revenues come in below estimate for January but remain $98M above expectations for the year

The February 2024 revenue report from the Legislative Budget Office released on Wednesday shows collections were $6,438,216, or 1.46% below the sine die revenue estimate for the month. Yet, year-to-date revenue collections through February 2024 were $91,869,649, or 2.00% above the sine die revenue estimate.

The total state budget for the current fiscal year is set at $7,523,800,000.

As a result of the 2022 income tax cut package passed by lawmakers and signed into law by Governor Tate Reeves (R), individual income collections have been significantly reduced during the fiscal year.

The February 2024 report shows individual income tax collections for the month were below the prior year by $51.3 million. Year-to-date individual income tax collections are $174.1 million below that of the prior year.

As for other revenue lines, year-to-date collections of sales tax, use tax, insurance premium tax, alcohol and tobacco tax, and gaming tax were all above the prior year’s totals eight months into the fiscal year.

The graph below shows the latest revenue collection data from the Legislative Budget Office.

As the 2024 legislative session continues, lawmakers will be debating appropriations and budget bills, setting the Fiscal Year 2025 state budget.

How these latest revenue numbers play into those discussions remains to be seen as some lawmakers have called for a cut to the sales tax on groceries while Governor Reeves has again called for further individual income tax cuts.