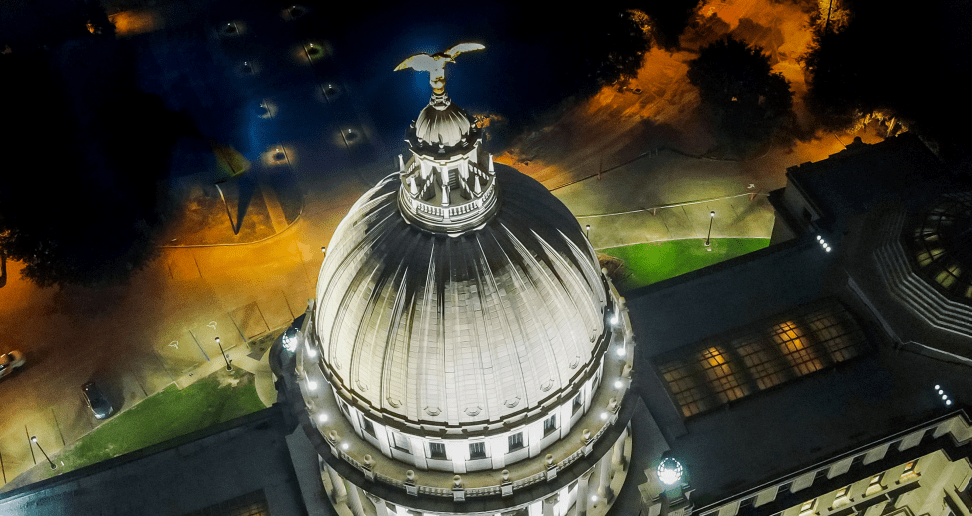

(Photo from Governor's 2024 EBR)

- Still, two months into the Fiscal Year, Mississippi revenues remain nearly $12 million in the black.

The Legislative Budget Office reported Thursday that Mississippi’s revenue collections for the second month of the current fiscal year were $5 million, or less than 1 percent below legislative estimates.

However, through the first two months of the fiscal year, Mississippi revenues have exceeded estimates by $11.9 million. July’s revenues outpaced estimates by $16.9 million.

The total Fiscal Year 2026 revenue estimate is $7.6 billion.

According to the LBO report, corporate income tax collections for the month of

August led the decline, coming in below the prior year by $22.1 million in the same month. Corporate income tax collections have been on the decline in the state since the 2023 fiscal year.

Sales tax collections were also under the prior year by $300,000, despite seeing consistent, significant gains over the last five fiscal years. In fact, sales tax collections have risen each year over the past decade.

Yet, even as Mississippi continues to phase out its individual income tax, individual income tax collections for the month of August were above the prior year by $6.5 million.

LBO notes that Fiscal Year-to-Date revenue collections through August are $11,918,133,

or 1.08 percent above the sine die legislative revenue estimate. Though, Fiscal Year-to-Date total revenue collections through August are $13,248,894, or 1.18 percent below the prior

year’s collections at this point.