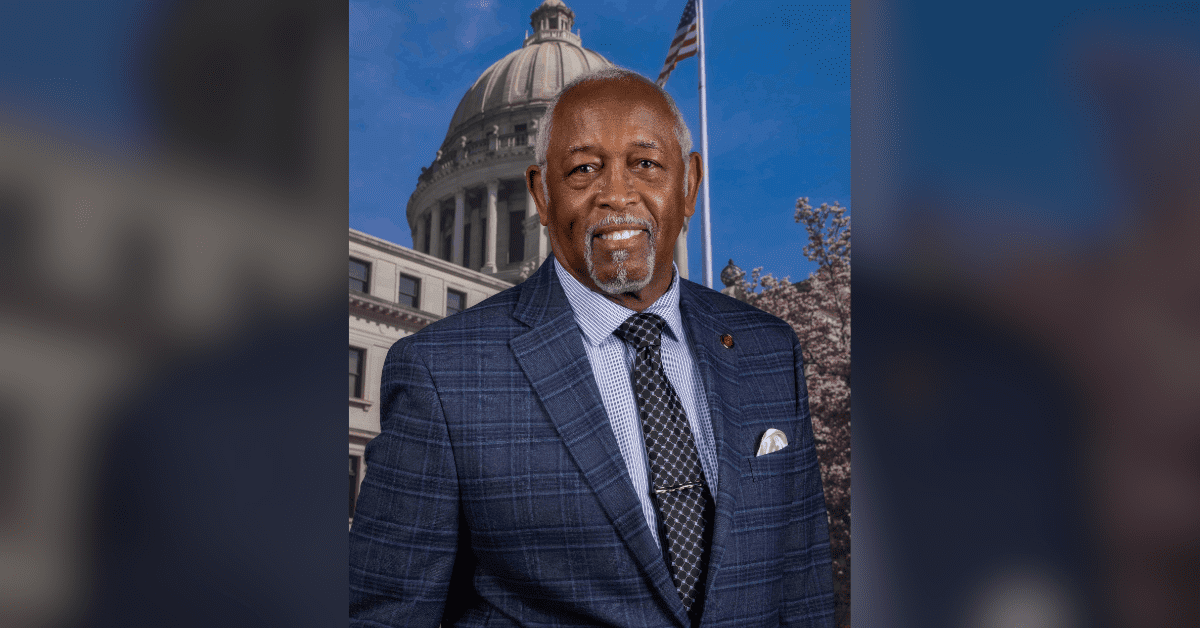

Speaker of the House of Representatives Jason White speaks during a GOP event held Tuesday where nine currently elected officials across the state are welcomed to the Republican Party. After the event White addressed the press about bills still being discussed this session, including the income and grocery tax bill. Photo by Jeremy Pittari | Magnolia Tribune

- The Democratic Caucus believes they were misled by House leadership in passing the Senate’s flawed amendment to HB 1.

Discussions are ongoing between the House and Senate related to the legislation passed last week that phases out Mississippi’s income tax, reduces the sales tax on groceries, adds a Tier 5 to the state employee’s retirement system and increases the gas tax.

Late last week, the House concurred with the Senate’s version of the bill which was later revealed to include a lower threshold for phasing out the income tax than the Senate originally intended.

The provision of the bill in question requires the economy to reach certain milestones in order to allow for future income tax cuts after the first four years of 0.25 points per year reductions. The bill was to require the economy to provide 85 percent or more of $400 million in tax collection surpluses for future cuts to occur. However, when the bill reached the House floor, a decimal point was added, making that threshold 0.85 percent.

Speaker Jason White (R) admitted Monday to House leaders knowing the error was in the bill before it was passed.

At a Republican Party press event Tuesday, White said additional discussions are expected to take place to address those economic thresholds contained in HB 1 as conference meetings occur related to SB 3095, a measure that now includes House tax reform language.

The Democratic Caucus spoke out about the passage of the bill that included the typo on Tuesday, saying they were misled. State Rep. Omeria Scott (D) said during the Democratic Caucus press event that the threshold requirements were brought up three times during discussion of the bill, but no details were provided.

“They knew what they were bringing us,” Scott said.

State Rep. Robert Johnson (D), the House Democratic Leader, also called out House Republican leadership for knowingly introducing a flawed bill on the floor, calling it an irresponsible act.

“I’ve never seen that kind of action. But they admitted they saw it and passed it like it was,” Johnson said.

However, Speaker White is still not satisfied with the bill. He said on Tuesday that the 85 percent or more thresholds are too high. Even if all the thresholds were met, the cuts would take about 14 years to complete instead of the 11 years as proposed by the House’s original bill, which did not require economic thresholds.

As such, White said he expects more discussion to determine reasonable thresholds to take place as conference is held on the House’s version now in SB 3095.

“We don’t want to pass a bill that says we eliminate the income tax when the mechanisms in place actually don’t allow for elimination,” White said.

Governor Tate Reeves (R) has indicated that he will sign HB 1 into law, noting that changes to the language can be worked out in the future.

There are other bills White hopes to pass this session before sine die, including those that relate to changing Certificate of Need laws and enacting Pharmacy Benefit Manager reform.

In terms of CON laws, the current regulations have held the state back, White believes. He said the House’s Public Health and Human Services Committee Chair Sam Creekmore (R) put a lot of time and effort into meeting with healthcare professionals to deal with the problem in a sensible manner.

“We didn’t just pull the rug out from under our providers. It is a methodical step that leads to more freedom in the space of delivering healthcare and remove hurdles where we can,” White added.

By removing those hurdles, the state can begin to provide more freedom in how healthcare is delivered, the Speaker contends.

“This will start to address that issue and move us toward a place where we can address some of those shortfalls,” White said.

As for the PBM legislation, Speaker White said the Legislature will need to consider the federal component, but it is a problem that remains front and center in their minds.

The aim of the House, he said, is to ease the burdens currently placed on independent pharmacists. The trick to dealing with the issue, White said, is ensuring employers and other businesses are not penalized by any legislation that might be passed.

Speaker White announced Tuesday that conference work was ongoing this week as budget negotiations were wrapping up as the end of session nears.