(Photo from Amazon website)

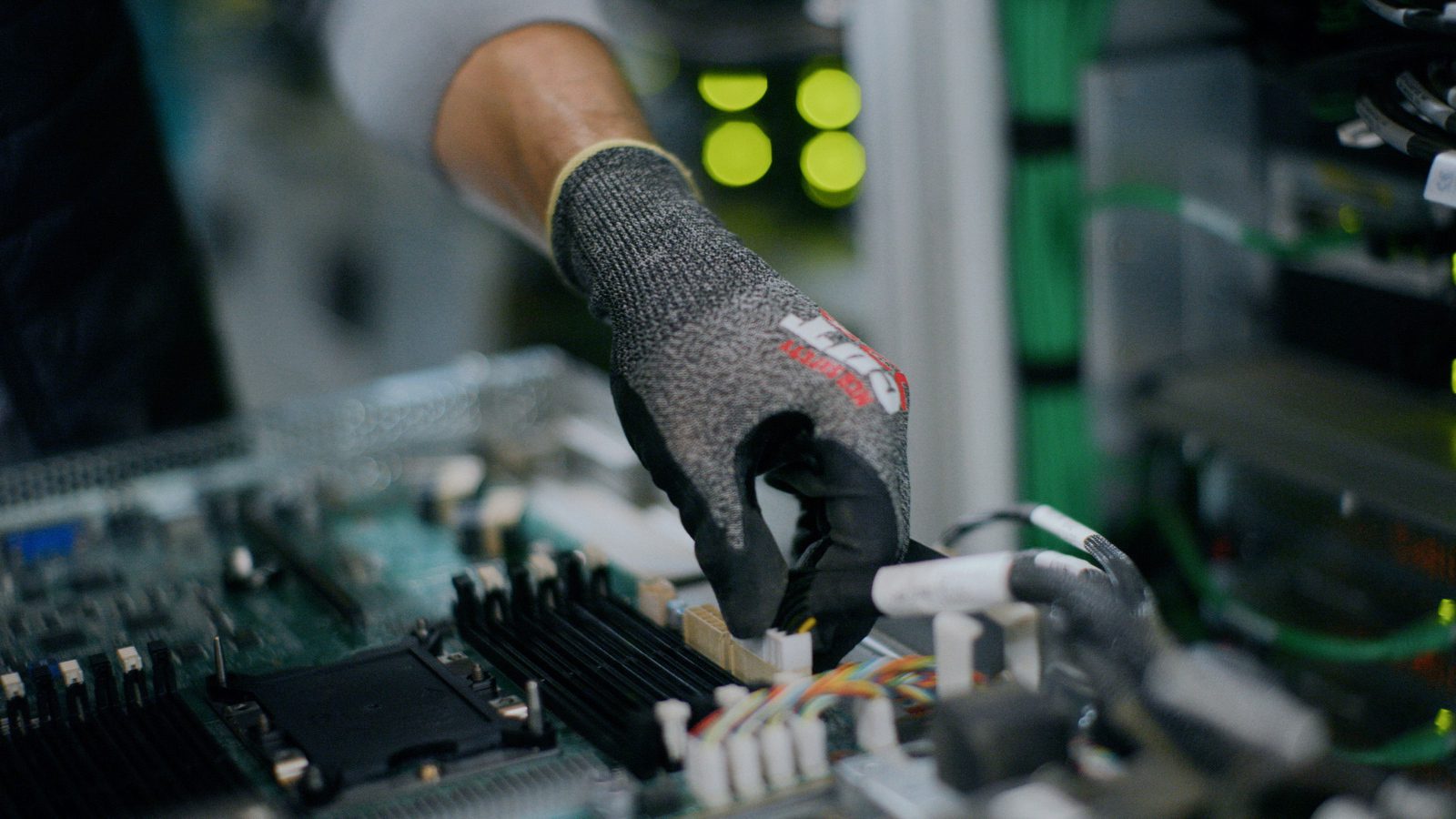

- The tax incentives in the legislation would make Mississippi more competitive with neighboring states, the bill’s author says.

A bill aimed at attracting more data centers to the state passed out of the Senate Finance Committee Tuesday morning. The author of the bill says it will make Mississippi more competitive with neighboring states.

The measure, SB 3168, states that any newly constructed data center that invests $250 million and creates at least 35 new, full-time jobs with a minimum average annual salary of 125 percent of the average annual state wage would be eligible for sales and use tax exemptions. In addition, a data center that met that same criteria when constructed and undergoes a $100 million expansion would be automatically eligible for up to two 10-year extensions for the exemptions.

“We’re trying to create something on par with other states,” Senator Josh Harkins (R) said. “Our constitution doesn’t allow us to go past ten years” in giving tax incentives.

The bill does not include the exclusion of corporate income or related business taxes but does specifically refer to hardware replacement.

“This speaks specifically to sales and use tax. They spend a lot of money upgrading their facilities, and other states give 30, 40-year exemptions,” said Harkins, chairman of the Senate Finance Committee.

Senator David Blount (D) asked about digital assets, including cryptocurrency, stablecoins and nonfungible tokens, which are mentioned in the bill.

Harkin replied that the bill “just defines what they are.”

Senator Joey Fillingane (R) asked if the sales and use tax is keeping more data centers from coming to Mississippi. As he understands it, that may be more from the state’s ability to produce enough electricity to power the centers. He asked if the measure gives revenue away unnecessarily.

“I think it’s more the sales and use tax going forward,” said Harkins. “Most states that have these data center incentives in place don’t have the constitutional provision that we have.”

He noted that the taxes could hinder recruiting data centers, but “ultimately” electricity or the availability of energy is also “a big deciding factor.”

“I guess my concern is not so much helping Jeff Bezos out, because I think he’s doing ok. But if this a factor that will make us less competitive in what we need to do, then by all means we need to do what we need to do,” said Fillingane, referring to the Amazon founder.

Mississippi has seen significant investment in data centers coming to the state over the last two years. In January 2024, it was announced that Amazon would invest $10 billion to construct two data center complexes in Madison County, making it the largest capital investment in Mississippi’s history at the time. The complexes the company said would create upwards of 1,000 jobs. Then, in January of this year, Compass Datacenters announced the construction of eight data centers over eight years in Lauderdale County, matching the $10 billion investment from the previous year.

The legislation passed out of the Senate Finance Committee on Tuesday and could be taken up by the full chamber later this week.

UPDATE:

The measure passed the Senate Wednesday afternoon and now heads towards to the House.

Senator Angela Turner-Ford (D) asked if local communities near the data centers would have a say in the tax decision. Senator Harkins answered no, saying the Mississippi Development Authority determines if the taxes are extended.