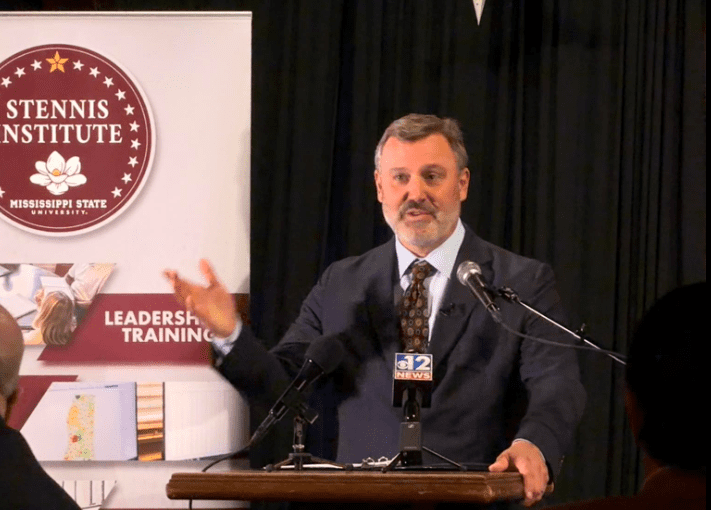

Mississippi State Finance Committee Chairman Josh Harkins, R-Flowood, in the Senate chamber at the Mississippi State Capitol in Jackson, Miss., Thursday, Jan. 25, 2024. (AP Photo/Rogelio V. Solis)

- Governor Tate Reeves said this week that the Senate’s income tax reduction instead of full elimination was a “non-starter” for him.

The Senate’s tax bill cleared a hurdle Thursday when the chamber’s Finance Committee voted to approve SB 3095. The Republican-led measure authored by Senator Josh Harkins (R) seeks to cut taxes by roughly $538 million despite Democrats’ concerns that reducing taxes while increasing the gas tax would hurt low-income workers.

The legislation calls for slashing the state’s income tax from 4 percent to 2.99 percent phased in over four years. It stops short of full elimination, as was proposed in the House tax reform package earlier this session. This is likely to lead to heated debate when the two chambers start conference talks next month.

Governor Tate Reeves (R) took to social media this week to compare the two plans, saying the Senate’s income tax reduction instead of full elimination was a “non-starter” for him.

“It doesn’t get anywhere near eliminating the income tax so it is a non-starter for me! I’m beginning to believe that there is someone in the Senate that is philosophically opposed to eliminating the income tax,” Reeves wrote.

READ MORE: House plan to eliminate income tax paints big vision, leaves big questions for Senate

In unveiling the Senate proposal earlier this month, Lt. Gov. Delbert Hoseman (R) said the Senate version would make Mississippi the third lowest state with income tax in the country.

Finance Committee Chairman Harkins said several times that the measure would assist the Magnolia State in attracting business and residents to the state, especially states with higher income taxes. He said tax policy is not the only issue that attracts investments and people, however, “it’s part of the equation.”

Additionally, the Senate bill calls for Mississippi’s sales tax on groceries to be reduced from 7 percent to 5 percent starting next July. It does not include a 1.5 percent optional sales tax for cities like the House version put forward.

To help offset the cuts, the Senate would increase the gas tax by 9 cents over three years, ending in a 27.4 percent tax on each gallon. Senate estimates show the jump will add $212 million to the state Department of Transportation’s roadway improvement efforts.

As expected, there was some pushback from the committee’s Democratic members. One member went so far as to say the Republicans had an “obsession” with reducing or eliminating taxes.

Senator Hob Bryan (R) accused outsiders of pushing the state’s Republican agenda on taxes, calling out Grover Norquist with Americans for Tax Reform.

“They care nothing about roads. They care nothing about public safety. They care nothing about public schools. What they care about is simply reducing government to the size that it could be drowned in a bathtub,” Bryan said.

Republicans countered that tax cuts are enticing to technology companies. Senator Daniel Sparks (R) said the Senate measure would continue to draw tech companies to the state.

Sparks admitted that erasing the income tax will not have “people lined up at the state line ready to spring into Mississippi.” However, he continued, “good tax policy brings businesses, which bring jobs, which brings opportunities.”

Speaker of the House Jason White (R) and his Republican caucus continue to tout their version of a tax reform package while also enlisting support from various sectors. On Thursday, White shared a letter from Mississippi Farm Bureau Federation backing the House plan as it aligns with their priorities. The day before White posted a letter from the Mississippi Bankers Association thanking the House for leading the conversation.

The Senate bill now goes to the floor for consideration while the House bill – HB 1 – sits in the Senate Finance Committee awaiting action.