- The Magnolia State’s year-to-date revenue collections are now $46 million above estimates for the first three months in the fiscal year.

For the first three months into the 2025 Fiscal Year, Mississippi revenue collections have exceeded legislative estimates each month.

The Legislative Budget Office reported Wednesday that the September revenue collections came in $14.3 million, or just over 2 percent, above estimates. That, along with the prior months, pushed the Magnolia State’s year-to-date revenue collections to $46 million above estimates.

Notably, the fiscal year-to-date total revenue collections through September 2024 are

$12.3 million, or 0.67 percent, above the prior year’s collections for the same period.

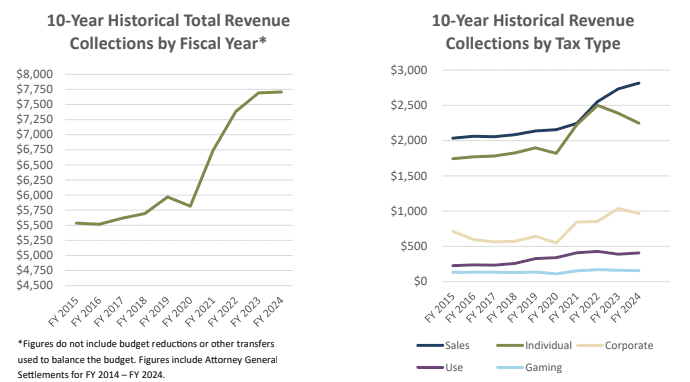

The total FY 2025 revenue estimate is $7.6 billion.

For September, General Fund collections were $11.1 million, or 1.57 percent, above the same period the prior year while individual income tax collections exceeded the prior year by $39.7 million.

Mississippi is currently in a phase-out plan passed in 2022 that moves the income tax to a flat 4 percent.

Sales tax collections for September were below the prior year by $2.5 million along with corporate income tax collections also being down from the prior year by $28.0 million.

Discussions among lawmakers are ongoing as to whether to pursue a sales tax cut on groceries in the 2025 session.

The September LBO report (shown above) clearly shows the spike in revenues that occurred in the years following the COVID-19 pandemic. Much of this increase, as has been seen in other states as well, can be attributed to individual federal government handouts and increased consumer spending, economists have said.

The Pew Charitable Trusts, noting a study by the National Association of State Budget Officers, or NASBO, pointed out in July 2024 that 2025 represents a return to more typical economic conditions after an atypical period for their budgets.

“The flattening of state revenue growth that began in fiscal 2023 and continued into fiscal 2024 can be attributed to a combination of tax policy decisions, as most states adopted tax cuts (both one-time and recurring) in recent years,” the NASBO report said, adding that “economic factors, including a weak stock market performance in calendar year 2022, slower growth in consumption, and slowing of inflation” also contributed.

Mississippi Governor Tate Reeves (R) and Speaker Jason White (R) are actively supporting legislative action in the 2025 session to build on the 2022 income tax cut in hopes of fully eliminating the tax through a phase-out approach.

On Wednesday, Governor Jeff Landry (R) in neighboring Louisiana announced that he was calling lawmakers into a special session to consider tax reform legislation. As reported by the Associated Press, Landry said he wants to put the state on “the road to reducing or eliminating the income tax” by 2030.

Mississippi Governor Reeves shared the news from Louisiana on social media, saying, “Another reason why Mississippi should ELIMINATE its income tax!”

Currently, nine states do not have an income tax, with southeast states Florida, Texas, and Tennessee among them.