(Photo from Governor's 2024 EBR)

- The August LBO report also noted that the prior year’s revenue collections exceeded FY 2024 estimates by over $979 million.

The Legislative Budget Office reported Friday that Mississippi’s revenue collections for the second month of the current fiscal year were up $26.5 million or over 5 percent above legislative estimates.

Through two months, Mississippi revenues has exceeded estimates by $31.7 million. The total Fiscal Year 2025 revenue estimate is $7.6 billion.

General Fund collections for August were $19.8 million or 3.76 percent above prior year collections for the same month. This included sales tax collections being up $5.3 million and corporate income tax collections rising $14.9 million over the prior year.

Individual income tax collections for the month of August were below the prior year by $8.0 million. This continues to be largely due to the phase in of the 2022 income tax cut.

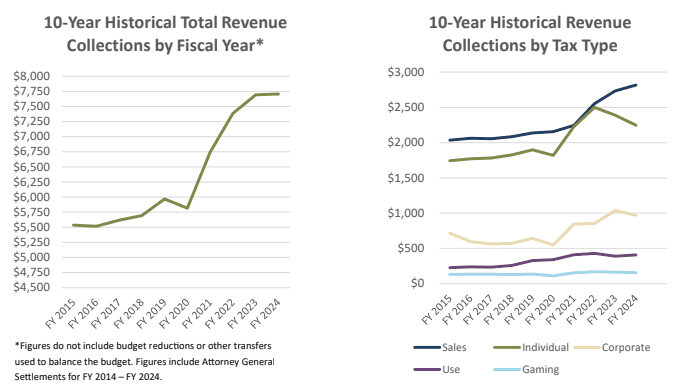

The chart below provided by the LBO shows the 10-year historical revenue trends. Total revenue collections appear to be leveling off after a major spike following the pandemic.

The reduction of individual income tax collections can also be clearly seen while sales tax collections continue to climb in the Magnolia State.

The August report also noted that the prior year’s revenue collections were over $7.7 billion, meaning the collections were $979.7 million above the FY 2024 estimate of $6.73 billion. The estimated excess includes reappropriations.