- Efforts to eliminate the state income tax were overshadowed by Medicaid expansion this session. Yet, Governor Reeves and Speaker White say they’re committed to ending the tax on work in Mississippi.

Given the Legislature’s focus during the 2024 session, a casual observer might mistakenly assume expansion of Medicaid was the most popular policy backed by Republican voters in a GOP dominated state.

However, a Mason-Dixon poll released by Magnolia Tribune in March showed 81% of Republican Primary voters surveyed opposed “Obamacare’s Medicaid expansion,” with 85% saying Governor Tate Reeves (R) was right to oppose the policy. Ninety (90) percent voiced opposition to the welfare expansion if able-bodied adults were not required to work.

Lawmakers ultimately failed to find common ground on Medicaid expansion. Even now, talk of another attempt at expanding the program come January 2025 is swirling.

With all of the energy dedicated to Medicaid expansion, a policy push to eliminate the income tax that began in 2021 under former Speaker Philip Gunn (R) and which saw the state move toward a 4-percent flat tax in 2022, fell by the wayside this session.

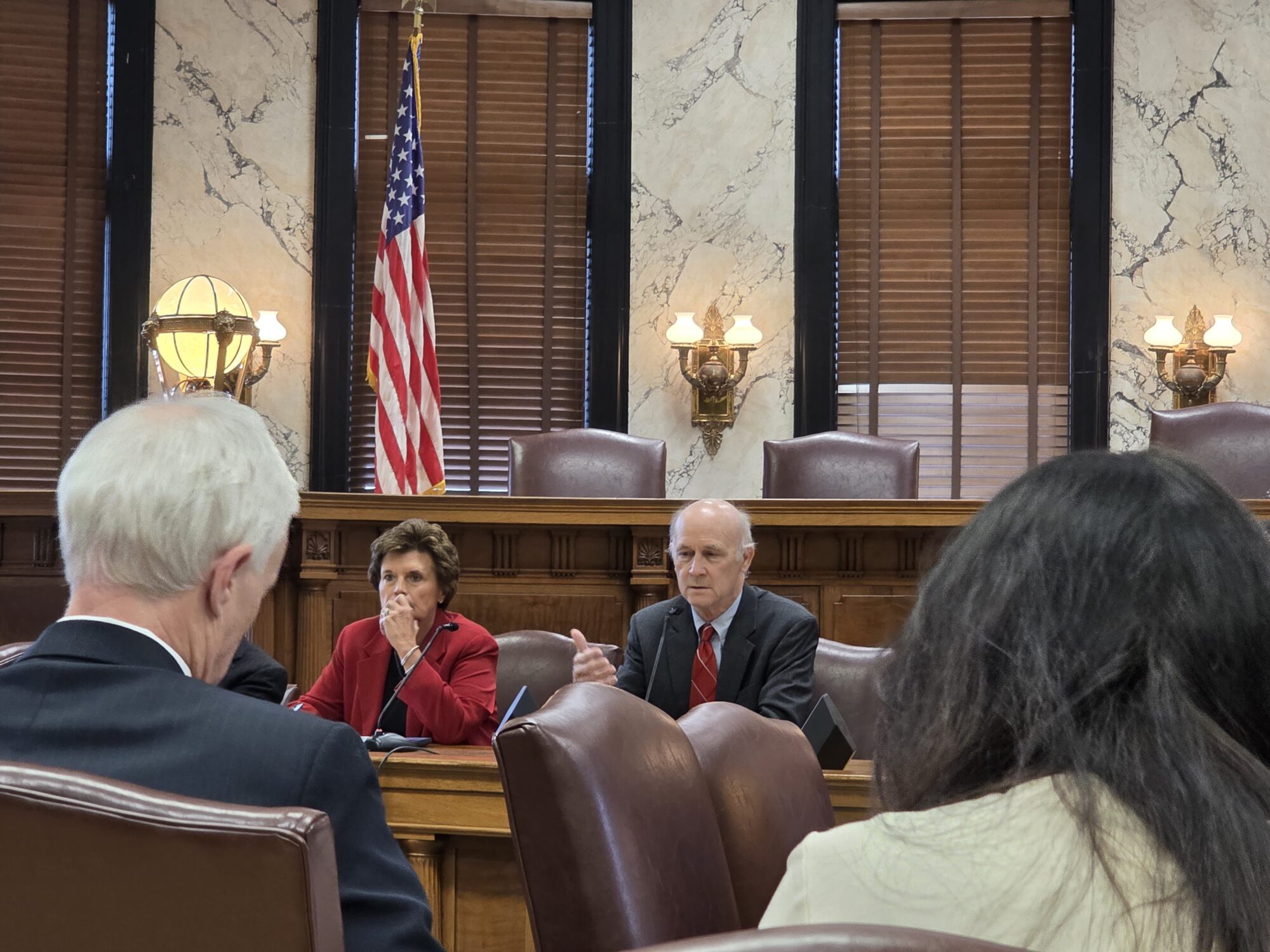

Still, both Governor Tate Reeves (R) and new Speaker Jason White (R) continue to voice support for Mississippi becoming the tenth state to operate without an income tax.

Support for Income Tax Elimination

According to a Mason-Dixon poll released by Magnolia Tribune in October 2023, 61% of Mississippians, informed about state government surpluses, supported elimination of the income tax in the Magnolia State. Only 20% voiced opposition.

Despite the support of voters, lawmakers did not move forward on any legislation that would continue the state’s path to full income tax elimination in 2024.

Mississippi is currently in the middle of a three-year plan to phase out the 5% income bracket, leaving the state with a 4% bracket only. The Legislature passed and Governor Reeves signed a $525 million tax cut plan in 2022 – the largest in state history – after negotiations for the full elimination failed. Governor Reeves and then-Speaker Gunn were rallying for full income tax elimination at the time, a position Reeves has maintained over the last two years.

Governor Reeves’ Fiscal Year 2025 Executive Budget Recommendation highlighted income tax elimination as his top priority based on the state’s “record-shattering economic momentum.” Reeves proposed taking the total amount of revenue above estimates with half going to eliminating the income tax. His phase out plan sought to immediately reduce the income tax to 3% in Fiscal Year 2025 and cut the income tax by 1% each year thereafter until the income tax was zeroed out by 2029.

“Eliminating the income tax does not require cutting expenditures or raising taxes in other areas,” Reeves stated in the EBR. “Rather, it requires that our government lives within its means and those in power recommit to the economic principles that helped build the greatest country in history.”

According to the Governor’s Deputy Chief of Staff Cory Custer, Reeves remains committed to pushing for full elimination.

“Mississippi is in the best fiscal and financial shape in its history, unemployment is at an all-time low, and our state’s economy is growing stronger every day,” Custer told Magnolia Tribune on Friday. “Governor Reeves continues to support eliminating Mississippi’s income tax, so long as it doesn’t raise taxes in other areas. If it were up to him, he would eliminate the income tax tomorrow.”

After back-to-back billion-dollar surplus years, the state has increased expenditures at a considerable rate, with a state budget that is over $1.5 billion bigger than just five years ago. Approximately half of the spending increase is attributable to investments in K-12 education during that period.

House Taking Next Steps, with Proposals Likely in 2025

The Governor could soon get some help in making his case heading into the 2025 legislative session.

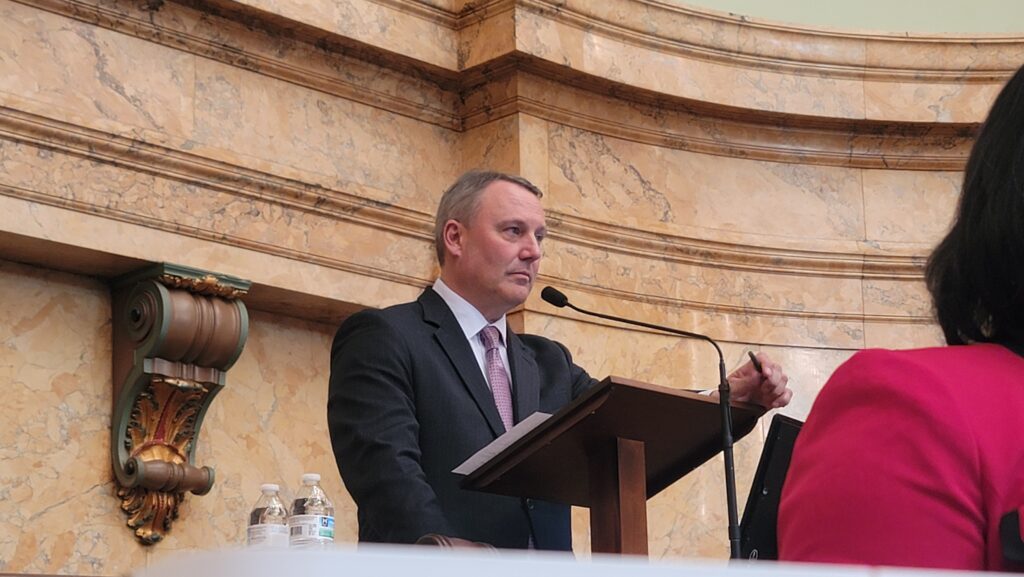

In a conversation with Magnolia Tribune on Wednesday, Speaker Jason White (R) said he plans to form a Select Committee on Tax Reform of 12-18 House members who will work through the fall in hopes of providing a recommendation to “move away from personal income tax and moving more toward a consumption model.”

Speaker White wants to eliminate the “tax on work” and focus more on sales tax, noting that also cutting the sales tax on groceries is a priority. In Mississippi, the sales tax on groceries is the same 7% charged on other consumer purchases.

Talk of cutting the sales tax on groceries has received bipartisan backing on the campaign trail and around the Capitol for some time. Democratic gubernatorial candidate Brandon Presley made it one of the pillars of his campaign in 2023, and Lt. Governor Delbert Hosemann (R) has previously voiced support for a reduction in the sales tax on groceries.

However, such a sales tax cut directly impacts cities and towns as the collections buoy a significant portion of local government budgets. Counties do not receive a portion of sales taxes, although they do benefit from the state’s use tax.

“That diversion that goes to cities, most of your small towns, that is the main sales tax generator in the town, is the grocery store. They just don’t have a lot of other sales tax coming in,” Speaker White said. “So, if you’re going to keep those cities whole, that’s where it gets tricky.”

White recognizes that to gain consensus around eliminating the income tax, cutting the sales tax on groceries while ensuring municipalities are not negatively impacted is key.

The Speaker said everything is on the table with two goals in mind, at least for him.

“At the end of the day we’re looking to do two main things: eliminate the personal income tax in as few years as possible and cut the grocery tax, hopefully in half,” Speaker White said.

White said the Select Committee he appoints will hold public meetings and workshops with tax experts and those who can provide innovative and practical options to achieve those goals.

He admits the timetable for full elimination may not be as aggressive as the Governor’s but White said he is confident Reeves will work with the House on the plan.

“I hope that we’ll have the Governor on board, and I do think we’ll have his support moving forward,” Speaker White said.

As for support in the Senate, that remains to be seen as lawmakers there have proven to be reluctant to move beyond what the Legislature passed in 2022, at least until that phase out is complete and the impact on the state budget is fully realized.