Eliminating the sales tax on groceries would negatively impact cities’ tax base. Cutting the car tag “in half” would force higher state taxes.

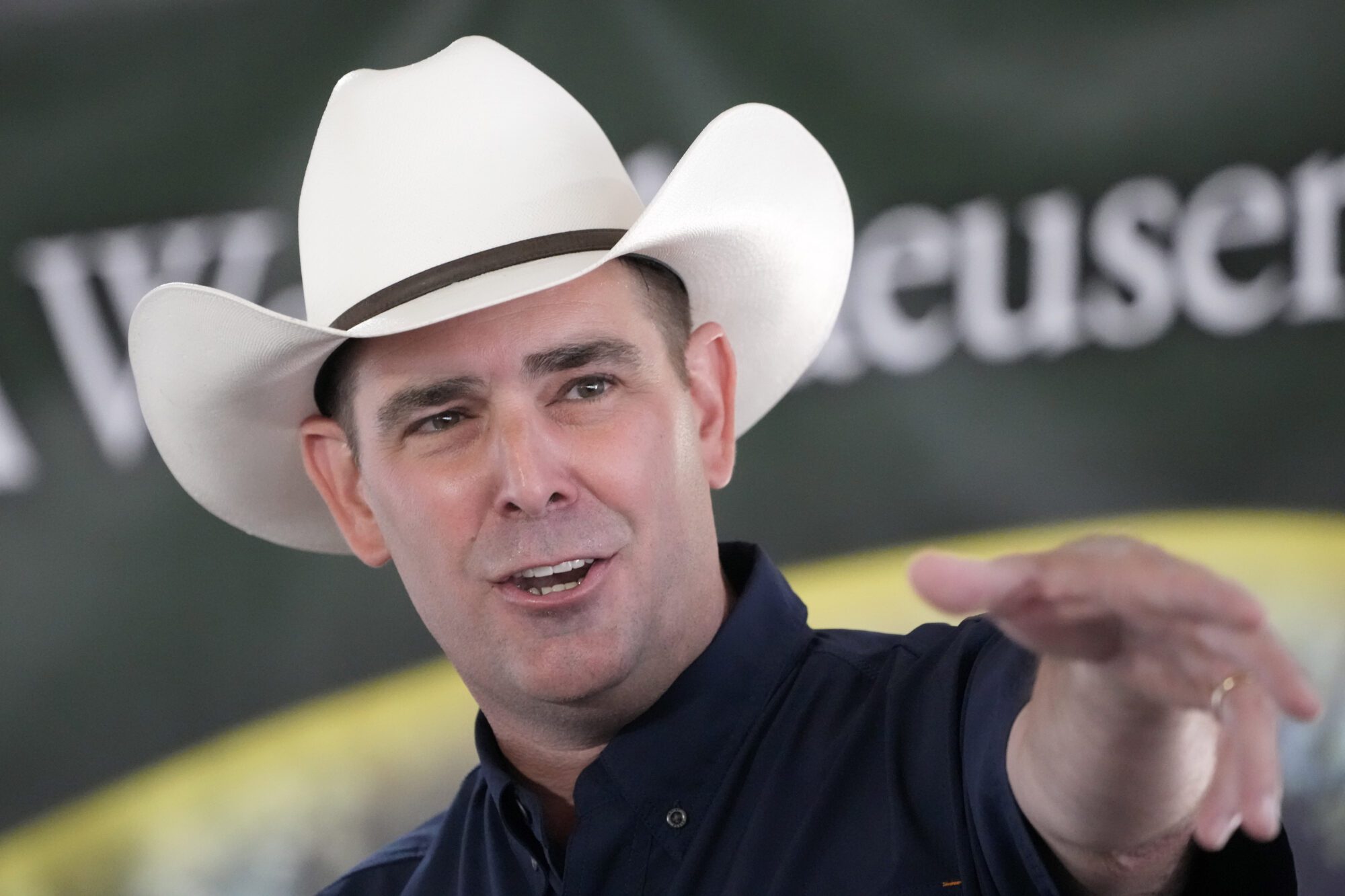

Democratic candidate for governor Brandon Presley wants to stop applying Mississippi’s sales tax to the purchase of groceries. He also wants to cut the “car tag” in half. Does that rev your engine? Well, ponder with me for a moment.

These proposals make for fine TV commercials. Here’s to cutting a car in half, with a battery-powered reciprocating saw, no less!

Setting aside the choice of tool in a commercial, these ideas are popular. But eliminating the sales tax on groceries would negatively impact cities’ tax base. Cutting the car tag “in half” would force higher state taxes.

Even if they could be effectively implemented, neither proposal comes close to matching the size or economic impact of recent tax reforms enacted by the Legislature.

RELATED: Mississippi Tax Freedom Act Spells Relief for Working Class Families

Before advancing, some basic truth: there is no such thing as a “grocery tax.” It is not some mythical outlier in the tax code. There is a sales tax that Mississippians pay when they buy things, including groceries.

Don’t get me wrong. Families are feeling the strain at the grocery checkout, and everywhere else. Three solid years of persistent inflation–the result of generationally dopey policy–will do that to working families.

But not charging sales tax on the purchase of groceries will have a small effect on Mississippian’s bottom line and will not contribute to improving the overall economic health of the state.

It will, however, negatively impact local tax collections, because cities get a nearly 1/5th portion of all sales tax collected in their jurisdiction–called a “diversion.” Eliminating the sales tax on groceries would eliminate funding from your city, which is why the Mississippi Municipal League and the towns it represents have historically opposed this idea.

It bears mentioning that Mississippi already makes provision for the poor when it comes to sales tax on groceries. No sales taxes are charged on groceries purchased with food stamps.

Proposals to cut car tags are equally cumbersome. The State of Mississippi collects very little in relation to the registration of vehicles. $14 for a new car and $12.75 for renewals.

The money Mississippians associate with car tags is actually assessed and collected at the county level. Counties assess and collect the taxes on a car tag. A proposal to cut the state fee in half might grant you enough to buy a value meal at McDonald’s.

A proposal to cut “car tags” in half is substantiallly more complicated. To do that, the state would have to pay the counties for half the cost of the tag through a credit.

Herein lies the rub. There is nothing that would prevent counties, having received the credit, from raising the price of a car tag. The effect of this would be to cost the state even more money. Half of a bigger number is, well, a bigger number. All the while, it would eat into any “savings” the person buying the car tag would experience.

Put your math hat on.

Let’s say the price of a car tag is $150. Under the proposal, the state sends the county $75, bringing the taxpayer’s price down to $75. But then, what if the county raises the price to $230 after the credit? What would have cost the state $75 at the inception of the program, now cost $115. Meanwhile, the actual savings to the taxpayer is now less than 25 percent. Multiplied over hundreds of thousands of vehicles, the cost of the program could become massive.

Of course, there would be no actual savings to any taxpayer. The proposal is at best the rearrangement of deck chairs.

Think about it. Mississippians pay the taxes that fund the state government. The state government then sends counties a credit so that Mississippians pay less for car tags. Mississippians aren’t actually paying less in taxes. The taxes are just being funneled through the state rather than paid directly to county tax collectors.