A Senate Appropriations Committee member reviews proposed legislation at the Mississippi Capitol in Jackson. (AP Photo/Rogelio V. Solis - Copyright 2023 The Associated Press. All rights reserved.)

Lawmakers point to the 2022 tax cuts being implemented as the reason for the reduction in state income tax collections.

According to the latest revenue collections report from the Mississippi Legislative Budget Office, state revenue collections for the month of August were below the estimate by $3 million for the second month in the current fiscal year.

The last time there was a monthly estimate below sine die was May 2020, according to LBO staff.

Total revenue collections for the month of August in FY 2024 were $2,986,467, or 0.56% below, the legislative sine die revenue estimate. However, Fiscal Year-to-Date revenue collections through August were $42,101,765, or 3.89% above the sine die revenue estimate.

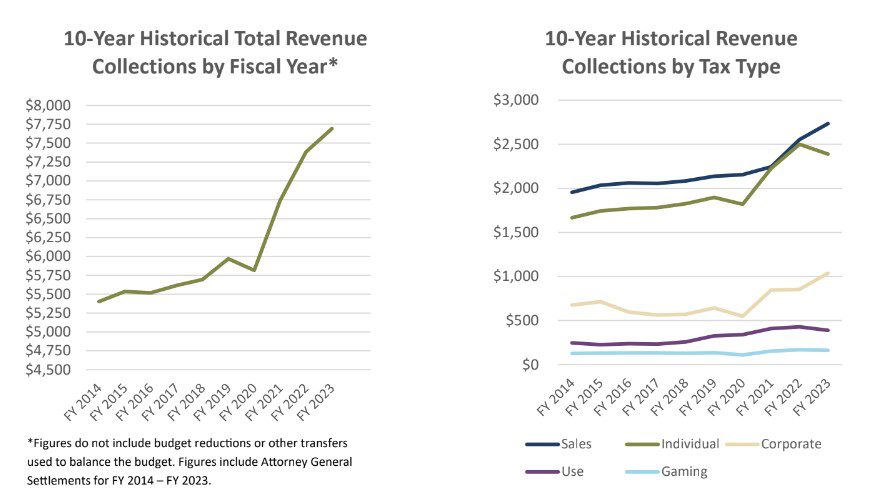

The full year 2024 sine die revenue estimate is $7,523,800,000.

The primary line items associated with the reduced revenue collection for the month of August were Individual and Corporate Income Taxes. Individual income tax collections for the month of August were below the prior year by $30.9 million corporate income tax collections were below the prior year by $15.3 million.

Lawmakers who spoke with Magnolia Tribune say this is by design.

“I am glad to see that we are up $42 Million over the estimate in collections during the first two months of this fiscal year,” State Rep. Trey Lamar said on Friday.

Lamar said income tax collections are down “due to our historic tax reductions in the tax on work.” But, Lamar said, the sales and use tax collections continue to outpace both the estimate and last year’s collections.

“This coupled with historic low unemployment are significant evidence of the strength of Mississippi’s economy,” the House Ways and Means Committee Chairman said.

Sales tax collections for the month of August were above the prior year by $8.4 million.

Senate Appropriations Chairman Briggs Hopson agreed.

“A quick review of the August monthly revenue report shows decreases in individual and corporate income tax receipts. It is certainly no surprise that individual income tax collections are down as the 2022 tax cuts are beginning to be implemented,” Sen. Hopson said. “A deeper dive into the numbers may provide additional information.”

Senator Hopson said also noted that sales and use tax revenue remains healthy.

“Other smaller income sources helped to offset the income tax decreases,” Hopson said. “Overall, state revenue was $3 million below estimates. However, a strong July report (approximately $45 million above estimates) provides plenty of cushion to offset a lesser month.”

Senator Hopson, a key player in the Legislature in setting the state budget, said it is obviously far too early to foretell a trend.

“After a few more months’ reports, we may be better able to predict the fiscal-year revenue,” the Senate chairman said. “Thankfully, our conservative budgeting has the state in overall strong financial shape.”

In total, the August General Fund collections were $22,338,039, or 4.06% below the prior year’s actual collections.

An additional note in the recently released LBO report that is worth highlighting is that Mississippi revenues for the prior fiscal year – FY 2023 – exceeded the legislative estimates and will end the fiscal year with an estimated excess of $1.312 billion.