FILE - Mississippi Gov. Tate Reeves says during his State of the State speech on Jan. 25, 2022, at the state Capitol that he supports a proposal to phase out the state income tax. House Speaker Philip Gunn, right, and the governor’s wife, Elee Reeves, listen to the speech. (AP Photo/Rogelio V. Solis, File - Copyright 2022 The Associated Press. All rights reserved.)

President Biden’s unconstitutional student loan cancellation and Congress’s COVID-era Paycheck Protection Program are ‘apples and oranges.’ The Clarion Ledger’s attempt to conflate the two & levy an attack on Gov. Reeves ignores a basic logical premise: liking an apple, and not an orange, does not a hypocrite make.

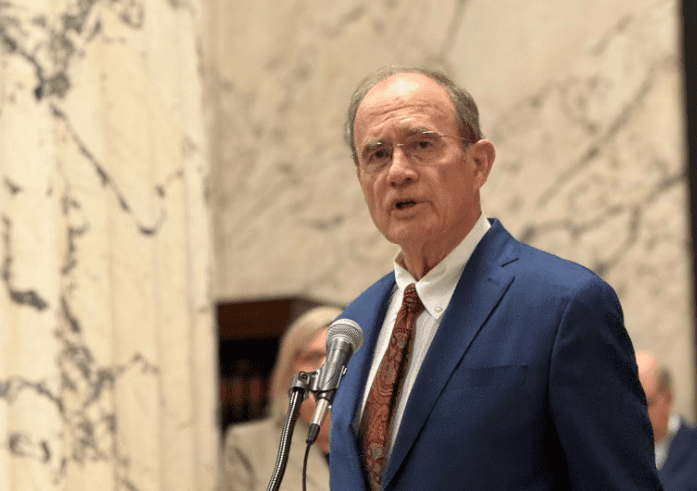

On Sunday, the Clarion Ledger published an attack piece on Gov. Tate Reeves guised as “news.” The article not so subtly suggested hypocrisy on the part of Reeves. At the center of the charge, Reeves’ opposition to President Biden’s student loan cancellation program, coupled with his family’s participation in the COVID-era Paycheck Protection Program (PPP).

Conflating student loan forgiveness and PPP is logically bankrupt. A vast chasm exists between them in both form and substance.

For starters, Congress actually passed PPP as part of the CARES Act. By contrast, the U.S. Supreme Court recently struck down Biden’s student loan cancellation plan because it was implemented, by executive fiat, without congressional approval. One followed the constitutional process for making policy. The other did not.

Substantively, the two policies also share little in common. COVID represented a temporary, acute crisis. The government’s response to it was also temporary and acute.

At the beginning of the pandemic, both federal and state governments effectively shut down businesses.

In the face of this de facto regulatory taking–literally telling some businesses they could not continue operating–PPP sought to incentivize affected employers not to lay off workers. In exchange for agreeing to maintain employment rolls, companies received forgivable loans.

The theory behind the program was that without the support to maintain payrolls, unemployment rates would balloon and it would be much harder to restart the economy on the tailend of the pandemic. Portraying PPP as a designed boon to corporate America ignores the intended beneficiaries–workers who kept their jobs.

To put a fine point on it, PPP was triggered by the government’s decision to shutter the economy in response to COVID. It was as much, if not more, about stabilizing the larger economy and aiding workers as it was helping individual businesses. Like the pandemic, itself, the need for the program was temporary.

None of the unique circumstances surrounding COVID and PPP are present when it comes to student loans writ large. The crisis that generated the need for PPP, and the program itself, are over. There is little, if any, remaining “moral hazard.”

A moral hazard in economic terms is where the person taking a risk does not bear the consequence of the risk, thus making unreasonable risk taking more likely.

The “crisis” around student loans has been building for decades and is a byproduct of bad policy, not a deadly virus. Because the need for student loans persists, the moral hazard of canceling those loans persists.

Companies that participated in PPP knew on the front end the conditions of the loans, and agreed to take on certain responsibilities in exchange for the promise of forgiveness. The government created a clear incentive to encourage a specific action.

Students taking out college loans did not agree to keep people employed during a pandemic. Nor did they receive any assurance that their loans would be canceled when they voluntarily assented to enter them.

All of this is to say that the two policies are ‘apples and oranges.’ Liking an apple, and not an orange, does not a hypocrite make.

To compound the hit on Gov. Reeves, the Clarion Ledger article implies his differing positions on student loan forgiveness and PPP are motivated by personal gain. It points to the fact that a business his dad runs and his wife’s employer both received PPP loans.

The Governor’s staff has previously denied that he has any role in the operation of his father’s air conditioning business, and stating the obvious, the Governor has no control over whether a company that employs his spouse applied for a PPP loan.

Both companies are among over 138,000 businesses in Mississippi that sought to protect their payrolls with a PPP loan. The Clarion Ledger’s parent company, Gannett River States Publishing Corporation, for instance, received a $1.165 million PPP loan.

Buried 13 paragraphs deep in the Clarion Ledger article is some recognition of the obvious distinctions between Biden’s student loan cancellation and Congress’s PPP. It reads like an editor got ahold of the piece and thought “this is a real stretch. Let’s preserve some credibility.” It’s not enough. The comparison was either dumb or dishonest.