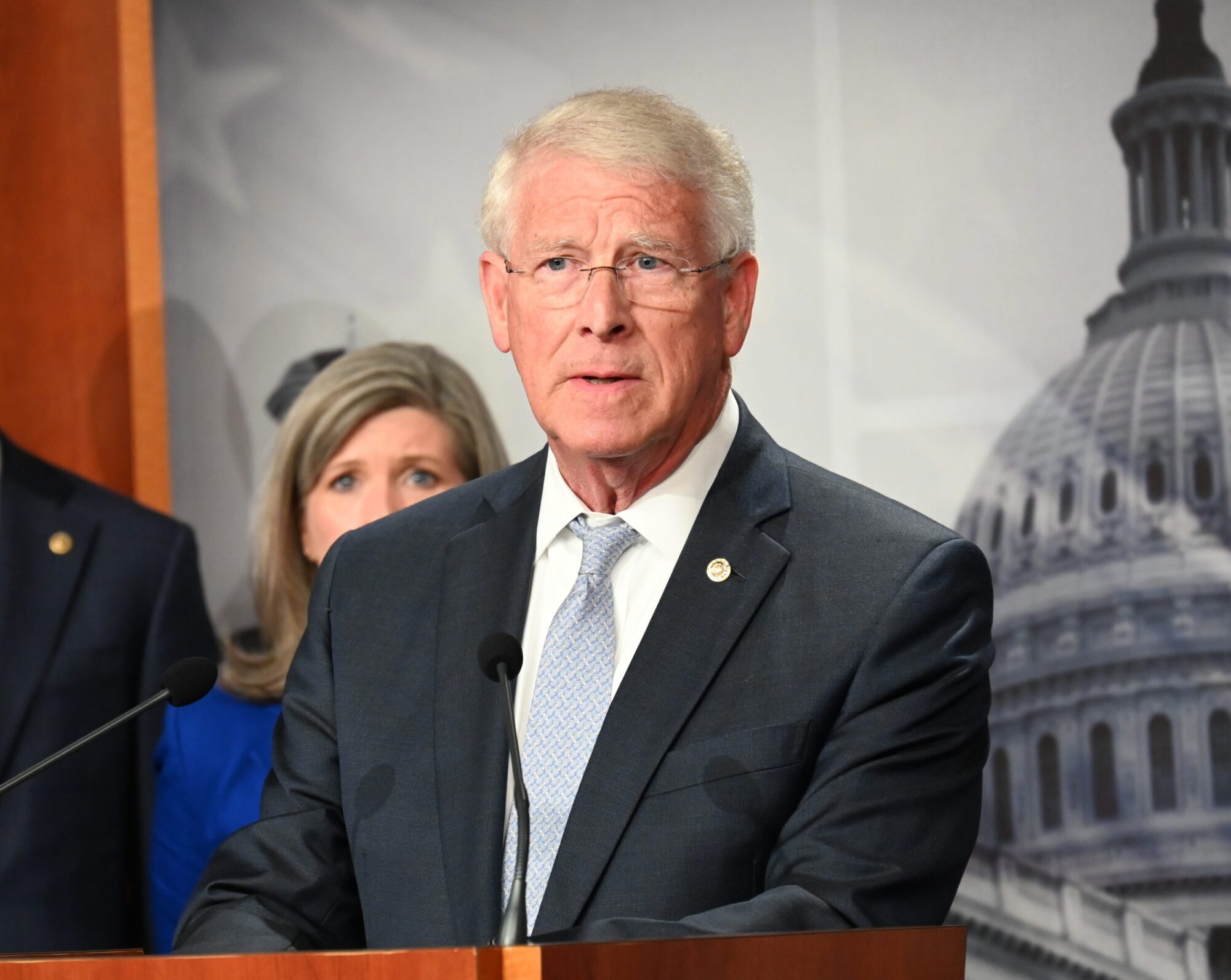

Sid Salter

By: Sid Salter

For both U.S. and Mississippi farmers, China is the primary export market for their crops and current forecasts anticipate record sales – if conditions in the forecast models hold. That’s a big “if.”

The most recent U.S. Department of Agriculture forecasts from the quarterly “Outlook for U.S. Agricultural Trade” from the agency’s Foreign Agricultural Service and their Economic Research Service predict overall U.S. agricultural exports Fiscal Year 2022 exports of $191 billion (a $7.5 billion hike) with increases expected in corn, cotton and soybeans.

Farm Policy News analysts pointed to this assessment from the forecast: “Soybean exports are projected up $1 billion to a record $32.3 billion as higher volumes more than offset lower unit values. Total oilseed and product exports are forecast $700 million higher to a record $44.3 billion. Overall livestock, poultry, and dairy exports are projected to increase by $1.2 billion to $40.4 billion, with gains across all major commodities except pork.”

At $36 billion, China remains America’s largest single agricultural export customer. With one-fifth of the world’s population at 1.4 billion, China buys food and feedstuffs on global markets to offset the nation’s limited arable lands and the dual impacts of pollution and climate change.

Chinese imports of soybeans, corn, rice, wheat and edible oils drive a great deal of the country’s global shopping lists as does an increasing national appetite for meat and poultry – with the widespread availability of meat (particularly for middle-class citizens) being a relatively recent development.

Agricultural import-export markets are actively impacted by inflation. U.S. and Mississippi farmers have seen production costs soar along with fuel prices. Those market forces are at work in China and other global markets as well.

The Russian invasion of Ukraine is wreaking havoc on global grain exports from that country – primarily wheat and corn – which in turn impacts U.S. and Mississippi producers. The same USDA quarterly reports indicated: “Sales and shipments of U.S. corn have accelerated as Russia’s invasion has constrained exports from Ukraine, which has also kept prices elevated.”

While South America was projected to have record production to fill the global crop shortages left by lower post-Russian invasion Ukrainian grain exports, a second year of droughts has reduced crop yields there.

Food Engineering Magazine’s Frederic Van Roie framed supply chain disruptions in the food and beverage industry like this: “The effects on the global F&B economy have already been profound, with soaring oil and gas prices affecting manufacturing, transportation and agricultural supply chains.

“Then there’s the role of Russia and Ukraine in food and fertilizer production to consider. Supplies of wheat, sunflower oil and corn are low, which could have particularly serious consequences for food security in Africa,” Van Roie wrote. “By blocking Ukrainian grain exports from leaving Black Sea ports, Russia is pushing the global price of the commodity up. The same goes for fertilizer, with producers of phosphates, potash, and other fertilizers reliant upon supplies of raw ingredients from Russia and Ukraine.”

Rising interest rates will impact farm credit. The global agricultural markets share the same concerns as other sectors about the inflationary spiral growing into a full-blown recession.

The global shortage of computer chips is another concern as farmers struggle to get new equipment or repair existing equipment or technologies on which they are reliant for higher yields. Yet another fear is a COVID resurgence that would exacerbate ongoing labor shortages.

But economic forecasts of increased ag exports should be good news for Mississippi’s $8.33 billion ag industry. China is the third leading trading partner for Mississippi exports behind Canada and Mexico, with $759 million in value in 2020 – with that number representing a 63.8% increase over the previous year.

Mississippi’s farm economy has long known what most of the rest of the country first saw clearly during the pandemic – the world is smaller, our economic fortunes are more closely intertwined than ever, and risk is an inherent facet of reward.