An analysis disproves the Administration’s claim that only 2% of farms would be affected by the $3.5 trillion tax & spending spree

In a summary released by the tax-writing Ways and Means Committee, Section 138208 is labeled “Increase in Limitation of Estate Tax Valuation Reduction for Certain Real Property Used in Farming or Other Trades or Businesses.”

The provision “amends section 2032A to increase the special valuation reduction available for qualified real property used in a family farm or family business. This reduction allows decedents who own real property used in a farm or business to value the property for estate tax purposes based on its actual use rather than fair market value. This provision increases the allowable reduction from $750,000 to $11,700,000.”

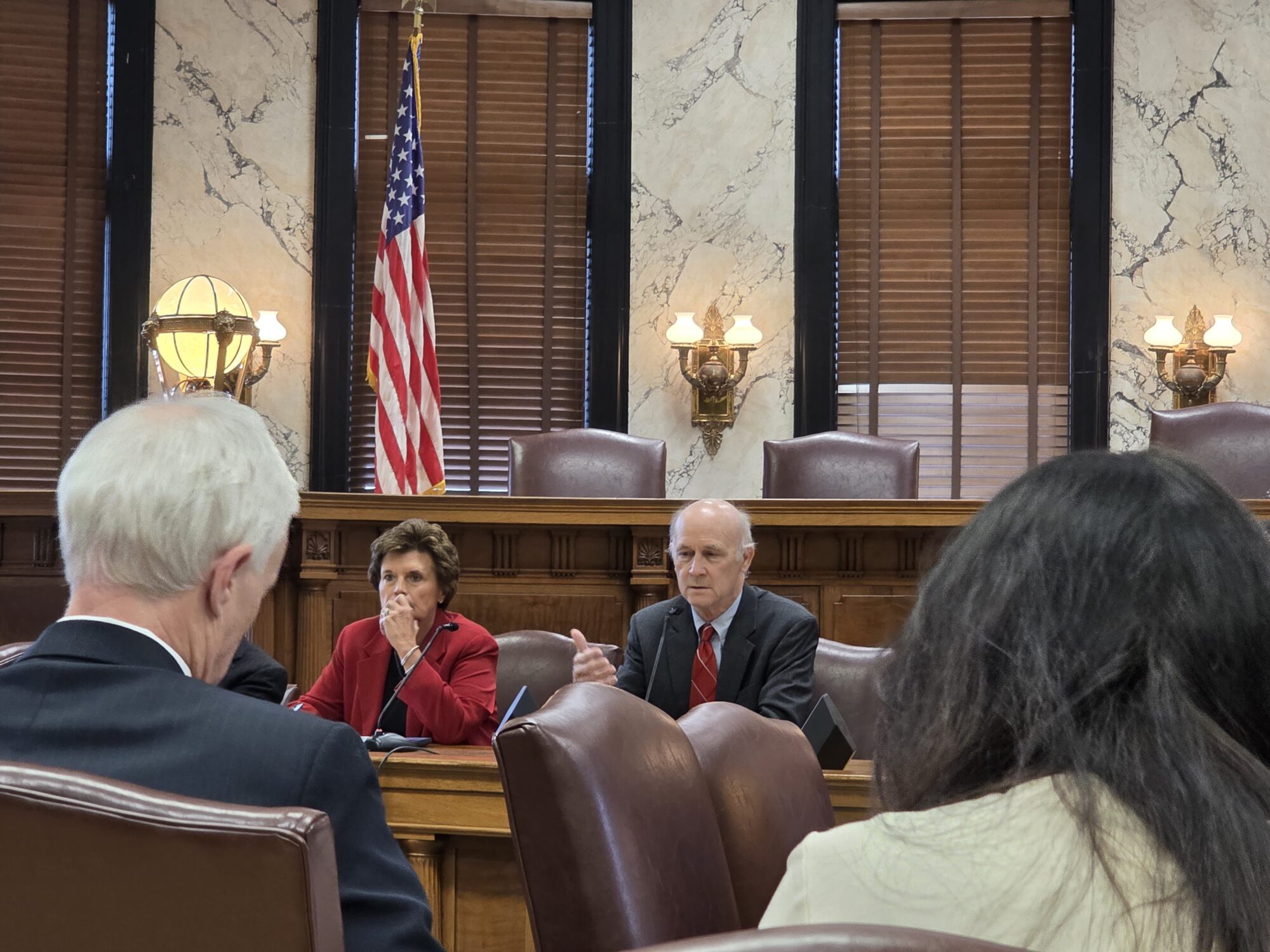

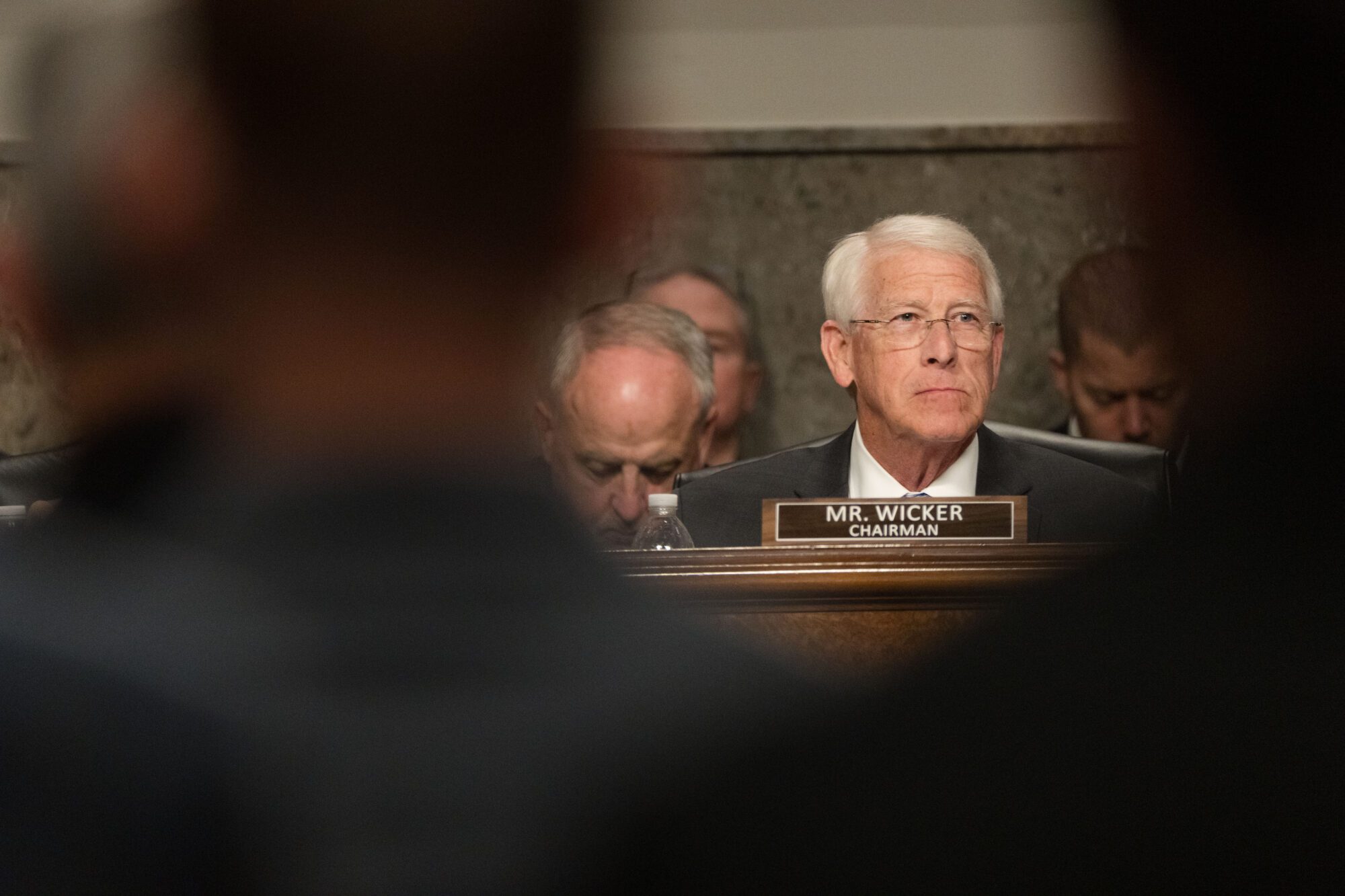

Last week, Senator Cindy Hyde-Smith warned that the agricultural portion of the Democrats’ evolving $3.5 trillion tax and spend package will worsen issues and threaten the future viability of the nation’s family dairies.

Hyde-Smith had pointed out in a hearing titled, “Milk Pricing: Areas for Improvement and Reform,” that the Democrats’ plans for agriculture and climate change offer no assistance to the dairy industry. She said that the industry will be harmed by proposed changes in capital gains tax rates and estate taxes, or stepped-up modifications in order to pay for the $3.5 trillion plan.

The Mississippi senator announced yesterday that a new report conducted by the U.S. Department of Agriculture (USDA) provides more evidence that capital gains tax changes to help pay for President Biden’s $3.5 trillion tax and spending plan will hit family farms more harshly than the administration will admit.

The USDA report, The Effect on Family Farms of Changing Capital Gains Taxation at Death, confirms Hyde-Smith’s disbelief that eliminating the federal estate tax stepped-up basis rule would affect only 2% of family farms.

The USDA Economic Research Service analysis shows that 17% of small farms, 66% of midsized farms, 80% of large farms, and 96% of very large farm operations would have a new tax burden with the elimination of stepped-up basis. The additional taxable gain on farm assets across all affected estates averaged $1.8 million per farm family.

The report states:

“The results suggest that of the estimated 32,174 family farm estates in 2021, 1.1 percent would owe capital gains taxes at death, 18.2 percent would not owe capital gains taxes at death but could have deferred tax liability if the farm assets do not remain family-owned and operated, and 80.7 percent would have no change to their capital gains tax liability.”

Sen. Hyde-Smith posted on Twitter that, “The USDA report effectively invalidates POTUS’ claim that most family farms/ranches would be held harmless by the Dem’s scramble to pay for their $3.5T spending spree. Really, this proposal would impose a tax burden on a broad swath of Ag operations across MS & the nation.”

The @USDA report effectively invalidates @POTUS claim that most family farms/ranches would be held harmless by the Dem’s scramble to pay for their $3.5T spending spree. Really, this proposal would impose a tax burden on a broad swath of Ag operations across MS & the nation.

— U.S. Senator Cindy Hyde-Smith (@SenHydeSmith) September 23, 2021

“The USDA report effectively invalidates the administration’s claim that most family farms and ranches would be held harmless by the Democrat’s scramble to pay for their $3.5 trillion spending spree,” Hyde-Smith said. “It only makes sense that a significant reduction in estate tax exemptions will place unacceptable new tax burdens on families that own and operate farms and ranches.”

It is reported that many companies and entities are supporting efforts to convince the Biden administration and congressional Democrats to drop plans to increase capital gains tax rates that harm family-owned operations.

Entities and associations include the American Farm Bureau Federation, National Federation of Independent Business, National Cattlemen’s Beef Association (NCBA), Associated General Contractors of America, National Association of Manufacturers, and the U.S. Chamber of Commerce.

NCBA headed a movement to write a letter to House Ways and Means and Senate Finance Committee leadership. The letter urged them to consider the implications that changes to federal tax policy will have on family-owned agricultural businesses.

Nearly 330 trade associations representing family-owned food, agriculture and related businesses agree that, when drafting legislation to implement President Biden’s “Build Back Better” agenda, it is critical that the “American Families Plan” must also support family farms and ranches.

“This reconciliation bill is effectively 100 bills in one representing every big government idea that’s never been able to pass in Congress. The bill is an existential threat to America’s fragile economic recovery and future prosperity,” said U.S. Chamber of Commerce President and CEO Suzanne Clark. “We will not find durable or practical solutions in one massive bill that is equivalent to more than twice the combined budgets of all 50 states. The success of the bipartisan infrastructure negotiations provides a much better model for how Congress should proceed in addressing America’s problems.”

The National Association of Manufacturers agrees.

“Building a strong economy takes more than wishful thinking; it requires a competitive business environment. Manufacturers are committed to rebuilding our economy and sustaining our recovery—even amid the surge of COVID-19 cases,” said National Association of Manufacturers Senior Vice President of Policy and Government Relations Aric Newhouse. “If lawmakers share that commitment, then they would rethink tax proposals like this. Few policies would stall our recovery faster. Now is not the time to pursue policies in Washington that will hurt the families and communities of manufacturers in America.”