Mississippi Legislature could have a bill to establish a medical marijuana program before start of 2022 session.

The U.S. Supreme Court declined to hear arguments in the case of a medical marijuana dispensary in Colorado that appealed a decision that denied them federal tax deductions that were available to other types of business owners. The case, Standing Akimbo v. United States, is interesting in that the company, while operating under Colorado law, is acting illegally under federal law putting it at odds with the Internal Revenue Service.

Supreme Court Justice Clarence Thomas made headlines on Monday noting that the federal government’s stance in this matter is a “half-in, half-out” approach.

“Once comprehensive, the Federal Government’s current approach is a half-in, half-out regime that simultaneously tolerates and forbids local use of marijuana,” Justice Thomas writes. “This contradictory and unstable state of affairs strains basic principles of federalism and conceals traps for the unwary.”

A similar business scenario could play out in Mississippi when the Legislature eventually approves a state medical marijuana program now that the issue is squarely in their laps following the state Supreme Court that overturned Initiative 65. Hearings in the state Senate are underway and a potential bill is forthcoming that would need to be acceptable to both chambers as well as to Governor Tate Reeves. Proponents are pushing for a special session before the start of the 2022 legislative session if the Senate and House can find common ground.

Justice Thomas opined that the prohibition on intrastate use or cultivation of marijuana may no longer be necessary or proper to support the federal government’s “piecemeal approach.” He goes on to say:

“Many marijuana-related businesses operate entirely in cash because federal law prohibits certain financial institutions from knowingly accepting deposits from or providing other bank services to businesses that violate federal law… Cash-based operations are understandably enticing to burglars and robbers. But, if marijuana-related businesses, in recognition of this, hire armed guards for protection, the owners and the guards might run afoul of a federal law that imposes harsh penalties for using a firearm in furtherance of a ‘drug trafficking crime.’… A marijuana user similarly can find himself a federal felon if he just possesses a firearm.”

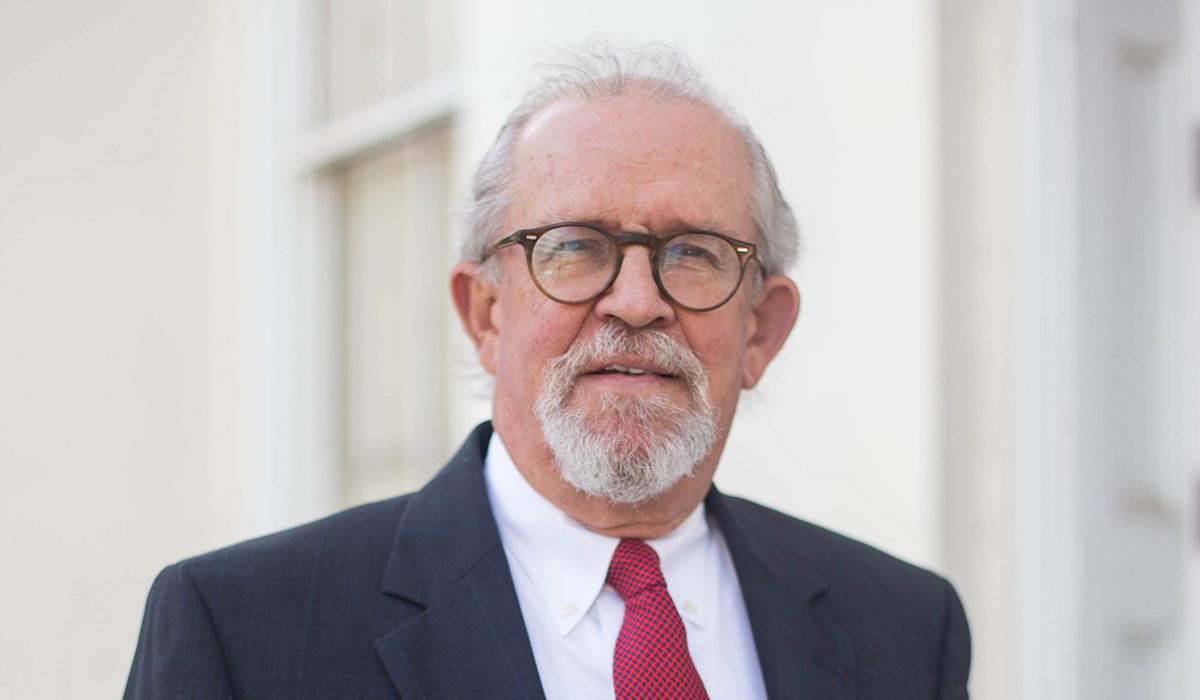

Gordon Fellows, President and CEO of the Mississippi Bankers Association, is closely following the medical marijuana hearings in the Legislature for the impact this scenario referenced by Justice Thomas will have on the financial institutions in the Magnolia State when a program is enacted.

“As in other states, any action taken by Mississippi to legalize marijuana will conflict with the federal Bank Secrecy Act and other laws that govern bank anti-money laundering procedures,” Fellows told Y’all Politics. “This conflict between state and federal law will create many issues for banks and any business that sells goods or services to the marijuana industry which cannot be solved by the Mississippi Legislature.”

With the Legislature moving toward replacing Initiative 65, Fellows said the MBA will continue to work closely with legislative leaders and state agencies to encourage that any potential medicinal marijuana program provide banks and the public with high levels of transparency that will help all interested parties recognize the difference in legal and illicit marijuana businesses.

“If the state passes a medicinal marijuana program that includes public visibility of important information such as license status and other business details, a few banks may choose to provide limited banking services to licensed marijuana businesses,” Fellows said. “Once the Legislature acts and state regulations are in place, each bank will have to make an individual decision about the amount of risk the bank is willing to take on in providing services to the marijuana industry.”

Fellows said as they have seen in other states, most banks will likely wait until Congress takes action to correct this conflict between state and federal law before choosing to provide services directly to marijuana businesses.

“Importantly, until Congress acts, businesses that provide goods and services to the marijuana industry should be aware that they might be required to disclose new information to their bank, and businesses could also experience potential disruptions in their banking services,” the MBA President said.

The Mississippi Bankers Association is monitoring a bill in Congress – HR 1996, the SAFE Banking Act – which would grant a federal safe harbor to banks that provide services to marijuana businesses legally recognized by states. It passed the U.S. House of Representatives 321-101 earlier this year, and currently awaits committee consideration in the U.S. Senate. Fellow says, “We hope it becomes law soon.”

Mississippi’s three Republican Congressmen Trent Kelly (MS-1), Michael Guest (MS-3) and Steven Palazzo (MS-4) all voted no on the House bill, while Democrat Congressman Bennie Thompson (MS-2) voted in favor of the SAFE Banking Act.

As for the conundrum medical marijuana places on law enforcement, Commissioner of the Mississippi Department of Public Safety Sean Tindell says his office and local agencies are discussing how a medical marijuana program will impact their duties as they attempt to enforce the law in a new environment. They are looking to other states that have gone down this road for examples of areas where additional training and tweaks to laws currently on the books may be necessary to accommodate the marijuana industry.

One of the main pitfalls, Tindell says, is how officers will attend to instances of driving under the influence. Unlike DUI enforcement related to alcohol, assessing impaired driving while using marijuana is not as easily determined. How officers assess that at the time an individual is in operation of a vehicle is being considered.

“From our perspective, it will certainly require some additional training, particularly as it relates to driving under the influence and enforcing those laws,” Tindell told Y’all Politics.

In addition, the Commissioner of Public Safety says safeguards should be put in place by the Legislature that would, as much as possible, remove the ability for any criminal network or cartels from using the new industry for nefarious purposes.

“It is important that we make sure that when we do have medical marijuana that the legal distribution of it for medical purposes and the production of it is done in a way that removes any criminal element from that process,” Tindell said.

Tindell agrees with Justice Thomas when he noted that, “Cash-based operations are understandably enticing to burglars and robbers.” The Commissioner understands why Fellows and the financial institutions want Congress to act to provide a federal safe harbor to banks as it relates to marijuana businesses legally recognized by their states.

“Anytime you encourage and promote the existence of a cash-only business the byproduct of that is that organized crime and the cartels love it because it’s easier to launder money,” Tindell said, pointing out how organized crime sought to initially make a play in Mississippi when casinos began but thanks to additional training and laws around that industry, such criminal activity was stifled.

Tindell, a former state legislator and judge, says the solution to much of this lies in the hands of the federal government.

“It’s an awful situation. There is now a hodgepodge of laws across the country and that creates a whole host of problems that otherwise could be resolved but hasn’t been,” Tindell said.