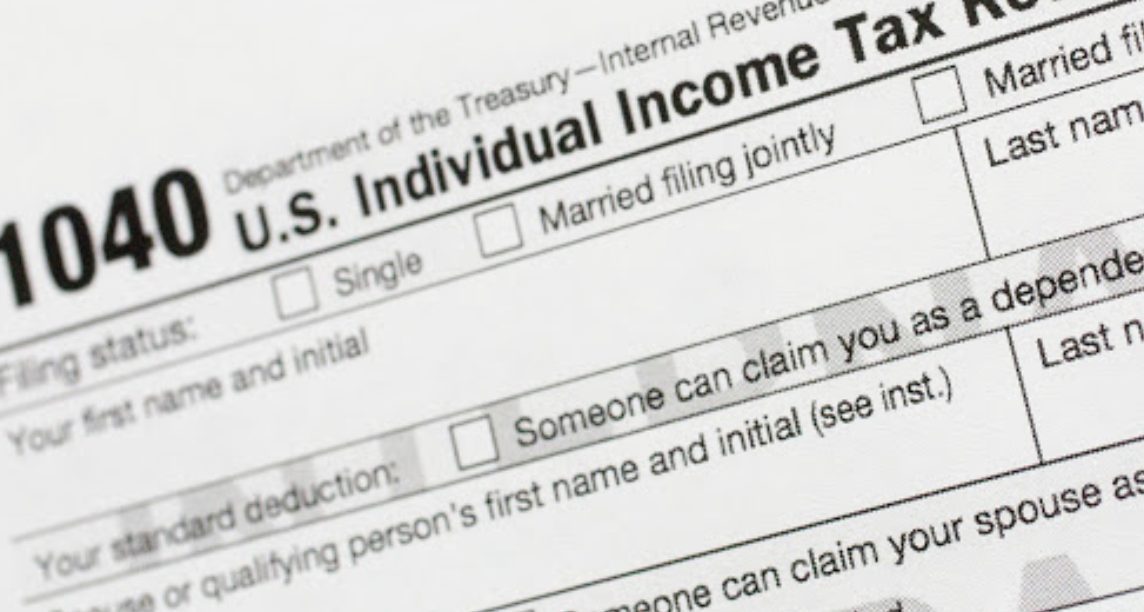

The Senate has declined to move forward with Speaker of the House Philip Gunn’s HB 1439 that would have phased out the state’s remaining income tax over the next 10 years.

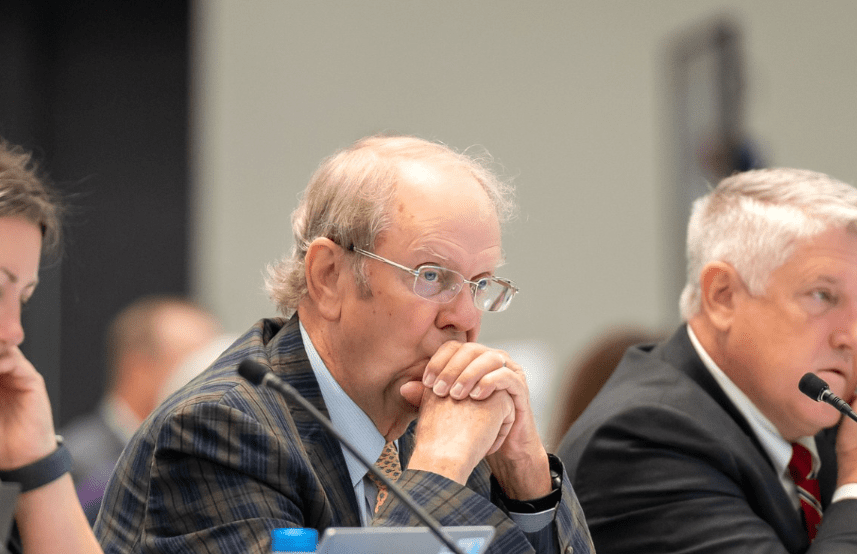

Instead, Senate Finance Chair Sen. Josh Harkins (R) has offered a resolution that would create a State Taxation Study Committee. When the Senate effectively killed the House bill by not moving it out of committee before a deadline, Harkins said they needed more time to know whether or not the policy presented in that bill was the best option for Mississippi.

RELATED: Finance Chair elaborates on Senate’s position regarding House income tax plan

SCR 536 puts together a committee comprised of four members of the Senate and four members of the House. Those individuals would be appointed by the Lt. Governor and the Speaker but follow certain guidelines. The State Economist and Commissioner of the Mississippi Department of Revenue would also sit on the committee.

The committee would be responsible for studying Mississippi’s current tax code and researching data that would lead them to a conclusion of the best way to do away with state income tax.

Their report is due to the Legislature by the start of the 2022 session.

“Once we got our hands around what was in the bill and some of the things the bill was calling for, we started trying to figure out what the implications were,” said Harkins. “We started thinking about possible pitfalls or things we would have to be concerned about.”

Harkins said they then called the State Economist, who had not done a model on the proposal, and the senators asked for one.

The Finance chairman added one of the first things that stood out to him was how this would impact the credits given to businesses that are promised a rebate on income tax for the amount of jobs they will bring to the state in relocating here. Harkins also said he had questions as to how cities would be made whole after the cut of the grocery tax.

Following the Senate’s move to kill the proposed bill from the House, Rep. Trey Lamar (R) placed the language for the tax cut into a bond bill on the House floor as a last attempt to see it survive this year.

Within this version, the House removes the tax increase on farmers, loggers and manufacturers. However, it is still unlikely it will pass during the conference process. Speaker Gunn seemed to agree with that sentiment on Twitter when he praised the passage of a teacher pay raise, another element that was also included in the income tax bill.

2/2 – Additionally, we are disappointed the Senate has declined to pass our income tax bill which would have put about another $1750 back into the typical teacher’s pocket. Overall we are pleased that once again we produced a bill supporting our state’s teachers this session.

— Philip Gunn (@PhilipGunnMS) March 18, 2021

It is possible that the Legislature could wrap things up this week on the 2021 session, holding a few days aside in the event they are needed to come back and appropriate federal dollars for the COVID-19 pandemic, but that has yet to be determined.