RELEASE:

SENATE COMMITTEE PASSES $577 MILLION TAX RELIEF PLAN

Plan would boost GDP, increase investment in state

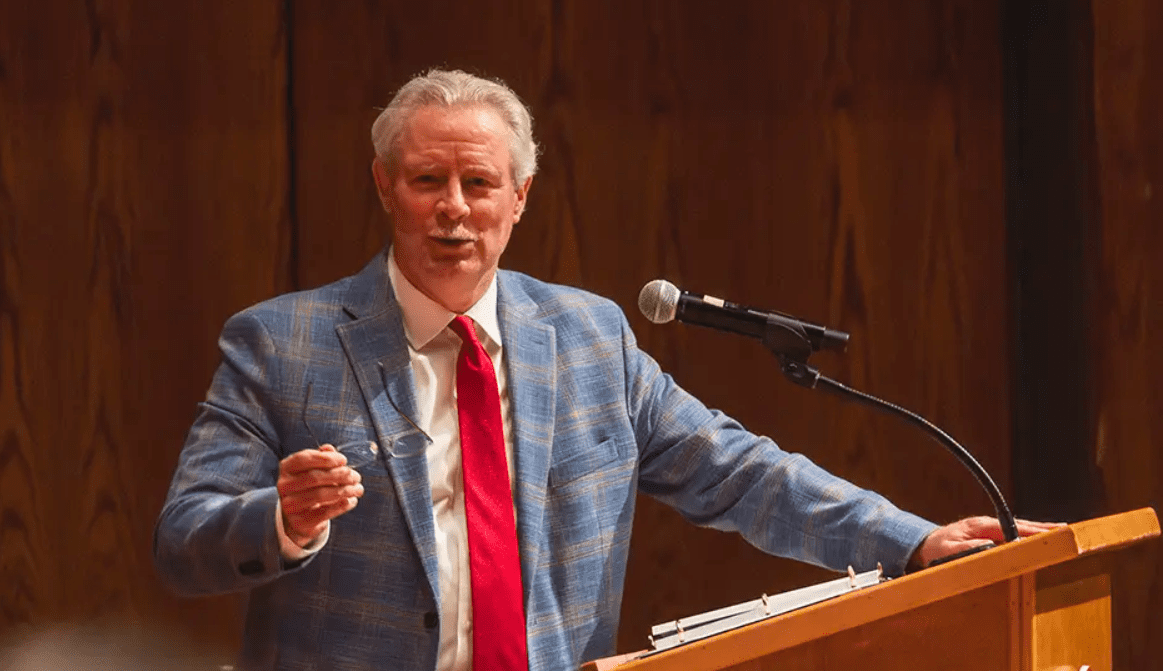

JACKSON – Lt. Gov. Tate Reeves said today his proposed Taxpayer Pay Raise plan to reduce individual and small business taxes will head to the Senate for consideration.

The Senate Finance Committee approved Senate Bill 2858 today after discussing how the plan will allow Mississippians to keep more tax dollars in their own pockets, not in a government bank account. The bill, sponsored by Finance Chairman Sen. Joey Fillingane, R-Sumrall, is similar to a compromise plan presented in 2015 by House and Senate leaders.

“Mississippi’s tax code needs to be flatter and fairer for both individuals and job creators to grow the state’s economy for the long term,” Lt. Gov. Reeves said. “We don’t need to grow the size of government; we need to grow the size of Mississippi’s economy. And we do that by allowing the taxpayers to keep their money to invest in their communities.”

The $577 million tax relief plan includes:

Eliminating the 3 percent and 4 percent tax brackets levied on income,

Reducing the overall tax burden on small business owners, and

Removing the investment penalty, or franchise tax, on businesses’ property and capital.

Eliminating the franchise tax alone would have grown the state’s GDP by $282 million and added 3,514 jobs within 10 years, according to a Mississippi State University study. Reeves’ plan would be phased in over a 15-year period, making it a fiscally responsible approach to long-term tax policy and economic growth.

3/9/16