RELEASE: Palazzo Praises Senate Passage of House Flood Insurance Bill

Cites passage as testament to people overcoming politics

WASHINGTON, D.C. – Congressman Steven Palazzo, (MS-4), today praised Senate approval of H.R. 3370, The Homeowner Flood Insurance Affordability Act, by a vote of 72-22. Today’s bill was a clean extension of the measure which Palazzo helped craft with House leaders, and which passed in the House a little over a week ago by a vote of 306-91. The bill passed by such strong margins in both legislative bodies that it heads to the president as a veto-proof measure.

“This bill is what everyday, middle-class Americans – in Mississippi and across the country – have been waiting for,” Palazzo stated. “I applaud the Senate’s strong support of our bill; this is truly a testament to people overcoming politics. I am encouraged by the extensive bipartisan, bicameral results, but real credit belongs to the communities all across the nation who worked with us to make this happen. I am pleased to report this bill truly reflects South Mississippi views and voices. I am proud to have played a part in these compassionate and fiscally responsible reforms that will ensure flood insurance remains affordable and available for those who need it. That has been my goal from day one.”

Palazzo was one of the first legislators to bring attention to unintended rate hikes and flawed FEMA procedures just a year ago, with the introduction of legislation containing several similar provisions to H.R. 3370, including slower phase-in rates for premiums and more compassionate flood insurance rates for grandfathered and subsidized properties as well as home sales. The bill also contains measures to hold FEMA accountable for faulty mapping practices, fast-track FEMA affordability studies, and protect homeowners who appeal faulty FEMA maps; all of which Palazzo has supported. Despite several key changes to the existing Biggert-Waters Act of 2012, H.R. 3370 is budget-neutral and adds nothing to the deficit.

The bill repeals Section 207 of the law and restores grandfathered rates, making permanent Palazzo’s delay that was recently signed into law as part of the omnibus budget bill. Under Biggert-Waters, homes lost grandfathered rates once a property was sold or maps were changed, resulting in drastic, overnight rate increases in some cases. The new legislation does away with home sale triggers, retroactively refunds home sale increases on pre-FIRM properties, and ties premiums to properties, not people. The House plan would also ensure that FEMA does not move the goal posts on those who built back to code after storms like Hurricane Katrina.

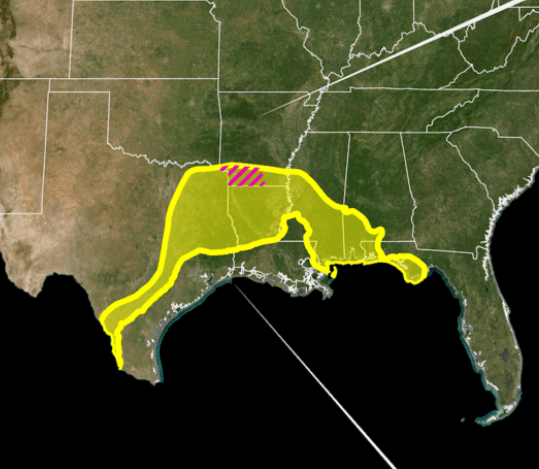

Palazzo pushed for inclusion of several other measures to hold FEMA accountable. Those measures include requirements that the agency certify its mapping methodology, expedite an affordability study, reimburse policyholders who successfully appeal FEMA maps, and establish a flood insurance advocate. Under Palazzo language submitted in 2011, the Technical Mapping Advisory Council, which would certify FEMA maps, must include adequate representation from the Gulf Coast. FEMA would also be required to notify communities of remapping as well as which models are being used in the mapping process. Further, FEMA will also be required to provide an affordability framework within 18 months after the affordability study is completed.

The House-drafted bill would also push FEMA to restrict rates to equal no more than one percent of home values, with yearly increases for individuals capped at eighteen percent of the previous year’s policy. The difference in rate calculations could mean thousands of dollars in annual relief for South Mississippi homeowners.

3/13/14