MID Completes State Farm Market Conduct Exam

Following over 22 months of extensive review of hundreds of thousands of documents and hours of sworn testimony, the Mississippi Insurance Department (MID) has completed its Special Target Examination of State Farm Fire and Casualty Insurance Company’s claims handling practices in the aftermath of Hurricane Katrina. The report has been sent to the company and will be placed on the MID-website ( www.mid.state.ms.us) for public review.

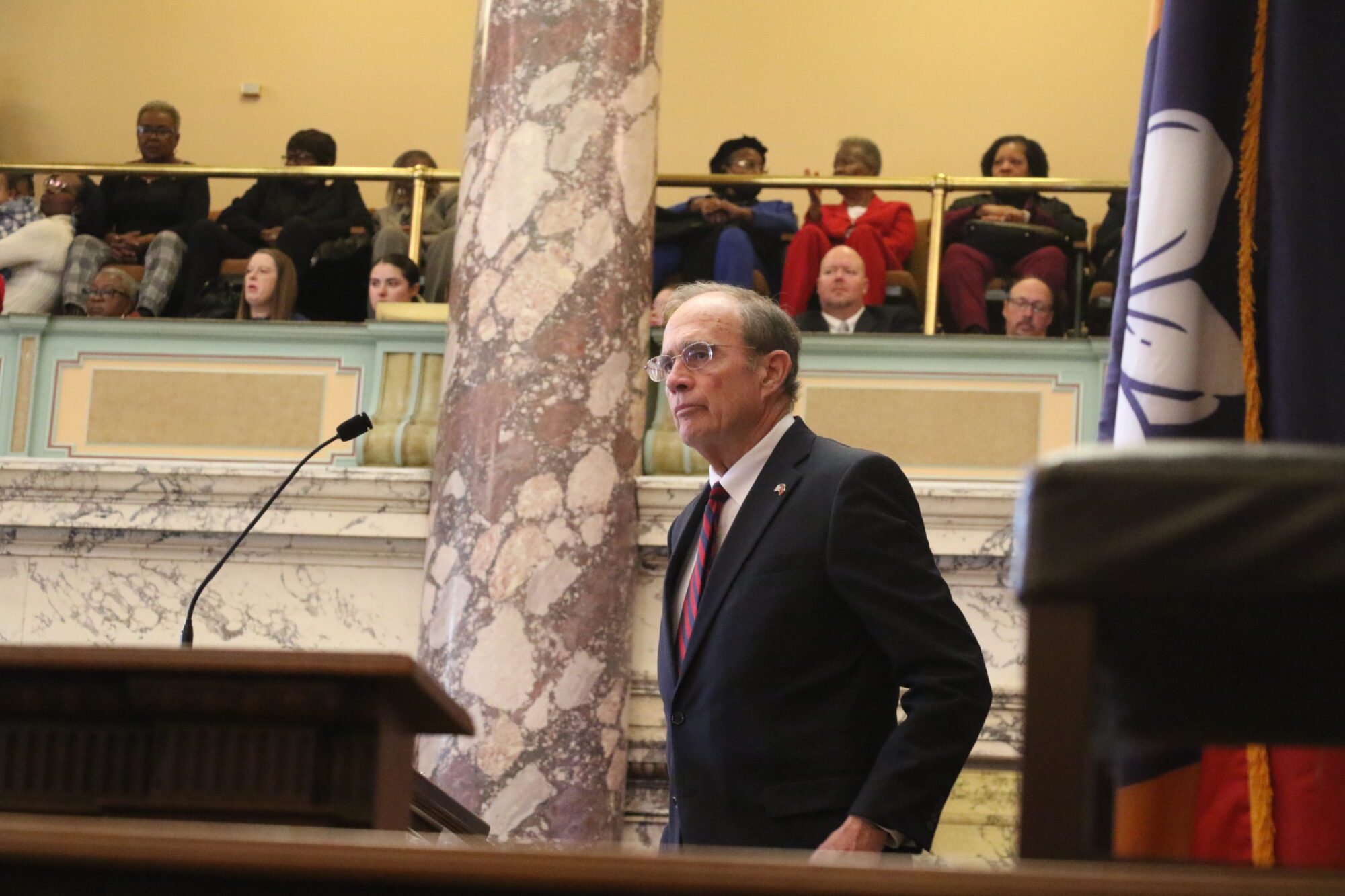

“As Insurance Commissioner, I am very aware that not everyone will be pleased with the conclusions reached in the report, therefore, I recommend that the report be read in its entirety. This report finds State Farm did some things right and some things wrong,” Commissioner Mike Chaney said.

“When I became Commissioner, I said we would put policyholders first while providing a fair, stable climate that would guarantee that Mississippians have plenty of viable insurance options. The report we are releasing today is a thorough and detailed accounting of what happened with State Farm policyholders after Katrina. I believe it is a very evenhanded report that helps identify problem areas for the insurance industry’s response to the devastation caused by hurricanes and other natural disasters,” Chaney said.

Among the report’s findings and discussion are:

* Some policyholders’ claims were not handled appropriately, although the exam found no specific violations of the Unfair Trade Practices statute.

* The exam found no pattern of violation of the insurance fraud statute, which parallels findings of Attorney General Jim Hood’s office.

* Although there were questionable decisions and irregularities by State Farm in handling claims, no scheme or plan to systematically mistreat policyholders was found.

* After numerous complaints and accusations by policyholders, State Farm agreed to reopen all slab cases through a MID-monitored program, which resulted in an additional $88 million dollars being paid to policyholders.

Chaney added; “Hurricane Katrina was an extremely trying situation for everyone involved. The real brunt was borne by the people on the coast who lost their homes and businesses. We do not and should not expect insurance companies to pay claims that are not covered by the policy, however, we expect them to promptly pay every penny that policyholders are owed on policies paid in good faith. To this end, I will continue to advocate and require that policies be written in plain, simple understandable language. I am committed to working with insurance companies to provide a good business environment in Mississippi, but I won’t tolerate unfair treatment of policyholders. I’m confident we can use findings of the exam as a constructive tool to help make policyholders’ lives easier the next time disaster strikes.”

MS Insurance Commissioner Mike Chaney Press Release

10/30/8