Stay up-to-date on what’s in the news with the Y’all Politics Daily Roundup.

YP – Hosemann receives National Award for Strong Support of Mississippi National Guard

Lt. Governor Hosemann’s efforts to make voting more accessible to overseas service members has earned him the award from the National Guard Association of the United States.

Hosemann was given the award in Las Vegas, Nevada surrounded by 4,000 active and retired soldiers from all over the U.S. The prestigious Major General Charles Dick Medal of Merit goes to state and national figures who have demonstrated significant and long lasting support of the National Guard.

“In recent days, we have again been reminded of the significant sacrifices our soldiers make every day for our freedoms,” Hosemann said. “The Mississippi National Guard are our American heroes.”

MEMA offers Ida debris tips

Recovery is underway for those impacted by Hurricane Ida and as survivors continue with the cleanup process, it's important to keep in mind these debris removal guidelines. ⬇

More information on #Ida recovery can be found here: https://t.co/VBFj11Xiwr pic.twitter.com/QIeOPdZSY9

— msema (@MSEMA) September 4, 2021

YP – NFIP increasing flood insurance rates October 1st. Over 80% of Mississippi policyholders to see increases.

For the first time in 50 years, the National Flood Insurance Program (NFIP) is changing how it rates risk, according to FEMA. The result will be flood insurance rate increases of up to 18% for several years for over 80% of Mississippians statewide. Rate increases will begin October 1, 2021, with most policyholders realizing the increases by April 2022.

Jimmy Heidelberg, counsel for the Mississippi Windstorm Underwriting Association, better known as the Windpool, joined Y’all Politics on Friday to discuss how these new rates will be determined, what it means for the roughly 62,000 Mississippi flood insurance policyholders, and what is being done to mitigate the impact at the state and local level.

YP – Mississippi State Health Officer says he hasn’t pushed for statewide mask mandates “in a long, long time”

“The change in the CDC’s mask guidance is foolish and harmful and it reeks of political panic to appear that they are in control,” Governor Reeves told the crowd at the Neshoba County Fair. “It has nothing to do with rational science.”

Those comments coupled with Reeves’ reluctance to order another round of mask mandates, similar to what was done at the beginning of the pandemic in Spring 2020, has led critics to believe he is not listening to public health leaders, namely the State Health Officer Dr. Thomas Dobbs with the Mississippi State Department of Health.

But that has now been proven false.

In an interview with Y’all Politics this week, Dr. Dobbs directly addressed mask mandates and his latest thoughts on masking.

“We haven’t really pushed for statewide public mask mandates in a long, long time,” Dobbs said. “It made sense to do stuff early on before we had other options but there are other things that are far more important than that.”

MSDH COVID-19 Reporting

Today MSDH is reporting 3,352 more cases of COVID-19 in Mississippi, 33 deaths, and 153 ongoing outbreaks in long-term care facilities. State #covid19 totals: 446,863 cases, 8,540 deaths, and 1,174,504 persons fully vaccinated. Full information: https://t.co/YCv9xPyJDk pic.twitter.com/bVHLAIKdax

— Mississippi State Department of Health (@msdh) September 3, 2021

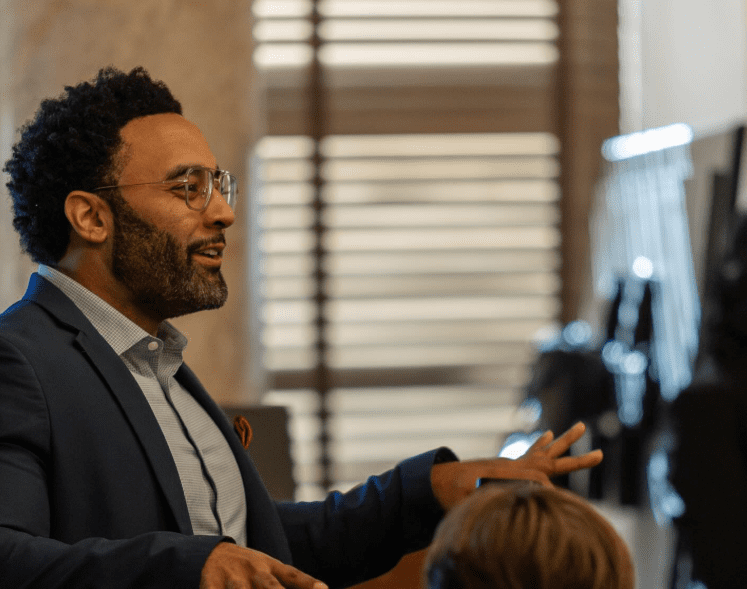

YP – Will Mississippi See the End of Its Individual Income Tax and Finally Enjoy a Growing State?

The Legislature’s Joint Tax Study Committee wrapped up two days of hearings on August 26 as experts testified about the possible benefits of scrapping the tax.

One advantage to getting rid of the state’s personal income tax — which is assessed at the rate of zero on the first $3,000 of taxable income, 3 percent on the next $2,000, 4 percent on the next $5,000 and 5 percent on all taxable income exceeding $10,000 — is that it is relatively low hanging fruit when it comes to the percentage of the state’s tax revenues.

Revenue from the income tax (more than $709 million in fiscal 2021) accounted for only 7.45 percent of the $9.5 billion in tax revenues collected by the state Department of Revenue. Sales tax accounted for 36.1 percent of all revenues collected ($3.44 billion). In fiscal 2020, sales tax ($3.22 billion) accounted for 39 percent of revenue collected while the income tax added up to 4.29 percent. That skew was likely affected by the COVID-19 pandemic.

YP – Palazzo calls for Biden, Secretary of Defense and Chairman of Joint Chief of Staff’s resignation

Congressman Steven Palazzo has called for the resignation of President Joe Biden, Secretary of Defense Lloyd Austin and Chairman of the Joint Chief’s of Staff General Mark Milley in a signed individual resolution.

This comes in response to the crisis in Afghanistan and what Palazzo called a “failure to fulfill their oath of office.” He indicated that this failure led to the condemnation of the United States by allies as well as a diminished standing on the international stage. He further elaborated that this lack of leadership allowed the Taliban to be armed with billions of dollars worth of taxpayer supplied military equipment as well as the unnecessary deaths of thirteen American soldiers.

Congressman Thompson announces Cheney as Vice Chair of Jan. 6 Committee

NEW: Chairman @BennieGThompson announces that @RepLizCheney will serve as the Select Committee's Vice Chair.

Read more here⬇️⬇️⬇️https://t.co/inETYmnykB

— January 6th Committee (@January6thCmte) September 2, 2021

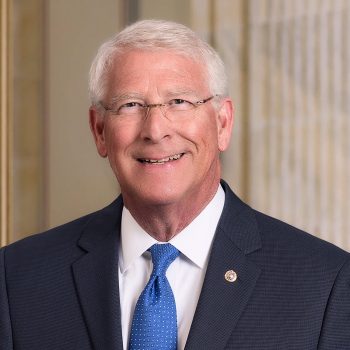

YP – WICKER: Infrastructure Paid Off During Hurricane Ida

Infrastructure projects have played an important role in mitigating storm damage. Since Hurricane Katrina, our nation has invested billions of dollars to improve drainage systems, flood walls, and levees, which failed catastrophically during Katrina but have not broken since. The Army Corps of Engineers has shored up pumping stations, which are critical to removing floodwaters after a storm. We have also invested in backup power systems in case our power grid fails because of storm-induced floods, and more resources have been devoted to storm preparation.

Congress is now considering a bipartisan infrastructure bill that would build significantly on this progress. I recently voted in favor of this bill because of the tremendous good it would do for Mississippi – funding new roads, bridges, rail, ports, aviation, water projects, broadband deployment, and more.