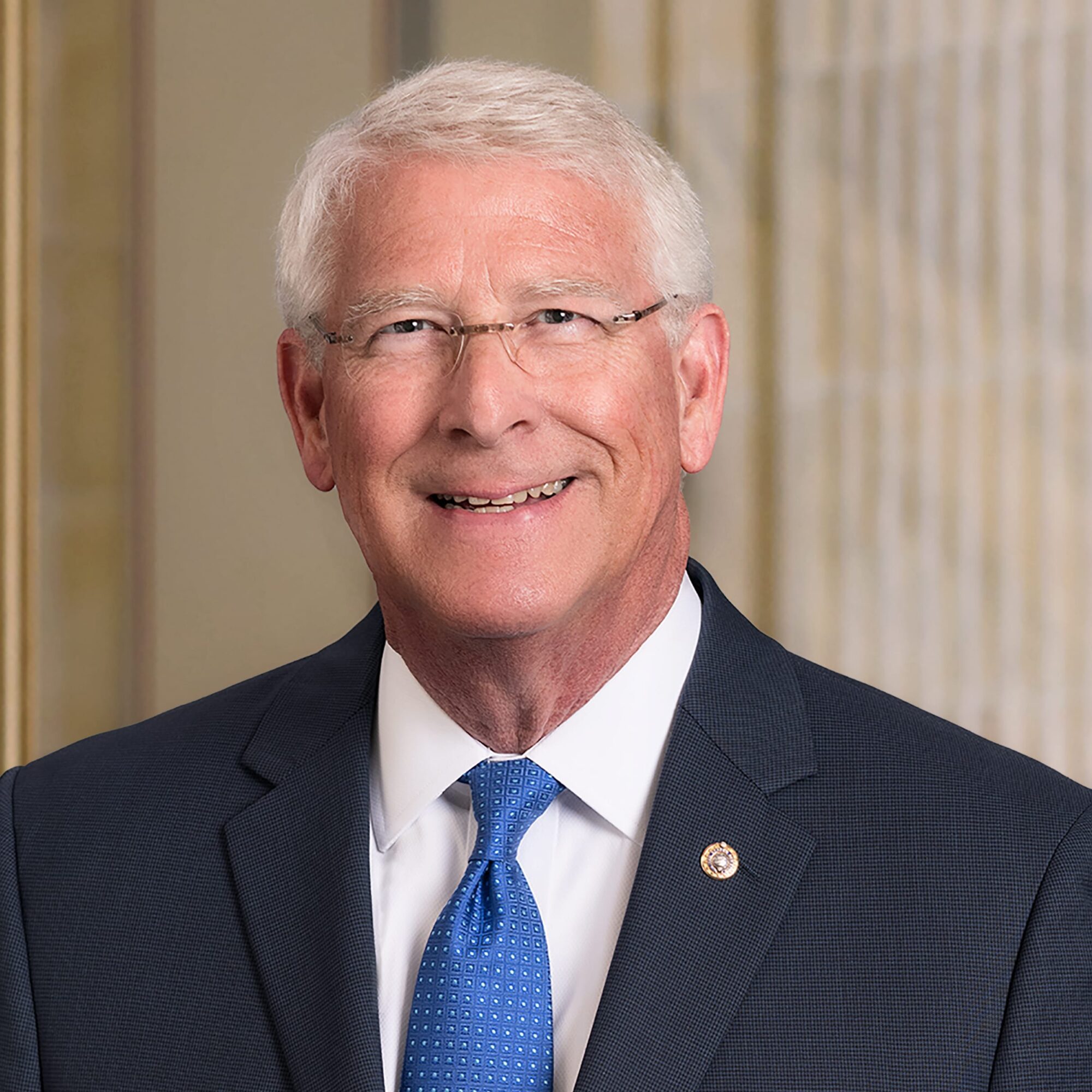

New Legislation Expands Window for Businesses to Support Employees

U.S. Senator Roger Wicker, R-Miss., supported passage of the “PPP Flexibility Act of 2020,” legislation that will update the popular Paycheck Protection Program to reduce some restrictions on how businesses may use funds for the duration of the COVID-19 crisis.

“The Paycheck Protection Program has been a core element of our federal response to the coronavirus outbreak,” Wicker said. “The legislation we advanced last night will allow more small businesses to access critical relief funds for their employees. I hope the President will sign the legislation without delay.”

The Paycheck Protection Program was authorized by the Congress in the Coronavirus Aid, Relief, and Economy Security (CARES) Act. The program provides small businesses with forgivable loans that operate as grants if funds are used primarily to pay payroll costs and other overhead, including interest on mortgages, rent, and utilities.

Among other provisions, the legislation would:

- Increase the loan forgiveness period from eight to 24 weeks;

- Reduce the proceeds required for payroll from 75 to 60 percent;

- Increase the loan repayment period from two to five years;

- Allow payroll tax deferral for PPP recipients; and

- Extend the June 30 rehiring deadline.

Press Release

6/4/2020