Structured Finance Securities Backed by Subprime Mortgages Contributed to the Financial Crisis

February 5, 2013

Contact: Jan Schaefer

Public Information Officer

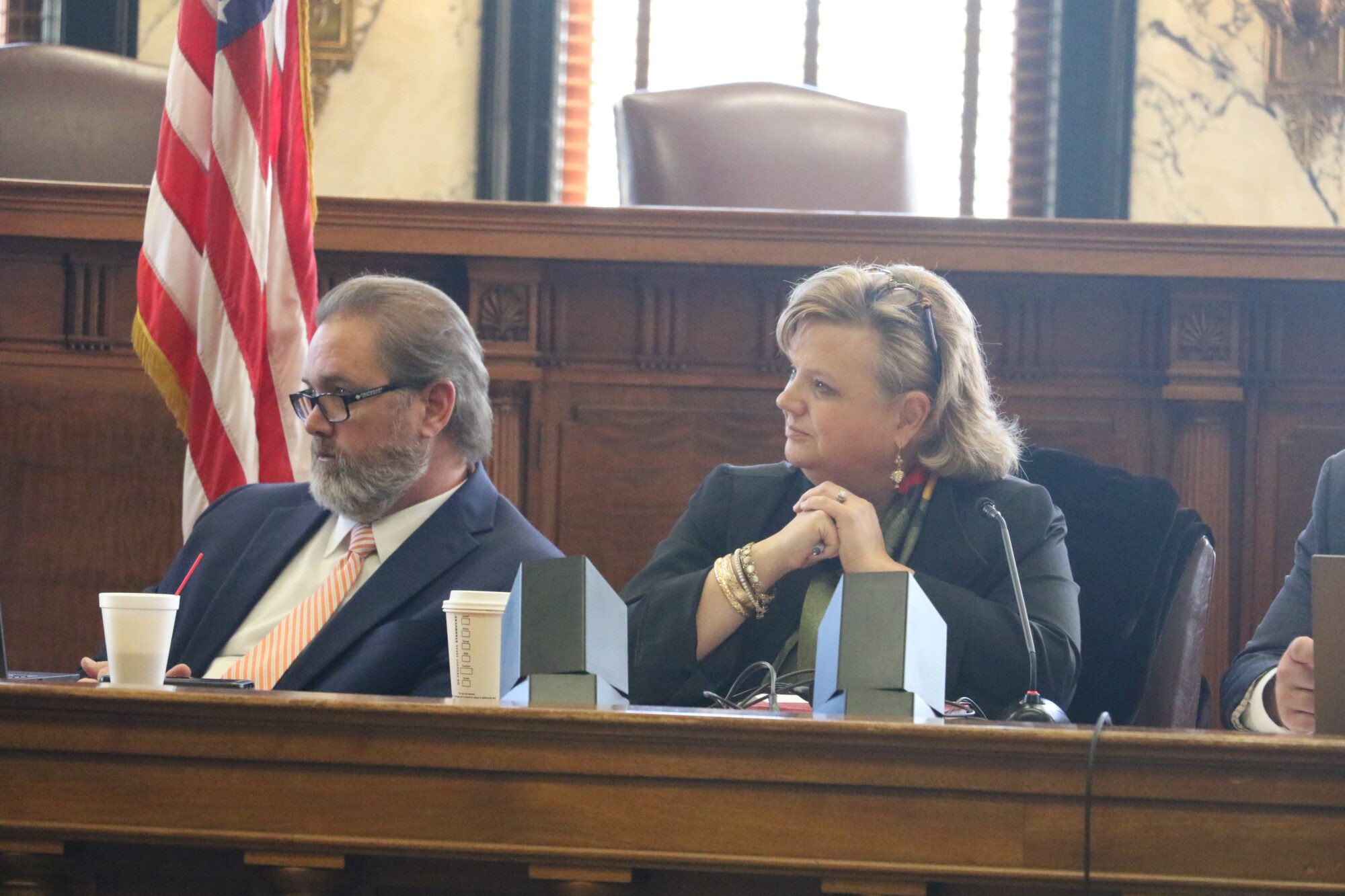

Jackson, MS–Attorney General Jim Hood today welcomed additional federal and state enforcement actions against Standard and Poor’s seeking accountability for alleged misconduct by the credit rating agency involving structured finance securities backed by subprime mortgages that were at the heart of the nation’s financial crisis.

Attorney General Hood has had a consumer protection lawsuit pending against Standard & Poor’s, as well as Moody’s, since May 2011.

Like Mississippi’s lawsuits, the new federal and state complaints allege that despite S&P’s repeated statements emphasizing its independence and objectivity, S&P allowed its analysis to be influenced by its desire to earn lucrative fees from its investment bank clients – who paid three times more for ratings of mortgage-backed securities than for ratings of traditional bonds and knowingly assigned inflated credit ratings to toxic assets packaged and sold by the Wall Street investment banks.

This alleged misconduct began as early as 2001, became particularly acute between 2004 and 2007, and there is new evidence that it continued as recently as 2011. Structured finance securities backed by subprime mortgages were at the center of the financial crisis. These financial products, including residential mortgage-backed securities (RMBS) and collateral debt obligations (CDOs), derive their value from the monthly payments consumers make on their mortgages.

“I am pleased that the U.S. Department of Justice and attorneys general from across the nation are joining us in our efforts to hold the credit rating agencies accountable by initiating lawsuits like the one we filed almost two years ago,” Attorney General Jim Hood said.

“The credit rating agencies, including Standard & Poor’s and Moody’s, are just as culpable as the investment banks in causing the financial crisis. In some ways, the conduct by the credit rating agencies was worse because these agencies held themselves out to be objective and independent,” continued Attorney General Hood. “As Mississippi has alleged in its lawsuit – and as is echoed now by the U.S. Department of Justice and multiple sister states in similar complaints – these representations were false.”

Like Mississippi’s pending case, the enforcement actions filed today seek court orders to stop S&P from making misrepresentations to the public; changes in the way the company does business; and civil penalties and disgorgement of ill-gotten profits, which may total hundreds of millions of dollars.

Connecticut was the first state to sue S&P and Moody’s on these allegations in March 2010. Mississippi filed a similar lawsuit against both ratings agencies in May 2011, and included additional allegations about the competence of the rating agencies. Illinois later filed suit against S&P in 2012.

States filing actions today include: Arizona, Arkansas, California, Delaware, the District of Columbia, Idaho, Iowa, North Carolina, Maine, Missouri, Pennsylvania, Tennessee, and Washington.

The congressionally appointed bipartisan Financial Crisis Inquiry Commission concluded in its final report that the financial crisis “could not have happened” without ratings agencies such as S&P.

During the housing boom, the demand for ratings of mortgage-backed securities increased exponentially.

Mississippi’s lawsuit alleges that, during the housing boom, S&P and Moody’s each earned fees in excess of $1 billion annually for rating these securities.

“The rating agencies should be disgorged of the hundreds of millions in profits they made from banks. As described in our complaint, these banks were submitting the faulty mortgage backed securities in exchange for the agencies’ seal of approval,” continued Attorney General Hood. “The rating agencies’ actions almost bankrupted our country. Although these are civil cases, somebody should have gone to jail over this.”

# # #