WSJ – Hood looking into banks overcharging public pension

Public pension funds have ramped up currency trading in the past decade but have failed for years to monitor prices banks charge in making these trades—and in one case, appeared to have ignored a consultant’s warnings of being overcharged.

Those alleged failings, described in government and court documents and interviews with consultants and others, are coming to light amid an investigation by state attorneys general about whether banks overcharged some funds for currency transactions to facilitate global stock trades.

…

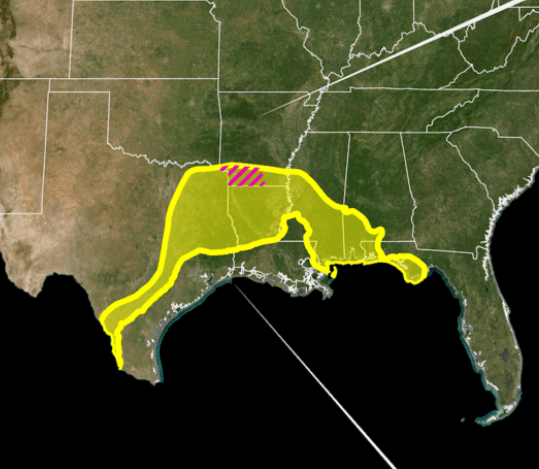

In Mississippi, Attorney General Jim Hood late last month requested a decade’s worth of foreign-exchange data to study how much the state pension fund paid for foreign-exchange moves.

Public pension funds only in recent years increased investments in foreign securities, thus increasing demand for foreign exchange. At the end of 2010, public pension funds had a median of 14.9% of assets invested in international stocks, compared with 7.7% in 1994, according to pension consultant Wilshire Associates.

Wall Street Journal

2/15/11