(Photo from Shutterstock)

- The legislative committee’s ultimate goal is to get more properties back on the tax rolls and redeveloped.

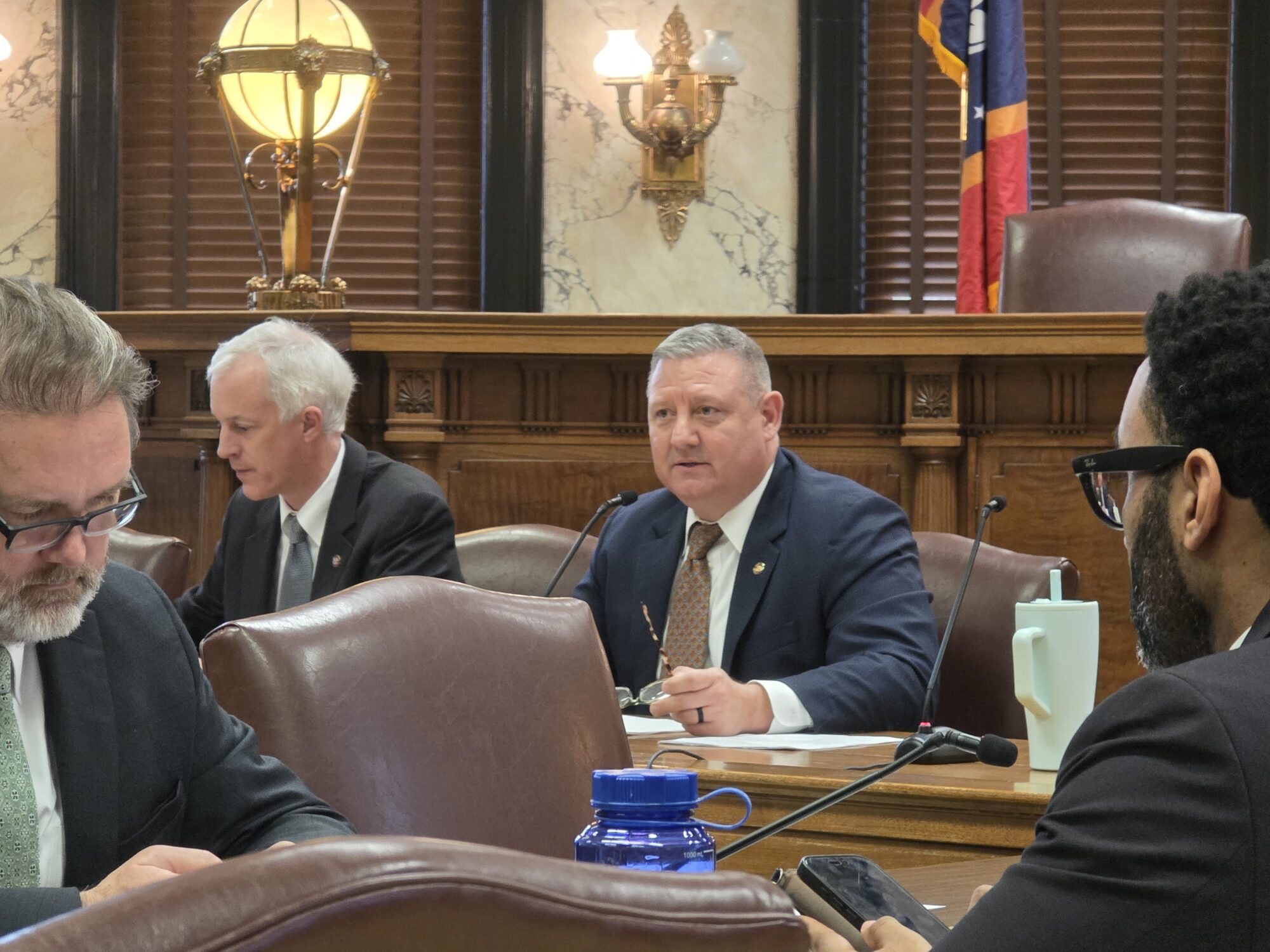

During a Thursday meeting at the State Capitol, members of the legislative Study Committee on Certain Unmerchantable and Uninsurable Titles heard how difficult it is for municipalities to solve the state’s blighted property issues.

Members agreed with the seven witnesses that Mississippi is struggling with blighted buildings. The committee’s goal is to get the properties back on the tax rolls and redeveloped.

Last session, several pieces of legislation were introduced to address blighted properties. New laws provide tax breaks of upwards of $50,000 for residential and $100,000 for commercial properties for developers to redevelop blighted properties. Another law allows local government to apply for 15, $2,000 grants to encourage municipalities to tackle blight. These properties are held by the Secretary of State’s office for back taxes.

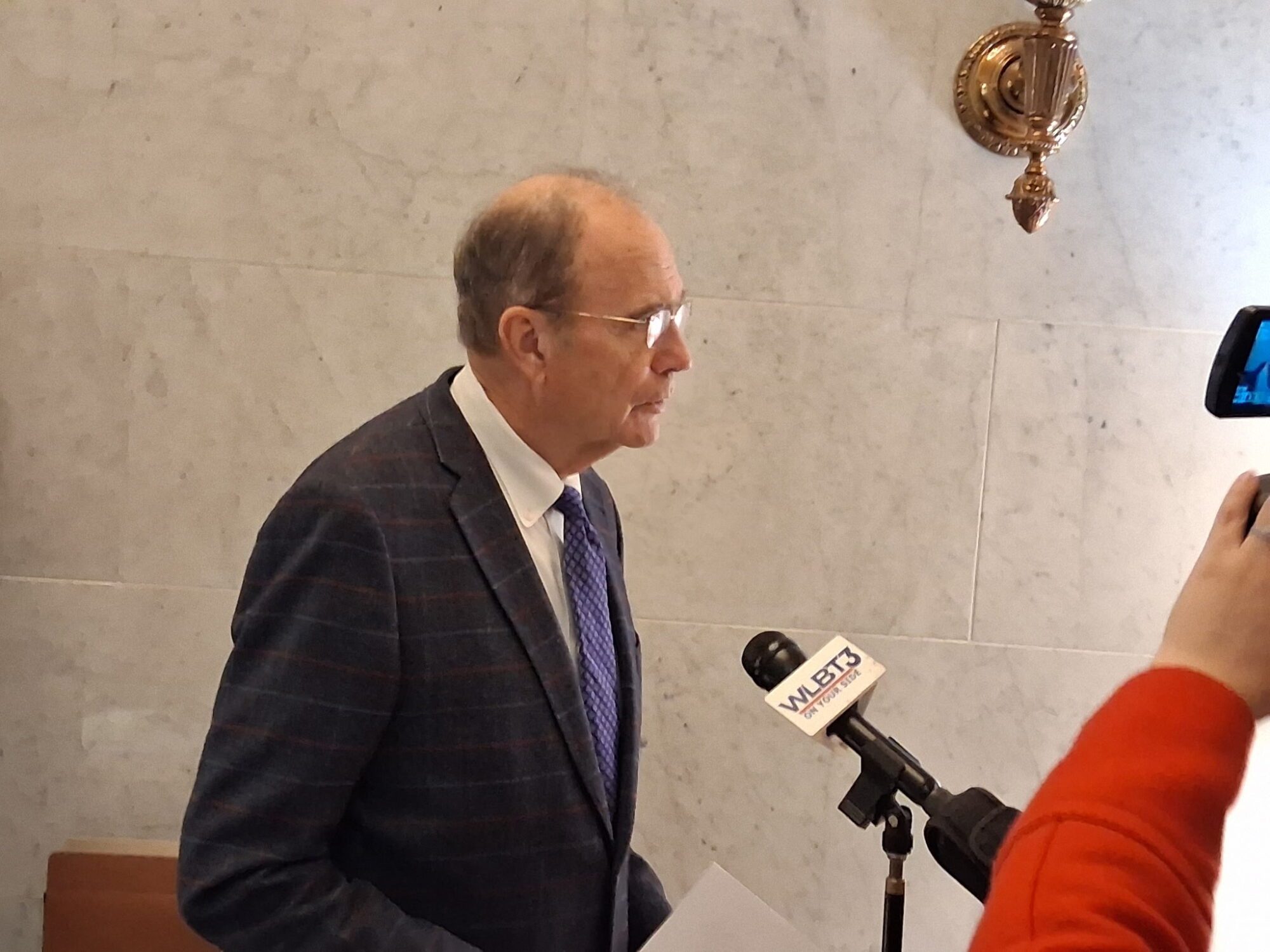

“There are some statutes that might need to be tweaked,” said State Senator Ben Suber (R), the committee’s chairman.

Stephen Jones, the Mayor of Columbus, said one of the biggest hindrances is the state not allowing localities to sell the property. Jones said multiple times that his town of 24,000 had offers on properties, but they could not be sold due to an outstanding tax bill.

Mississippi Tax Title Association, a trade group of attorneys and investors in unmerchantable and uninsurable properties, said tax sales impact all parcels in the Magnolia State that could have back taxes. Sam Martin with the Association warned the study committee about rewriting laws, “because if you tweak one statute, you got to be aware of the practical fact.”

Martin handed the committee a draft bill, proposing a change to allow the tax sale purchaser to provide notice to the landowner and the mortgage holder the same way as the county does – by mail.

Another section deals with back-end fees. Currently, Martin said, purchasers are disincentivized from making improvements to the property because if the tax sale is set aside, they will not be reimbursed.

Trey Pittman, who represented GovEase, a tech company specializing in delinquent tax bills across 15 states, from liens to deeds told members that from a data standpoint, Mississippi should study the unsold liens that are now state-owned property. Currently, if a local government cannot sell the property within a short period of time, it is handed over to the state, where it may sit for years. He suggested the state leave the sale open for multiple years.

The Land Title Association’s Charles Grier said confirming tax titles is difficult, because there is “a hundred years of law out there that says that courts should take every possible step to avoid forfeitures.”

Whatever bill emerges from the committee on unmerchantable and uninsurable titles will need to involve the court system to confirm that the notices were properly given.

The committee chairman said he is unsure if the study committee will have another hearing before the end of year when their work is slated to end. However, Suber said the goal is to improve the system, and in doing they will investigate what other states are doing.

“If we can’t come up with anything through the legislative session, we may ask to extend this study committee another year,” he noted, saying it was important to get any changes right instead of being a quick fix.

You can watch the full meeting below.