Lt. Gov. Delbert Hosemann addresses the media, March 2025 (Photo by Jeremy Pittari | Magnolia Tribune)

- The Senate signaled its willingness to phase out the state income tax by way of economic triggers while the House maintained its position in favor of quicker, automatic cuts to eliminate the tax.

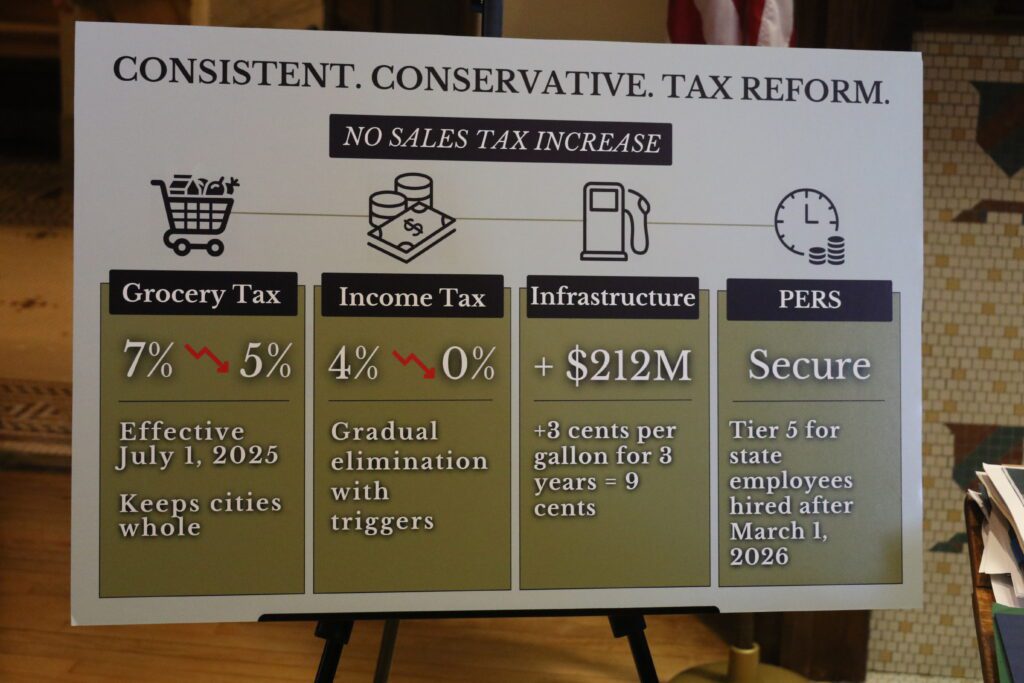

On Monday, Mississippi lawmakers moved closer to finding consensus on a tax reform package this session that would offer working Mississippian tax relief while addressing critical needs such the state employee retirement system and road maintenance.

Committees in both chambers amended legislation originating in the other. On the Senate side, an amended version of HB 1 was passed out of the Senate Finance Committee while the House Ways and Means Committee passed a revised version of SB 3095.

The Senate’s plan entails cutting the current income tax rate of 4 percent by 0.25 percent each year until 2030. The first cut would take place in 2027. After 2031, future cuts would be determined by the performance of the state’s economy.

Senator Josh Harkins (R), Chair of the Senate Finance Committee, said that a one percent cut to the income tax equates to $400 million. If the economy can produce 85 percent of that $400 million in surplus tax collections, the Legislature would then enact a further 20-basis point cut to the income tax rate. If the surplus is 100 percent of the $400 million, then a 25-basis point cut would occur, and if the surplus is 115 percent, then a 30-basis point cut would be enacted.

“So, depending on how the economy is doing and if these triggers are met, we will have the ability to reduce the income tax in the out years until it is eliminated,” Harkins described. “The strength of our economy will dictate whether a cut is warranted going forward.”

The Senate’s bill also proposed an immediate two percent cut to the sales tax on groceries, bringing the rate from 7 to 5 percent starting July 1 of this year. To keep cities whole as the revenue makes up a large portion of tax base, 18.5 percent of the general sales tax and 25.9 percent of the grocery sales tax will go to cities.

The Senate also proposed to fund road and bridge maintenance and construction fund by way of a 3-cent increase on gasoline to occur each year for three consecutive years, making the total increase 9 cents per gallon. The increased funding will consist of 23.25 percent to state aid roads, 2.75 percent to the intermodal fund, and 74 percent to the Mississippi Department of Transportation. Senator Harkins estimated that the additional funding will generate $212 million when fully implemented.

Efforts to address issues with the state retirement plan were also outlined in the Senate strike-all amendment. Senator Daniel Sparks (R) said those changes to PERS are mostly the same as a measure which passed in the Senate earlier this session. It would establish a new Tier 5 for state employees hired after March 1, 2026, where 4 percent of their retirement savings would be placed in a defined benefit plan and 5 percent would go to a defined contribution plan, similar to a 401K.

New employees would be vested after 8 years, and retirement benefits would be based on the 8 highest years of compensation. Unlike current PERS beneficiaries, new hires would not receive an automatic cost of living payout, often referred to as the 13th check. However, the Legislature could provide such an adjustment when it deemed necessary.

Employees at the age of 62 with 30 years of service could retire while employees with 35 years of service could retire at any age. Otherwise, the retirement age would be 65 with at least 8 years of service.

Senator Sparks added that the bill will end the Special Legislative Retirement Program, or SLRP, for any incoming legislator elected after March 1, 2026.

Lt. Governor Delbert Hosemann (R) said during a press conference held Monday after the bill left committee that the goal has always been to reduce taxes on Mississippians while not increasing the general sales tax, as was proposed in the House tax package.

“We don’t want to raise the sales tax, we have been consistent with that from day one,” Hosemann said.

As for the changes to the state retirement system, Hosemann said the aim is to stop digging the hole the state has been digging for years. He added that in the last week, the retirement system lost over $800 million.

“That’s what the Tier 5 does for us, it stops the digging and we start to refill the hole,” Hosemann said.

Harkins, Sparks and Hosemann all described the Senate’s plan as being fiscally responsible, pointing to the “guardrails” put in place with the cuts. However, Senator Hob Bryan (D) disagreed with the proposed income tax cuts and changes to the retirement system.

“This is a very sad day and future generations can look back to this moment… when the Senate capitulated to this absurd notion that we should abolish the state income tax,” Bryan said during the committee meeting.

He went on to disagree with the Legislature having to pass legislation to provide cost of living increases for future state employees.

As for the tax cuts, Bryan said it will be the poorest of the state who will be affected the most.

“The only feature that we have in our whole tax structure that doesn’t fall disproportionally on people of lower and modest incomes is the income tax,” Bryan described. “The sales tax falls most heavily on those who earn the least amount of money.”

House amends its tax proposal

As the Senate was amending the House bill, the same was being done across the Capitol.

On the House side, their revised tax package proposes a different path to tax relief.

“To maintain the momentum of the greatest tax cut in Mississippi history, Chairman Trey Lamar has amended SB 3095 with a revised HB 1. The revisions in this bill stem from negotiations with the Senate, the demand of Mississippi taxpayers to eliminate the income tax, and opportunities the House identified to bring the most significant tax relief to Mississippians,” Speaker of the House Jason White (R) said.

In the House’s revised version, the income tax would be cut from 4 percent to 3.5 percent in 2027, with subsequent cuts taking place each year until 2037 when the income tax in Mississippi would be eliminated.

The House’s proposed cut to sales taxes on groceries is the same as in the Senate, a reduction from 7 percent to 5 percent.

However, the House’s bill proposes a one percent sales tax increase on all other purchases, bringing the statewide rate to 8 percent. There increase would apply to Mississippi’s use tax, as well. The first $48 million of that additional revenue would go to the state aid road fund, with the remaining surplus going to the general fund. Proceeds of the use tax increase would be used to shore up the Homestead Exemption Reimbursement Fund, which provides Mississippians over the age of 65 with a $200 credit on their property tax.

As for the gas tax, the House proposes to increase the excise tax by 5 cents per gallon each year for three years.

To address the state retirement system, $100 million of the state lottery proceeds would be reallocated to PERS until it is funded at a ratio of 80 percent. All other lottery proceeds would be sent to the Education Enhancement Fund.

“We are on the cusp of bringing all Mississippians the most significant tax cut in state history. This cut would provide a tax credit to seniors on their property taxes, reward our workforce, and relieve the tax burden at the grocery store while also stabilizing PERS, dedicating a source of revenue to infrastructure, and enhancing our economic development opportunities,” Speaker White.

Unless either chamber decides to concur with the other’s amendments, conference is likely as lawmakers continue to move closer to a final proposal prior to the end of the legislative session.

If no consensus is reached, rumors of Governor Tate Reeves (R) considering a special session are swirling. Elimination of the income tax is a top priority for the Governor.