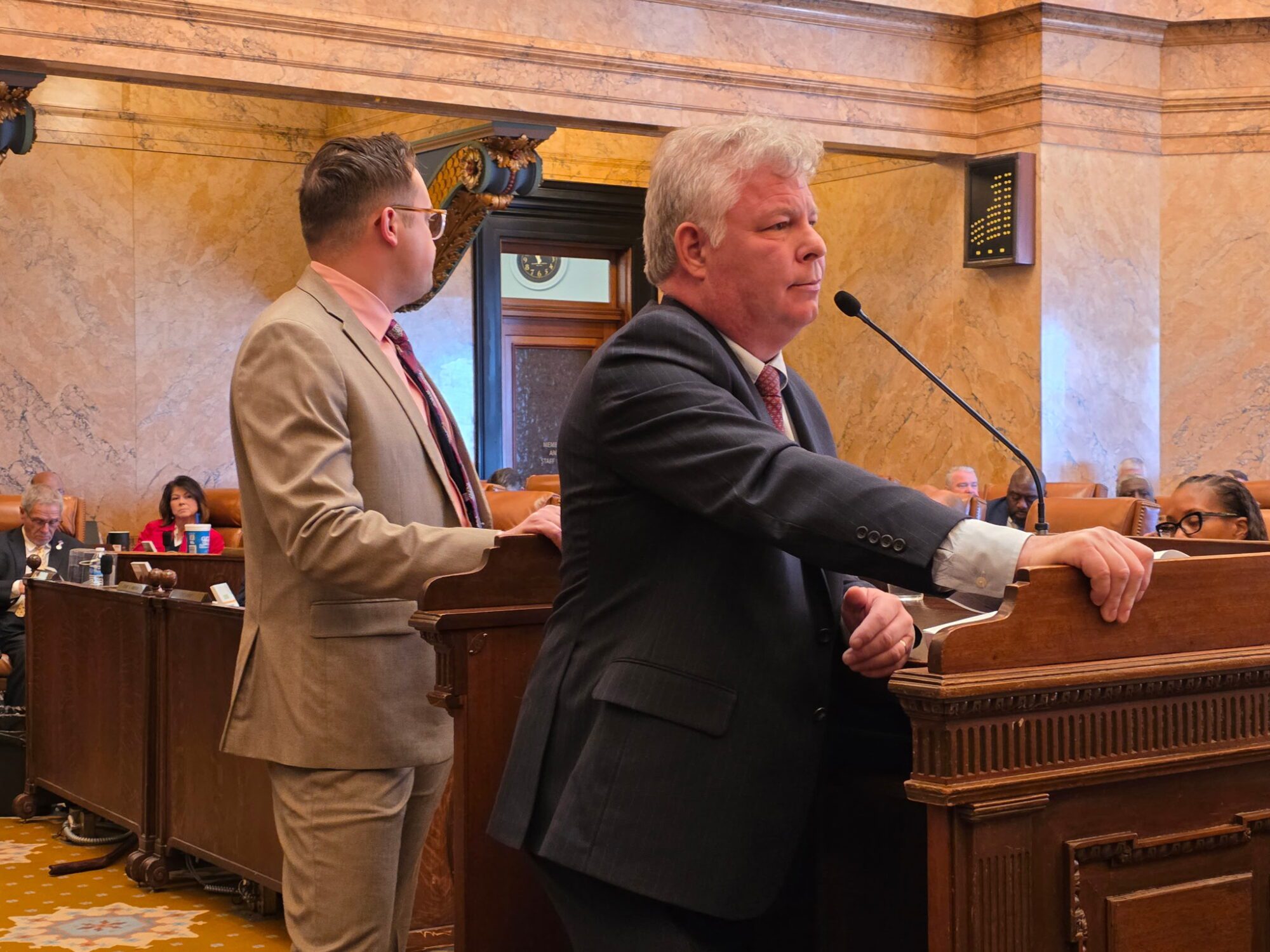

Lt. Governor Delbert Hosemann presents the Senate tax plan - February 12, 2025 (Photo: Daniel Tyson | Magnolia Tribune)

- Time is running out for a deal to be reached on income tax elimination. With a special session looming, the Senate has the opportunity to improve the House’s proposal, help deliver transformative relief, and quiet growing concern that it obstructs conservative policy.

Nine states operate without a state income tax. Mississippi should make ten.

Collectively, “the nine” kick the heck out of national averages on population growth, economic growth, and even revenue growth to the state — all while carrying lower overall tax burdens on citizens. Growth, it turns out, is king.

In our neck of the woods, Tennessee, Florida and Texas shine without a tax on work, drawing in wealth and massive capital investments.

It makes sense. Allowing people to keep what they earn means they have more resources to spend on their families, in their businesses, and across their communities. And people spend their own money better than government — a core tenet of conservatism.

Volumes of economic data back up the principle that private sector activity is the key to prosperity. Unfortunately, too often we confuse the size of government with the well-being of people. The two actually have an inverse relationship. The greater the dependency, the worse the outcome.

The effort to eliminate Mississippi’s income tax started in earnest in 2016. It continued in 2022, when the Legislature compromised on the largest tax exemption in the country among states that tax income, and a flat, lower 4 percent rate on all other income.

Along the way, the Legislature made a series of additional tax cuts oriented toward business. These included becoming the first state to offer companies the ability to take full and immediate expensing of capital investments.

At each step, naysayers warned of impending economic doom. But none came. Even when adjusted for inflation, Mississippi’s economy grew by nearly 10 percent in the last 10 years. Tax revenue to the state grew even faster in that same period, by 39 percent to nearly $11 billion annually.

With it, the Legislature has grown the general fund spending from just $5.7 billion in 2019 to what will be nearly $7.1 billion this year.

In recent years, legislators made almost $800 million in new investments in public education — for which they draw only scorn. The education status quo brigade will never be happy. Legislators also funded multiple large capacity infrastructure projects through MDOT. And they paid down a billion dollars in state debt, while building state reserves into the billions.

Even with the marked increased spending, the state is due a nearly $700 million dollar surplus this year alone. It’s time to return it to the people who earned it in the first place.

The Legislature can eliminate the income tax and drive growth if done responsibly. The only questions left are ones of will and ego.

Room for Collaborative Improvement

The Mississippi House’s proposal is bold, but includes real room for improvement. Chiefly, the legislation should ensure tax offsets included are not front-loaded so Mississippians feel relief immediately. The Mississippi Senate’s proposal is cautious. But the chamber’s legitimate concerns about sustainability can be addressed and still result in full income tax elimination.

Any plan to eliminate the tax should include an element of spending restraint similar to Colorado’s TABOR. A spending limit that adjusts with population growth and inflation could help to ensure the state does not end up under water.

Additional cushion could be achieved by eliminating the gimmicky proposal to reduce the sales tax on groceries. Yes, it’s popular, but the impact of that policy is minuscule, both for families and the broader economy.

A household making $50,000 in taxable income would save $2,200 a year from complete elimination. The household would have to buy $110,000 in groceries annually to achieve that same savings from a 2 cents reduction in the grocery tax, as proposed in the Mississippi Senate. If government data is to be believed, most families spend less than $1,000 a month on groceries.

The offsets proposed in the House plan help to speed the process of eliminating. They also direct resources to municipalities and counties, to the core function of infrastructure, and to increased funding for PERS. As alluded to, the design of these offsets can be better, but the idea is not a bad one. Even with the local sales tax option proposed, Mississippi’s sales tax would be roughly one cent less than all surrounding states. Without them, income tax elimination can be achieved, just at a snail’s pace.

Pressure Mounting on Mississippi Senate

There are good, smart and capable leaders in both chambers capable of finding the common ground. Certainly, Lt. Governor Delbert Hosemann is among them. But the Mississippi Senate, and in particular, Hosemann, are drawing near a time for choosing.

Pressure is mounting against Hosemann from all corners. The Governor and Speaker aligned early in the session on the goal of complete elimination. Auditor and would-be gubernatorial opponent Shad White is snipping (effectively from a PR standpoint) at Hosemann’s heels. And a bevy of conservative organizations who have kept powder dry are growing impatient.

The increasing perception that the Senate has become an obstruction to conservative policy may not be entirely fair, but it is there. The Senate’s decision to stonewall education reforms pushed by President Trump and conservative leaders across the country in favor of special interest groups that align with Democratic causes has only served to compound that perception. The House has been willing to tell those folks to pound sand, siding instead with over 70 percent of Mississippians who support families having more education options.

Hosemann and his Senate colleagues can quell the whispers among conservative leaders and donors before they become screams, while maintaining the Senate’s deliberative function. They can make this idea better and share ownership. But better to do it before the end of session than wait to the intensified scrutiny of a Gov. Tate Reeves’ called special session falls on them.

Eliminating the tax on work makes dollars and cents.