- In part 5 of this series on modernizing PERS, Steven Gassenberger says fixing PERS for sustainability won’t be easy, but reasonable solutions are within reach.

Mississippi has a $25 billion problem.

The state-run retirement system has only about half of what experts project we will need to pay retirees. We say “we” because it’s not just about retirees.

In fact, every single employee and retiree the Mississippi Public Employee Retirement System today will get the benefits they were promised. A unanimous vote of the Legislature couldn’t change that. Courts across the country, including in Mississippi, have held they are a legally enforceable contract – a promise.

It is precisely because of that fact – that current benefits can’t be changed – that this is everyone’s issue. This is a Republican issue. This is a Democratic issue. This is a government employee issue. This is a taxpayer issue. This is an issue for every Mississippian, even if you think you don’t care about it.

Quite simply, an increasing share of state and local tax dollars will be funneled into the retirement system to meet those promised benefits. If you’re a conservative, think about what this unchecked retirement fund shortfall means for taxes. If you’re a liberal, think about what it means for state dollars you’d rather see focused on things like healthcare or education. If you are a city or state employee, think about what this means for your prospects for salary increases.

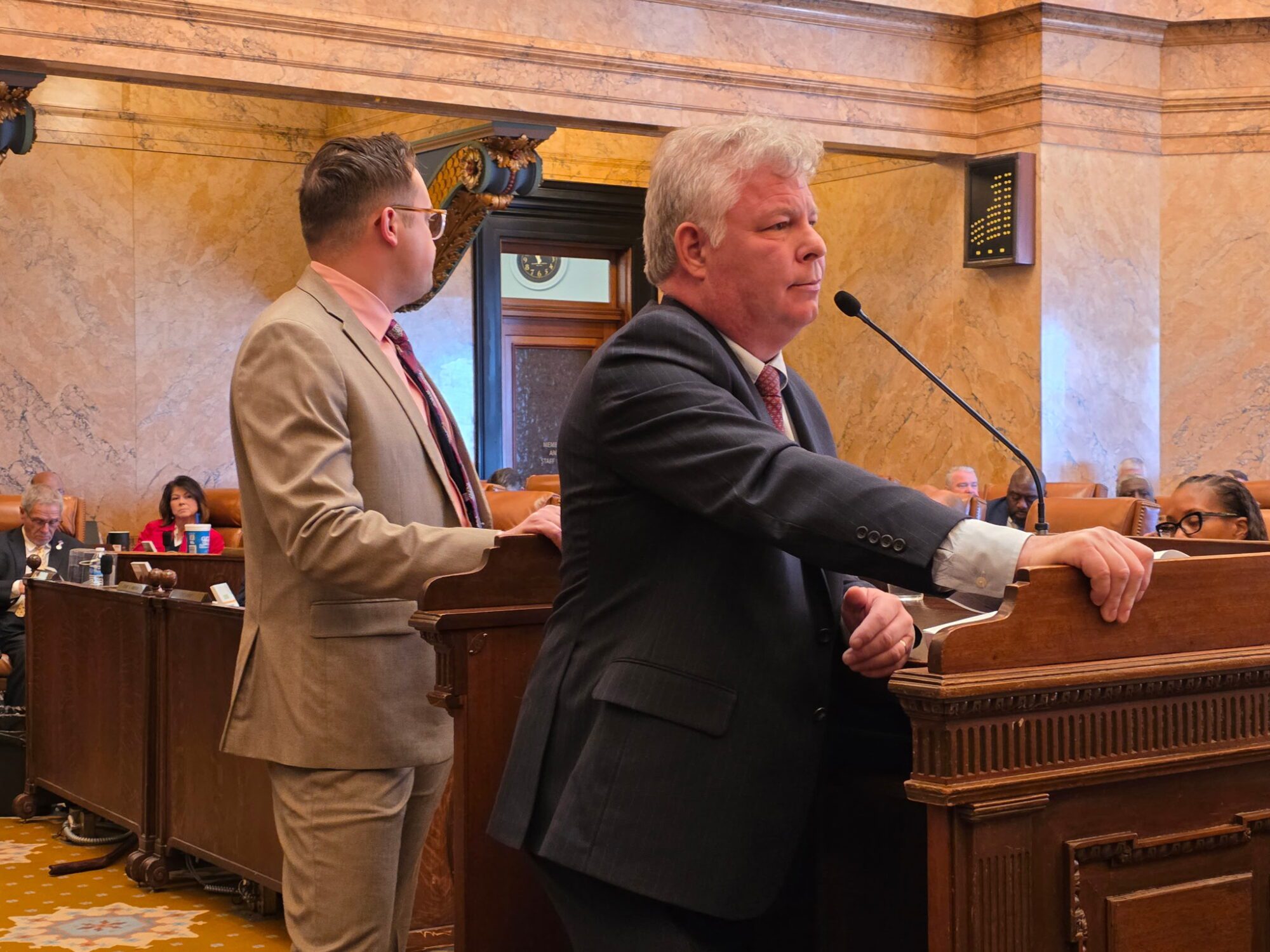

The sooner we begin to face the challenges and adjust for the future, the less painful the solutions will be. That’s why when political leadership steps up to the plate to begin tackling this – as they did in the 2024 legislative session – they deserve serious consideration, not fear mongering and politics. It’s a real problem that needs sober consideration and consensus, or we will all end up with an even bigger problem.

Over the last few weeks, we have run a series of articles talking about the causes, challenges, assumptions, and solutions before us, including:

- Investment growth is far less predictable than it once was, and state employment patterns have changed significantly, just as they have in the private sector. Both have significant impacts on our future financial picture, and a couple of major shocks to the investment markets could be catastrophic.

- The state can’t keep offering the current set of benefits to new hires. While current employees and retirees will get their full benefits, future state employees will need a new program that promises less, offers more flexibility, and recognizes new career path trends.

- The 2024 legislation stabilized the system for the moment, but the larger issues require considerable attention, tough decisions, and, quite frankly, money.

- State and local governments and school districts are going to have to pay more into the system.

Fixing PERS for sustainability won’t be easy, but neither is this insurmountable. Reasonable solutions are within reach.

The good news is that we can do this. Other states have met this challenge. Some states are prudently dedicating budget surpluses to off-set rising state and local obligations. But what won’t work is fear and hyperbole. Only with rational, transparent consideration can we build a consensus among all players to address the fiscal needs of the system.