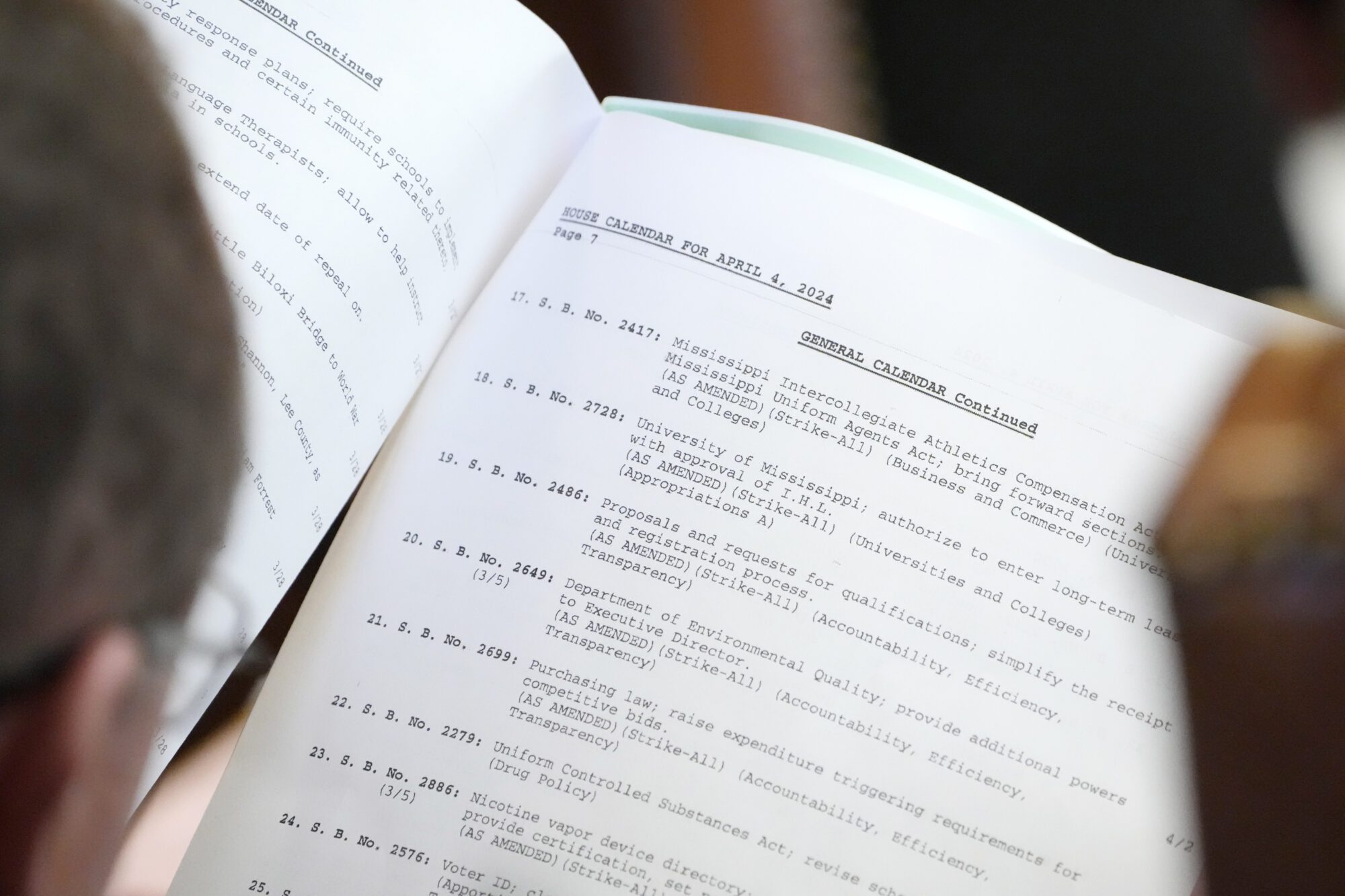

A member of the Mississippi State House of Representatives reads through the day's calendar of bills requiring action in the House chamber, Thursday, April 4, 2024, at the state Capitol in Jackson, Miss. (AP Photo/Rogelio V. Solis)

- Bill would have increased the total amount of tax credits that could be taken for donations to independent schools, foster care organizations.

First passed in 2019, the Children’s Promise Act provides an incentive to businesses who donate to qualifying independent schools or foster care organizations in the form of a tax credit that lowers the business’ tax liability.

A bill this session would have increased the total amount of tax credits that could be taken under the Children’s Promise Act. However, the legislation died on the Senate floor late in the 2024 session.

State Rep. Trey Lamar’s (R) House Bill 1988 aimed to increase the aggregate cap on tax credits businesses could claim when donating to qualifying independent schools and non-profit foster care organizations.

“The best tax credit programs are the ones that have a great purpose and also are really good for the taxpayers. And I don’t know of one that is better than the Children’s Promise Act,” Lamar told Magnolia Tribune.

Lamar said the money that goes to eligible schools or foster care organizations are private donations.

“There’s not one dollar of state money appropriated to private schools or foster care organizations because of this Act. Not one dollar,” the House Ways and Means chairman added.

HB 1988 sought to increase the current aggregate cap on tax credits from $18 million up to $48 million. The current cap in total eligible donations is split equally between two categories: $9 million in qualified donations can be made to non-profit foster care organizations and $9 million can be made to independent schools that meet certain requirements.

In order to qualify to receive the donations, the independent school or foster care organization has to be a 501(c)(3) non-profit registered with the Department of Revenue (DOR). Independent schools have to sign affidavits indicating they educate children who are in foster care, have children with special needs, or have students that qualify for free or reduced lunch.

Another requirement in the Act is that the tax credits cannot be more than 50 percent of a business’ total tax liability. This provision means that while the credits can lower a business’ tax liability, they do not result in the state making any payments.

If all of the requirements are met, the donation is made to the non-profit and confirmation of that donation is submitted to DOR which would then issue final credit on that business’ taxes.

Shane Blanton, Executive Director of the Midsouth Association of Independent Schools, said that if a school is not doing a good job educating its children, businesses and corporations will be less likely to provide donations going forward. The same is true for the foster care organizations.

Blanton contends that “the Children’s Promise Act is probably the most accountable tax credit there is in the country.”

Under the Act, increases to the aggregate cap have taken place since it became law. Rep. Lamar’s goal to increase the amount to a total of $48 million this year did not get the same support in the Senate as it did in the House of Representatives. When it reached the Senate, the cap was adjusted to half of Lamar’s goal, $24 million total.

“I was reluctant to do that, but I wanted to try to get something good going forward,” Lamar said about the compromise.

The amended HB 1988 received a vote of 22-17 on May 3rd in the Mississippi Senate. However, bills which deal with taxes require a three-fifths vote to pass and so the bill died for the year. The vote reflects that 13 senators were not present to vote on the bill.

Rep. Lamar said the Act has already saved the state money. Foster care organizations do so by preventing children from ending up in the state’s care. According to Lamar, foster care saved the state more than $200 million over the last five years by not putting those children under state care. The organizations also keep the children close to family.

Meanwhile, the state’s independent schools provide an education to more than 50,000 students, while not using state appropriations. Parents of private school students still pay federal and state income taxes, sales taxes, and property taxes. A portion of each help fund Mississippi’s public schools.

In the five years that it’s been law, the Act has provided economic benefits and cost savings to the state. Rep. Lamar said using the recently adopted base student cost of $6,695, the state saves more than $334 million when multiplied by the 50,000 students independent schools educate, he noted. Then there’s the income taxes and other economic impacts that come with employing thousands of teachers and other staff across 130 campuses.

Blanton stated about 6,500 people are employed across those 130 campuses in Mississippi.

“If there was any other business that came into the state of Mississippi that said, ‘Hey we’re going to anchor your communities with 130 satellite businesses across the state and we’re going to employ about 6,500 people,’ they would give them tax credits for eternity,” Blanton added.