- Important state and national stories, market and business news, sports and entertainment, delivered in quick-hit fashion to start your day informed.

In Mississippi

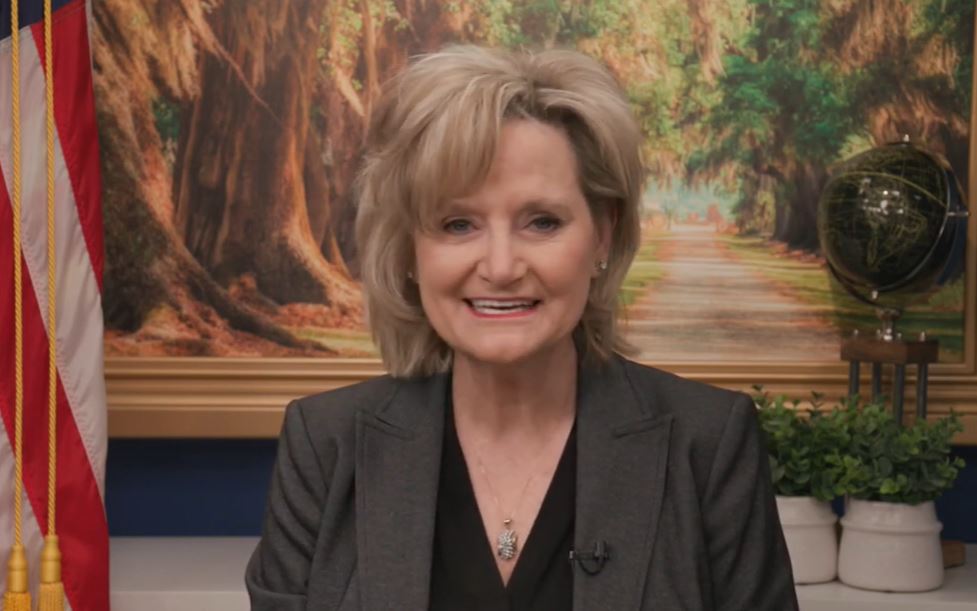

1. Senate passes Whole Milk for Healthy Kids Act

With its approval by unanimous consent on Thursday, the U.S. Senate passed the Whole Milk for Healthy Kids Act, co-sponsored by Mississippi Senator Cindy Hyde-Smith.

The bill that would again allow whole and 2 percent milk to be served at schools.

“For generations, children have benefited from the nutrients found in milk, which are essential for healthy growth and development. I am hopeful that we will succeed in enacting the Whole Milk for Healthy Kids Act, restoring access to healthy milk choices for kids,” said Hyde-Smith previously.

The legislation now goes to the House for approval.

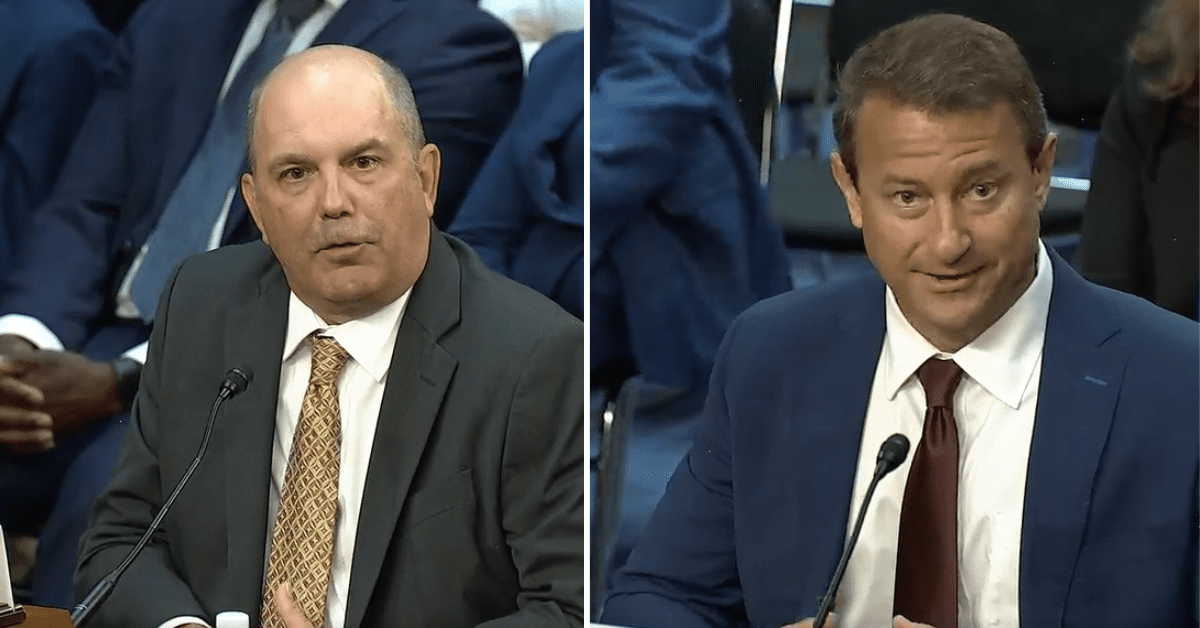

2. Gipson, MDAC notify farmers of Hansen-Mueller bankruptcy

Ag Commissioner Andy Gipson and the Mississippi Department of Agriculture and Commerce (MDAC) are notifying Mississippi farmers and producers that the Hansen-Mueller Company filed for Chapter 11 bankruptcy in the U.S. Bankruptcy Court for the District of Nebraska.

Although Hansen-Mueller does not have an office in Mississippi, Gipson and MDAC said the company is licensed as a grain dealer in the state and is subject to its laws with regard to transactions in Mississippi.

Commissioner Gipson advises farmers who have not received payment from Hansen-Mueller to contact an attorney immediately to protect their legal rights. Additionally, Gipson asked farmers to forward any unpaid invoices, bills, contracts or other documents with evidence supporting a claim that Hansen-Mueller has not paid for grain deliveries in Mississippi to MDAC by emailing the documents to grainclaims@mdac.ms.gov.

National News & Foreign Policy

1. Senate divided over allowing Senators to sue from being surveilled by Biden-era DOJ

The U.S. House opposed a provision in the government funding bill signed last week that would allow U.S. Senators “surveilled by the Biden-era Justice Department to sue the federal government for hundreds of thousands or even millions of dollars in damages,” The Hill reported. The bill to reverse this now sits in the Senate.

As The Hill reports, “Democratic senators clashed with Senate Majority Leader John Thune (R-S.D.) on the Senate floor Thursday when the GOP leader proposed a resolution to clarify that any damages won by Republican senators from lawsuits against the Department of Justice (DOJ) would go to the U.S. Treasury and not to the senators’ bank accounts.”

“Responding to complaints that empowering Republican senators to sue the Justice Department for millions of dollars is inappropriate or unseemly, Thune on Thursday proposed a compromise,” The Hill reported. “He suggested that colleagues approve a resolution by unanimous consent to clarify that any financial compensation awarded to senators would go to the U.S. Treasury, so that lawmakers would not be seen as enriching themselves.”

The Hill continued, “Democrats immediately shot down the proposal, declaring it didn’t go far enough to address the appearance that the recently passed law had created a major conflict of interest.”

2. Zelenskyy ready to engage with Trump peace plan

The New York Times reports that “President Volodymyr Zelensky said on Thursday that Ukraine would engage ‘constructively, honestly and operationally’ on a peace plan that the Trump administration proposed after consulting with Russia — but not with Ukraine.”

“The 28-point settlement plan echoes long-held Russian demands, including that Ukraine surrender territory, limit the size of its army and forgo any role for a Western peacekeeping force after a cease-fire, according to officials familiar with the proposal,” NYT reported.

NYT went on to report, “Mr. Zelensky’s comments came after a meeting with the U.S. Army secretary, Dan Driscoll, whom the Trump administration had sent to Ukraine to help restart peace talks. Mr. Zelensky said American and Ukrainian teams would begin work on what he described as the ‘points of the plan to end the war,’ without elaborating on what those were.”

Sports

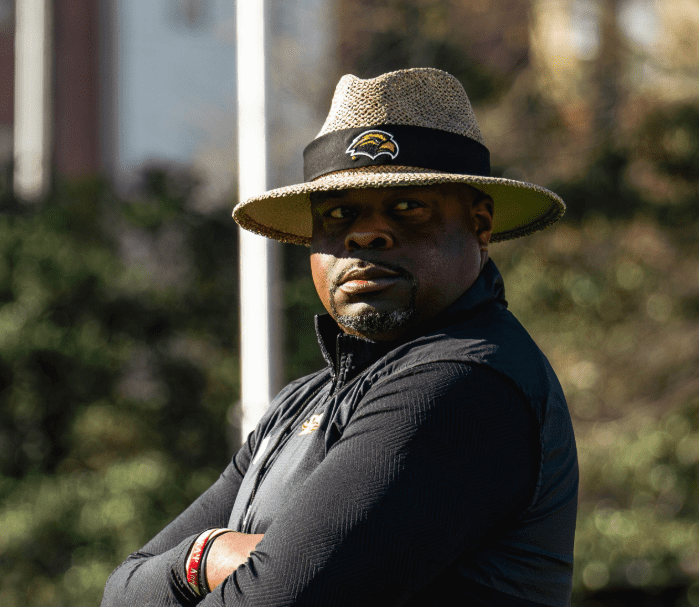

1. Ole Miss, MSU off; USM on the road

Only one of Mississippi’s Big 3 will take to the gridiron this Saturday, as Ole Miss and Mississippi State have a bye week ahead of their annual Egg Bowl rivalry.

Southern Miss is looking to bounce back after an upset last week as they head to Mobile to take on South Alabama.

The Golden Eagles kick off at 2:30 p.m. with ESPN set to air the game.

2. JSU-Alcorn to tee it up Saturday

Jackson State is hosting in-state rival Alcorn State at Veterans Memorial Stadium on Saturday in a key Southwestern Athletic Conference (SWAC) matchup.

With a win, the JSU Tigers clinch the SWAC East Division title and a berth in the conference championship game.

The game kicks off at 2:30 p.m. on ESPN+.

Markets & Business

1. Futures fall as AI stocks lead the decline

CNBC reports that “S&P 500 futures fell on Friday as pressure on Nvidia and other artificial intelligence stocks persisted, as did that on bitcoin, following a massive intraday reversal in the previous session.”

“The Dow at one point on Thursday rose more than 700 points as investors cheered a blockbuster Nvidia fiscal third-quarter earnings report,” CNBC reported. “The benchmark, along with the S&P 500 and Nasdaq Composite, ended the day sharply lower after new U.S. jobs data raised doubts about whether the Fed will cut rates once more before year-end.”

CNBC noted, “AI stocks led the declines, with Nvidia ending the day lower by 3% after rising as much as 5%. Thursday’s reversal put the stock down more than 10% for the month.”

2. Drop in mortgage rates has more people looking to refinance

The Wall Street Journal reports that the “recent decrease in mortgage rates has led to a pop in the number of people who are looking to refinance home loans they took out when rates were closer to 7% or 8%.”

“The Mortgage Bankers Association’s weekly refinance application activity index in mid-November was more than double what it was a year prior,” WSJ reported. “That isn’t a surprising reaction to falling 30-year fixed mortgage rates. The weekly national average has gone from around 6.8% a year ago to under 6.3% now, according to Freddie Mac tracking. But the extreme speed at which people are moving to find new rates has been startling.”

WSJ added, “Why the rush? There are likely many drivers. Higher levels of rates and higher home prices can mean that even the dollar savings of obtaining a somewhat lower rate are significant. Whatever the reason, actually doing so is getting easier for some borrowers.”